أيروجيني — مساعدك الذكي للطيران.

الرائج الآن

Categories

Europe Aircraft ACMI Leasing Market: Trends and Forecasts 2025–2032

Europe Aircraft ACMI Leasing Market: Trends and Forecasts 2025–2032

The Europe Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing market is set to experience substantial growth through 2032, driven by shifting airline operational requirements, technological progress, and a heightened focus on sustainability. As airlines contend with variable demand and increasing operational complexities, ACMI leasing has become a vital mechanism, enabling carriers to swiftly adjust capacity in response to seasonal fluctuations, unexpected demand surges, or temporary aircraft shortages.

Market Overview and Growth Projections

The European ACMI leasing market is projected to expand significantly, reaching an estimated value exceeding USD 8.31 billion by 2032, up from USD 5.49 billion in 2024. The market is expected to grow by USD 5.72 billion in 2025 alone, with a compound annual growth rate (CAGR) of 5.8% from 2025 to 2032. This robust growth reflects airlines’ increasing reliance on flexible fleet management strategies amid economic uncertainties and evolving regulatory landscapes.

Key Market Drivers

Operational flexibility remains a primary driver of the ACMI leasing market, as it allows airlines to efficiently scale their operations while mitigating risks associated with aircraft ownership and fleet management. Technological advancements, including enhanced flight management systems, improved communication technologies, and sophisticated data analytics, are further optimizing ACMI operations by reducing costs and enhancing efficiency. Additionally, sustainability initiatives are encouraging airlines to utilize ACMI leasing to access newer, more fuel-efficient aircraft, thereby supporting efforts to reduce carbon emissions and comply with environmental regulations. The ACMI model also plays a critical role in crisis response, facilitating rapid deployment of aircraft and personnel during humanitarian emergencies and natural disasters.

Market Structure and Definitions

The ACMI leasing market comprises various leasing arrangements tailored to different operational needs. Wet leases involve the lessor providing the aircraft, crew, maintenance, and insurance, while the lessee is responsible for fuel and operational fees. Dry leases consist solely of the aircraft provision, with the lessee managing crew, maintenance, and insurance. Damp leases represent a hybrid model, typically including aircraft, maintenance, and insurance, with optional crew provision. Hybrid leases are customized agreements that combine elements of wet, dry, and damp leases to meet specific requirements.

Competitive Landscape and Challenges

Europe’s ACMI leasing sector operates within a highly competitive environment. The region’s engine maintenance market, which accounts for 22% of global spending from 2025 to 2034, underscores the critical role of maintenance services, even as engine growth in Europe trails the global average. This dynamic is prompting airlines and lessors to pursue strategic partnerships and acquisitions to maintain or expand their market presence. Nevertheless, the market faces challenges stemming from fluctuating demand linked to economic volatility and shifting regulatory frameworks. Airlines are responding by refining their fleet strategies, while lessors are adapting their service offerings to sustain competitiveness.

Outlook

As the aviation industry continues to evolve, ACMI leasing is anticipated to assume an increasingly central role in enhancing airline resilience, operational adaptability, and sustainability objectives. The market’s projected growth highlights its significance not only for established carriers but also for new entrants seeking cost-effective and flexible fleet solutions in a rapidly changing environment.

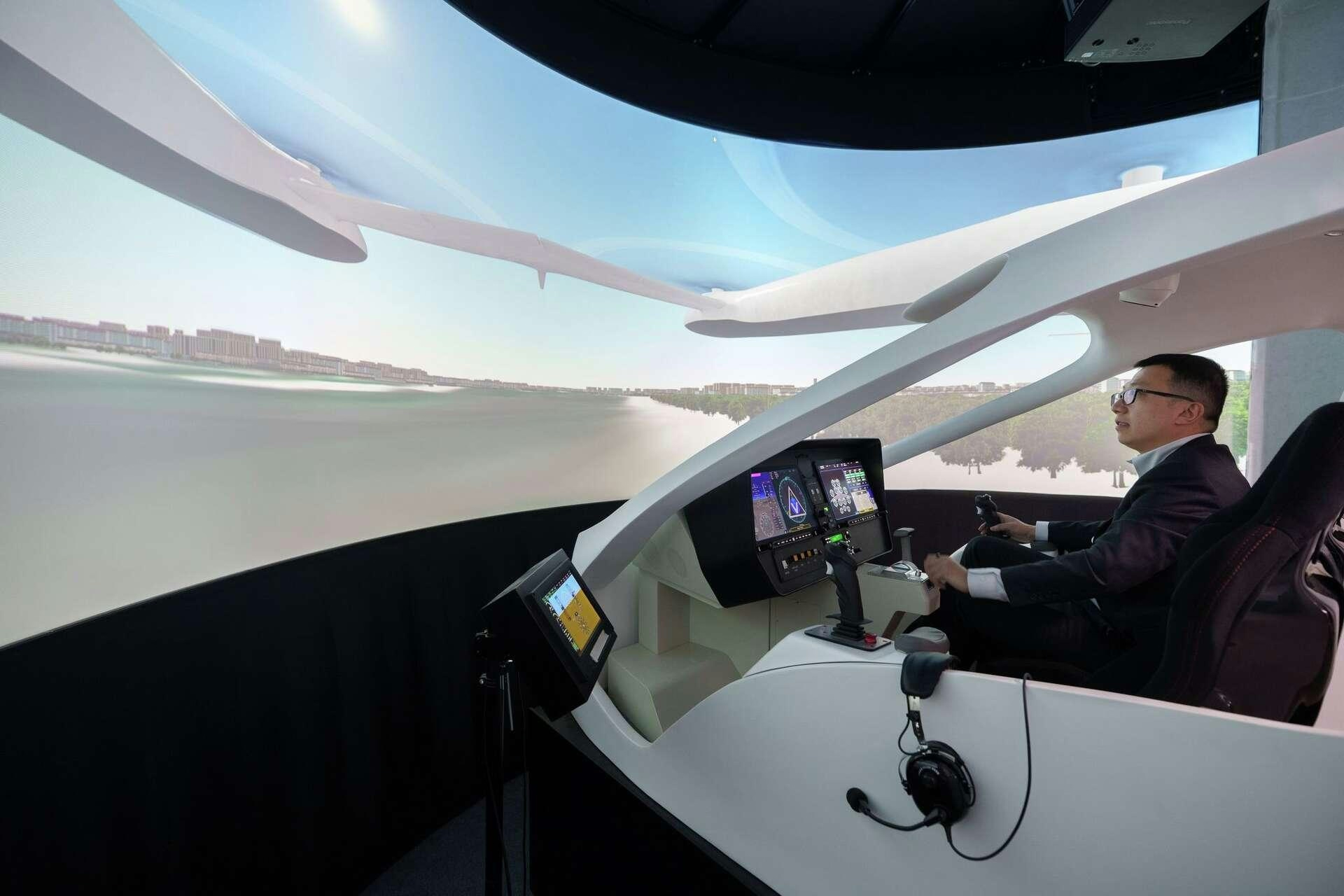

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services

ETF Airways to Receive First ATR Aircraft