Smarter email, faster business.

Trending

Categories

Archer Shares Fall 15% After $850 Million Sale Amid Trump Air Taxi Pilot Program

Archer Shares Fall 15% Following $850 Million Stock Sale Amid Trump Air Taxi Pilot Program

Archer Aviation’s shares dropped sharply by 15% on Friday after the electric air taxi manufacturer announced an $850 million stock sale. The company sold 85 million shares at $10 each, increasing its pro forma liquidity to around $2 billion. This capital raise aims to accelerate the development of Archer’s all-electric vertical takeoff and landing (eVTOL) aircraft, known as Midnight, but it also raised concerns among investors about the company’s valuation and future growth potential.

Strategic Investment to Support Expansion and Innovation

Archer plans to deploy the newly raised funds to expand its infrastructure, launch an artificial intelligence-driven aviation software platform, and advance its Launch Edition program. This program includes a formal partnership to provide air taxi services during the 2028 Los Angeles Olympics, positioning the company for a high-profile operational debut. Adam Goldstein, Archer’s founder and CEO, emphasized the company’s strengthened financial position, stating, “We now have the strongest balance sheet in the sector and the resources we need to execute both here in the U.S. and abroad.” He expressed confidence in the company’s future prospects.

Despite this optimistic outlook, the market responded negatively, reflecting investor skepticism about Archer’s ability to sustain growth and secure its market position. The share price decline followed a period of enthusiasm earlier in the week, when shares of Archer and rival Joby Aviation rallied in response to former President Donald Trump’s executive order establishing a pilot program to support the development and deployment of eVTOL vehicles in the United States. This regulatory support had initially boosted optimism about the sector’s potential.

Industry Context and Competitive Landscape

The demand for eVTOL technology has surged in recent years, driven by its promise to reduce emissions and ease urban traffic congestion. However, the industry continues to face significant regulatory and safety hurdles before widespread adoption can be realized. Archer has already formed a partnership with United Airlines to launch an airport air taxi service and is preparing to showcase its Midnight aircraft at the upcoming Paris Air Show. The United Arab Emirates is slated to be the company’s first international market.

Meanwhile, competitor Joby Aviation recently secured the first $250 million installment of a $500 million contract with Toyota, aimed at supporting eVTOL certification and production. While responses from competitors to Archer’s latest capital raise remain uncertain, the steep decline in Archer’s share price highlights persistent doubts about the company’s long-term viability and the broader trajectory of the eVTOL market.

'Blue Sky' Powerhouse Begins Operations

Air Cambodia to Acquire 20 Boeing 737-8 Aircraft

Iberia A321XLR Sustains Engine Damage from Bird Strike, Returns to Madrid

Thiruvananthapuram Airport MRO Gains EASA Approval, Plans Wide-Body Hangar

Delta Airlines Implements AI for Real-Time Ticket Pricing

Pilot Declares Mayday After Engine Failure Shortly After Takeoff

The Shortest US International Widebody Flights in August

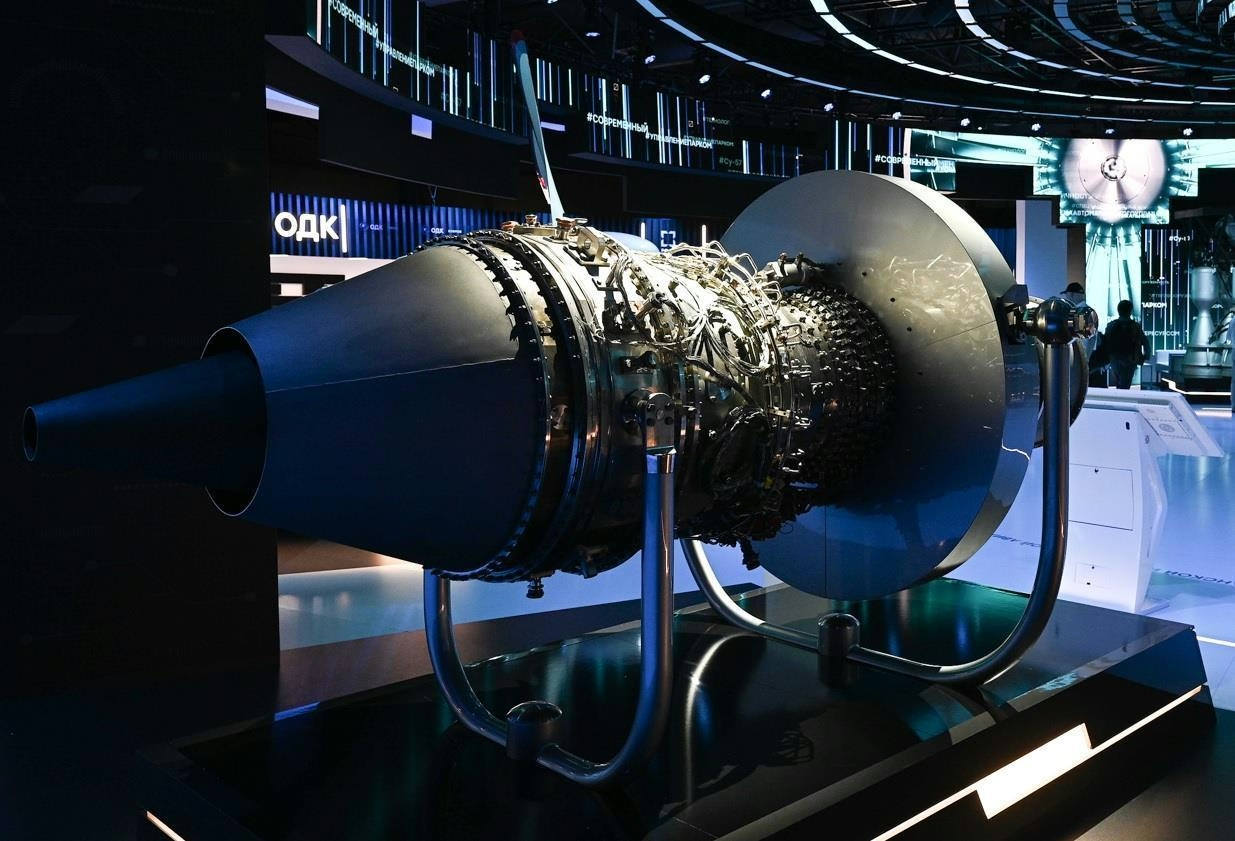

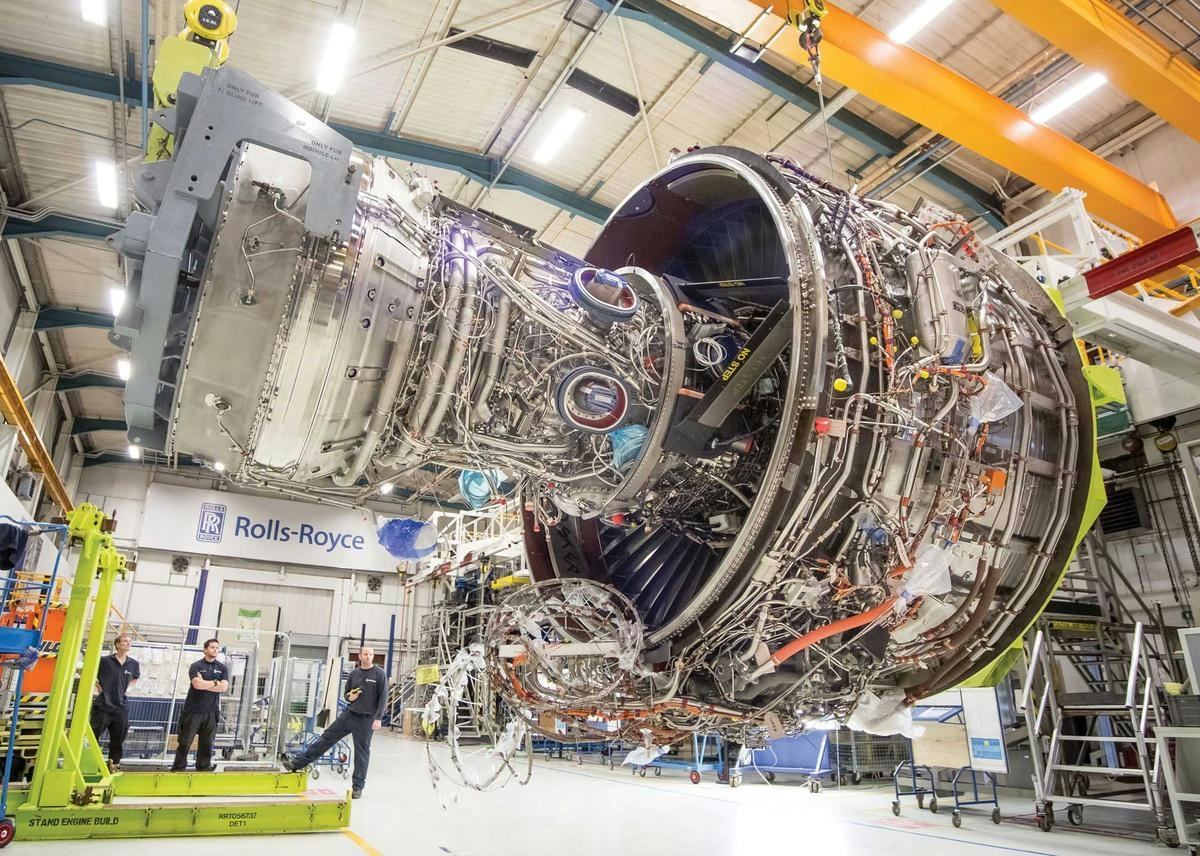

Comparing Fuel Efficiency of Rolls-Royce Trent 900 and Trent XWB Engines

Russia Seeks Ethiopian Airlines Aircraft Amid Western Sanctions