Smarter email, faster business.

Trending

KKR Finances Greenbriar’s Acquisition of West Star Aviation

KKR Finances Greenbriar’s Acquisition of West Star Aviation

KKR Leads Debt Financing for Strategic Acquisition

KKR, the global investment firm, has announced that its credit funds and accounts are spearheading the debt financing for Greenbriar Equity Group’s acquisition of West Star Aviation, a leading provider of maintenance, repair, and overhaul (MRO) services in the business aviation sector. This transaction highlights sustained investor confidence in the resilient aviation MRO market, although the deal’s scale and the involvement of prominent private equity firms may attract regulatory scrutiny.

Founded in 1947, West Star Aviation has established itself as a premier independent MRO provider, delivering comprehensive services across all major aircraft manufacturers. The company operates full-service facilities in Illinois, Colorado, Tennessee, New Jersey, Missouri, and North Carolina. It also maintains the nation’s largest Aircraft On Ground (AOG) technician network, enabling rapid mobile repair services. Employing over 3,000 professionals, West Star is widely recognized for its technical expertise and commitment to customer service.

Noah Blitzer, Managing Director at Greenbriar, expressed appreciation for KKR’s support, emphasizing that the financing will enable the company and its management team to build upon West Star’s legacy as a top-tier MRO provider. Gene Kolodin, Managing Director at KKR, stated that the firm is pleased to back Greenbriar in acquiring West Star Aviation, which is well-positioned to expand its market presence within the growing aviation MRO sector.

Market Context and Industry Implications

This financing arrangement comes amid steady growth in the aviation MRO market, driven by rising demand for business aviation services. However, the transaction may elicit mixed reactions within the industry. Observers anticipate that regulatory authorities could closely examine the deal due to the consolidation of significant financial interests in a critical sector. Competitors may respond by enhancing their service offerings or adjusting market strategies to safeguard their market positions.

KKR, renowned for its expertise in alternative asset management and capital markets, continues to prioritize growth support for its portfolio companies. The firm manages investments across private equity, credit, and real assets, with its insurance operations conducted under Global Atlantic Financial Group. Greenbriar Equity Group, a middle-market private equity firm with over $10 billion in capital commitments, focuses on investing in market-leading services and manufacturing businesses, targeting companies with strong growth potential and experienced management teams.

With more than 78 years of industry experience, West Star Aviation remains committed to providing comprehensive airframe maintenance, paint, interior, and avionics services. Its extensive technician network and strategically located facilities underpin its service capabilities.

As the acquisition progresses, industry stakeholders will closely monitor its impact on the competitive landscape and whether regulatory reviews influence the transaction’s timeline or structure.

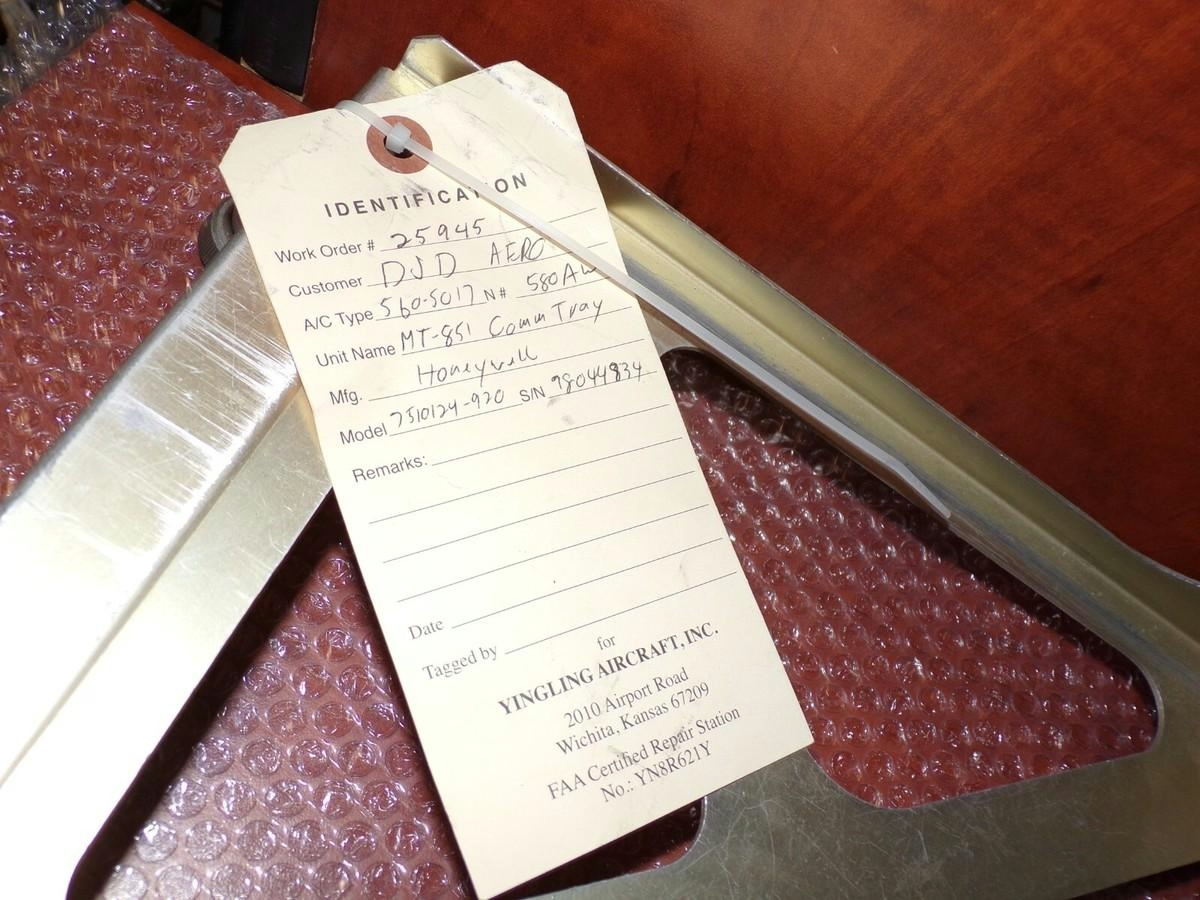

Yingling Aviation Named Authorized Honeywell Dealer

Does Joby Aviation's Milestone in Dubai Point Toward Further Growth?

New Invention Promises to Eliminate Airplane Emissions in Country

Key Questions on Chinese Travel, AI, and Airlines Answered by Skift

SAS Orders Up to 55 Embraer E195-E2 Jets

China edges closer to Airbus mega-deal, leaving Boeing out in the cold: analysts

Rano Air Collaborates with Aviation Authorities to Investigate In-Flight Engine Malfunction

Portugal Hosts Aviation Pioneers at World Aviation Festival in Lisbon

World Star Aviation Backs XMAL’s First Lease Deal with easyJet