Smarter email, faster business.

Trending

Categories

Why Emirates Operates Without Narrowbody Aircraft

Why Emirates Operates Without Narrowbody Aircraft

Emirates distinguishes itself in the global aviation sector as the largest airline operating an exclusively widebody fleet, deliberately excluding narrowbody aircraft from its operations. This strategic choice is deeply influenced by the airline’s geographic positioning in the Middle East, its reliance on a hub-and-spoke operational model, and a concentrated emphasis on efficiency and profitability through the deployment of large, long-range jets.

The World’s Largest Widebody Fleet

Emirates commands a fleet of 261 widebody aircraft, comprising the world’s largest assemblages of Airbus A380s and Boeing 777s. This fleet size significantly surpasses that of its nearest competitors. For instance, United Airlines, which holds the second-largest widebody fleet, operates approximately 226 aircraft, many of which are smaller models such as the Boeing 767 and 787. Emirates’ dedication to widebody aircraft is further demonstrated by its substantial order of 204 Boeing 777X jets, positioning the airline to maintain its status as the foremost operator of these advanced next-generation aircraft.

While other carriers, including Virgin Atlantic, also maintain all-widebody fleets, their scale is comparatively modest. Virgin Atlantic’s fleet consists of just 44 aircraft, and other all-widebody operators like Air Tahiti Nui operate even fewer. Among Gulf carriers, Qatar Airways and Etihad Airways maintain significant widebody fleets as well, but neither approaches the size or scope of Emirates’ operations.

Hub-and-Spoke Model at a Global Crossroads

The sustainability of Emirates’ all-widebody fleet is closely tied to its hub-and-spoke model, centered at Dubai International Airport. This model channels passengers from across Asia, the Pacific, Africa, and Europe through a single, strategically located hub. Emirates’ long-range aircraft facilitate connections between distant markets, including North America and parts of South America, enabling high-capacity flights that optimize both efficiency and profitability.

In contrast to many global airlines that have shifted toward more flexible point-to-point networks, Emirates remains steadfast in its commitment to the hub-and-spoke system. This approach allows the airline to consistently fill large aircraft, thereby justifying the deployment of widebodies on nearly all routes.

Strategic Focus and Market Challenges

Emirates’ choice to exclude narrowbody aircraft is also shaped by the presence of flydubai, Dubai’s other major airline, which specializes in regional and short-haul routes using narrowbody jets. This clear division of labor permits Emirates to focus exclusively on long-haul, high-density markets where widebody aircraft are most effective.

Nevertheless, this strategy presents challenges. Emirates continues to grapple with Boeing’s production delays and global supply chain disruptions, which have hindered the delivery of new aircraft and affected fleet expansion plans. Additionally, the airline has expressed concerns regarding protectionist policies in key markets such as India, arguing that such regulations impede its growth and restrict access to lucrative routes.

Competitive Landscape

By not operating narrowbody aircraft, Emirates leaves room for competitors to serve regional and secondary markets. Rival airlines often leverage mixed fleets to address these segments, particularly where Emirates’ widebody-only approach is less practical.

Despite these challenges, Emirates’ unwavering focus on widebody aircraft remains central to its corporate identity and operational success, enabling it to dominate long-haul travel and sustain its position as a global leader in aviation.

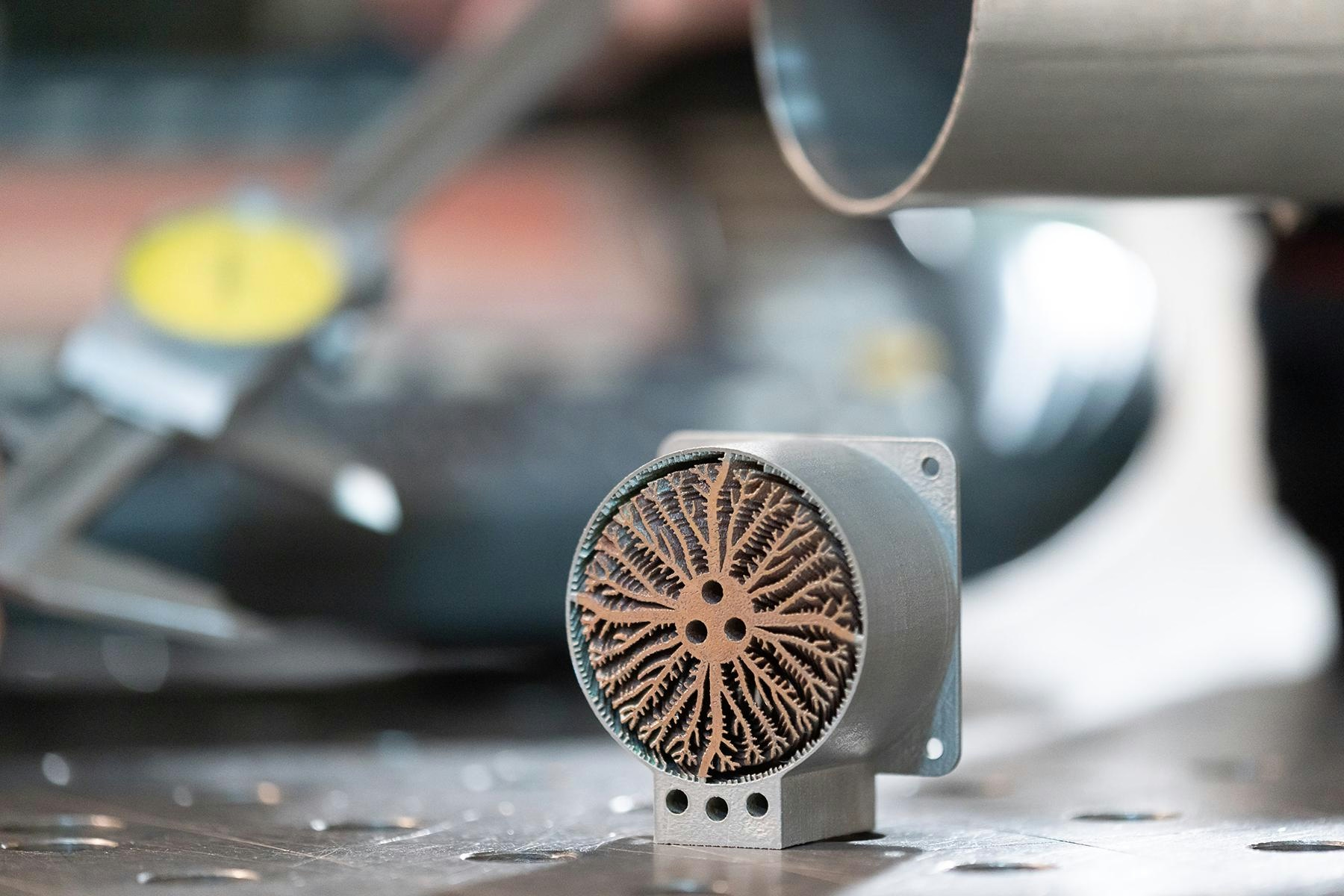

Additive Manufacturing Transforms the Aviation Titanium Alloy Supply Chain

American Airlines Criticizes Delta's AI Pricing While Increasing Solo Passenger Fees

NPA Denies Aviation Fuel Shortage, Assures Stable Supply

Airbus and Rolls-Royce Secure £5 Billion Deal to Supply Indian Airlines

American Airlines CEO Responds to Delta Criticism on AI Pricing

Brazil’s Azul Requests Approval for $1.57 Billion Financing

Asman Airlines Receives New Dash-8 Aircraft

Advances in Aviation Engines Strengthen China’s Air Combat Capabilities

Japan Orders 100 Boeing Jets Amid Rising Supply Chain Concerns