热门趋势

China Weighs Purchase of 500 Airbus Jets, Challenging Boeing

China Weighs Purchase of 500 Airbus Jets, Challenging Boeing

Expanding Airbus Order Amid US-China Trade Tensions

China is reportedly considering a substantial order of up to 500 aircraft from the European manufacturer Airbus, marking a significant development in the ongoing trade tensions with the United States. This potential deal comes just weeks after China returned planes it had previously ordered from Boeing, signaling a shift in preference toward European suppliers. Discussions surrounding the agreement have been underway for more than a year, but recent reports indicate that the scale of the order has expanded from an initial 300 aircraft to as many as 500, encompassing both narrow-bodied and wide-bodied models. The timing of this move coincides with escalating diplomatic and economic frictions between Washington and Beijing. Industry sources suggest that an official announcement could be made as early as next month during a scheduled visit by European leaders to Beijing.

Diplomatic Context and Strategic Implications

The negotiations for this sizeable Airbus order began in earnest following Chinese President Xi Jinping’s visit to France last year, highlighting the interplay between diplomatic engagement and commercial agreements. China has a history of unveiling large aircraft purchases during state visits, using such deals as instruments of broader diplomatic strategy. This potential order not only reflects China’s efforts to diversify its aviation suppliers but also underscores the growing complexities in Sino-American relations, where trade and geopolitical considerations increasingly influence business decisions.

Aviation Expert: Boeing Dreamliner Software Reduced Fuel Use Twice Without Pilot Input

23 Years On, the 737-800 Remains the Core Narrowbody for a Major $20 Billion Airline

FL Technics Launches Around-the-Clock Aviation Logistics Service

SR Technics and Safran Extend LEAP-1A Engine Support Partnership

Condor Expands Fleet with Four More Airbus A330-900s

Swiss Airlines Reviews Future of A220-100 Fleet Amid Engine Problems

Oscar Torres, Former Kellstrom CEO, Joins AE Industrial

Indian Pilot Group FIP Threatens Legal Action Against Wall Street Journal Over AI 171 Coverage

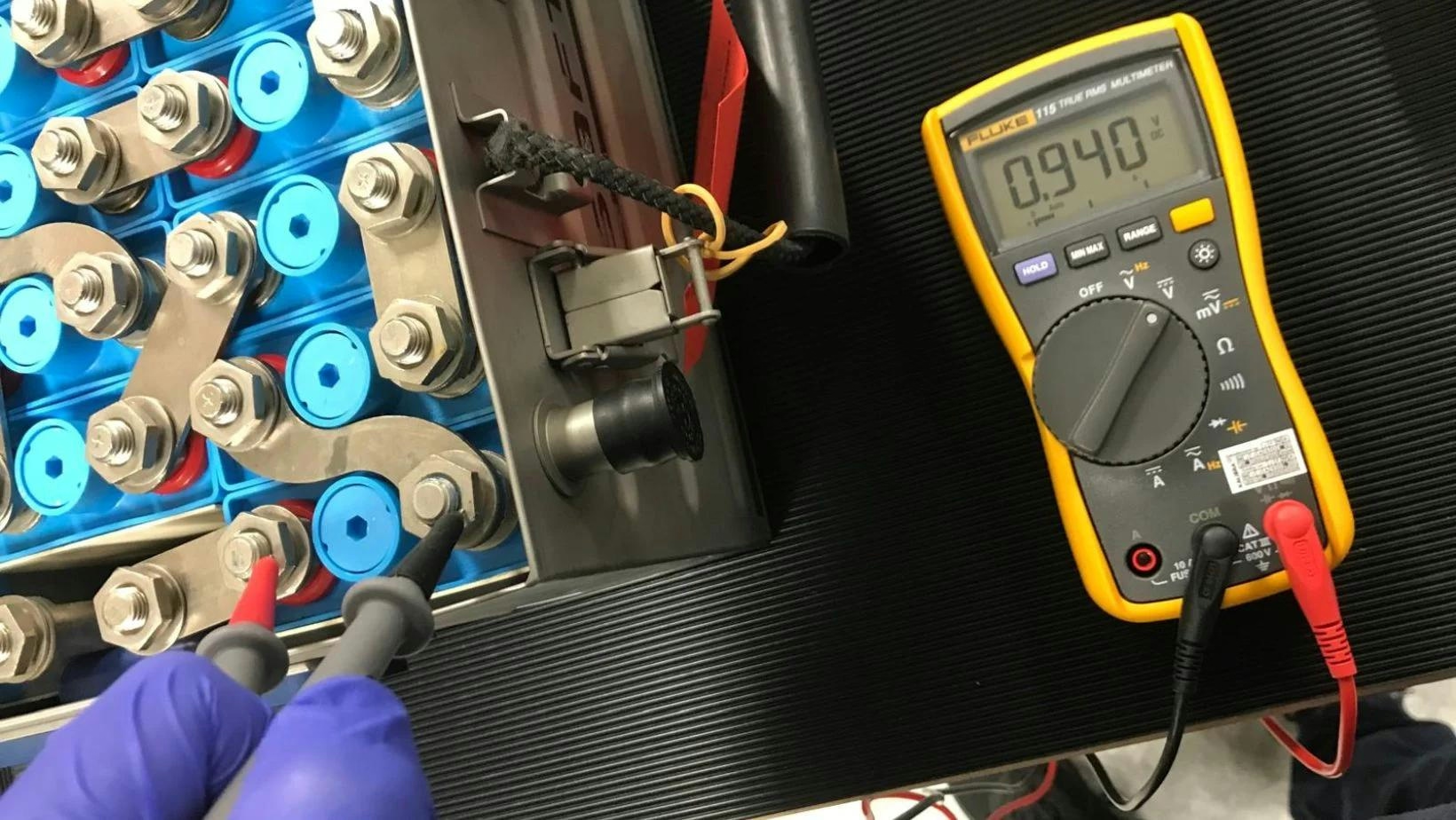

Closing the loop: How to recycle aircraft batteries