AeroGenie — Votre copilote intelligent.

Tendances

Categories

Archer’s Electric Aircraft Reaches 126 mph in 55-Mile Flight

Archer’s Electric Aircraft Achieves 126 mph in 55-Mile Piloted Flight

Archer Aviation has reached a pivotal milestone in the advancement of electric aviation with its flagship Midnight eVTOL aircraft completing its longest piloted flight to date. The company reported that the aircraft, carrying a pilot onboard, covered 55 miles in 31 minutes, reaching speeds of up to 126 miles per hour. This record-setting flight occurred in Salinas, California, a critical testing location for Archer’s development efforts.

Progress and Challenges in eVTOL Development

This achievement follows just two months after Archer initiated piloted test flights, highlighting the rapid progress made in refining the Midnight design. Archer emphasized that the flight not only demonstrates the aircraft’s range but also its operational reliability, positioning Midnight as a formidable contender in the burgeoning urban air mobility sector.

Despite these advancements, Archer faces significant challenges on the path to commercial deployment. Regulatory approval remains a major obstacle, as aviation authorities worldwide continue to develop certification frameworks tailored to eVTOL aircraft. Furthermore, Archer is navigating intense competition from other electric aircraft manufacturers such as Vertical Aerospace and Joby Aviation. These competitors are advancing their own piloted test programs and exploring hybrid-electric models to enhance range and performance.

Market Dynamics and Industry Response

The broader market is closely monitoring these developments, with growing anticipation surrounding early commercial operations and potential partnerships with third-party operators. Industry analysts suggest that substantial government incentives will be crucial to accelerate the adoption of electric aircraft and to support the necessary infrastructure for widespread use.

In response to Archer’s progress, competitors are actively forming strategic alliances and investing in new technologies aimed at improving aircraft capabilities and expanding market presence. As the race to commercialize electric aviation intensifies, Archer’s latest flight highlights both the promise and the complexities involved in bringing eVTOL technology into mainstream aviation.

Growth Expected in Aviation Biofuels Market

Civil Aviation Minister Says Air India Crash Investigation Is Thorough and Professional

Airline Industry Challenges in 2025: Layoffs, Mergers, and AI Pricing

FAA to Review Honda’s Exemption Request for eVTOL Aircraft Trials in the US

New Aviation Maintenance and Training Center Planned for North Bali

Airbus Exceeds 2025 Delivery Target with 793 Aircraft

TransDigm Group Reshapes the Aerospace Supply Chain

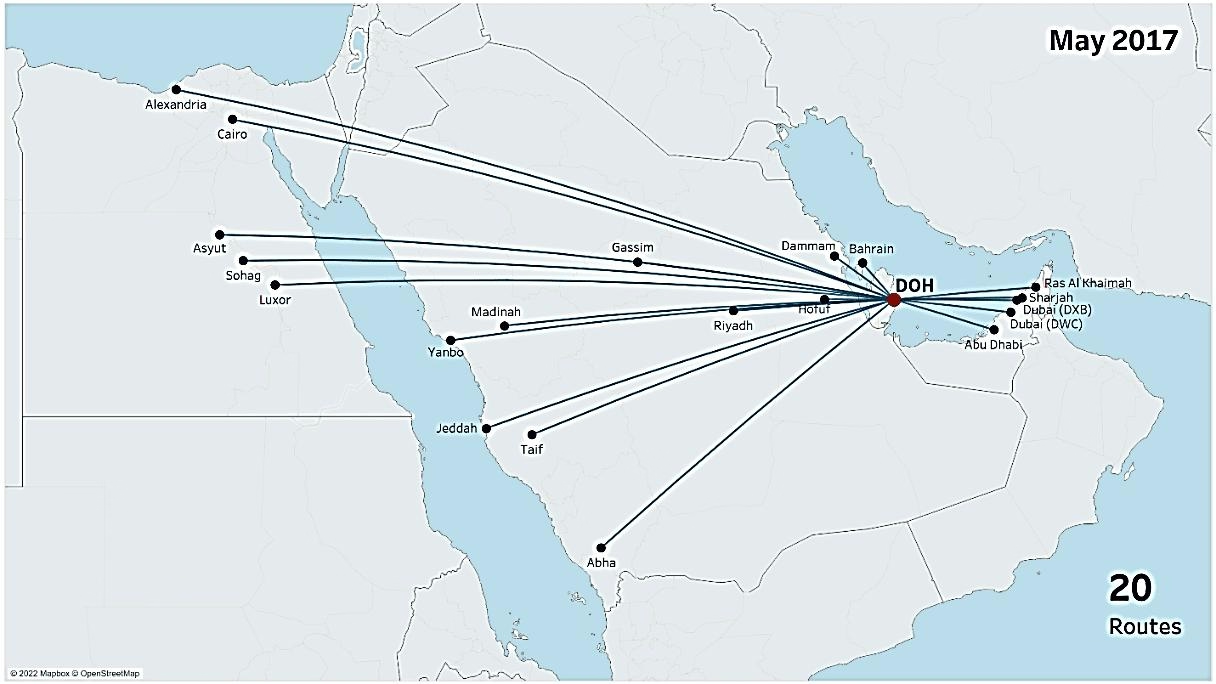

Qatar Secures ICAO Re-election and Expands Aviation Routes

UAE and China Advocate for Flying Taxis Over Self-Driving Cars