AeroGenie — Votre copilote intelligent.

Tendances

Categories

GE Shares Edge Up 0.06% on $950 Million Volume Amid Cathay Pacific's Increased GE9X Order

GE Shares Edge Up Amid Cathay Pacific’s Expanded GE9X Engine Order

General Electric (GE) shares experienced a slight increase of 0.06% on August 6, 2025, supported by a robust trading volume of $950 million. This volume positioned the stock 98th in daily liquidity rankings, reflecting heightened investor interest following a significant commercial agreement with Cathay Pacific. The airline has committed to purchasing 14 additional GE9X engines for its Boeing 777-9 fleet, raising its total order to 35 engines. The contract also encompasses a comprehensive service agreement that includes maintenance, repair, and overhaul provisions.

Strategic Importance of the GE9X Engine

The GE9X engine is widely regarded as the most powerful and fuel-efficient commercial jet engine currently available. It offers a 10% improvement in specific fuel consumption compared to its predecessor and is compatible with sustainable aviation fuel blends. This latest order underscores Cathay Pacific’s confidence in GE Aerospace’s advanced technology for long-haul operations and reinforces the GE9X’s dominant position in the market for high-capacity aircraft propulsion. Exclusively designed for Boeing 777X models, the engine represents a critical asset for airlines aiming to reduce emissions while maintaining operational efficiency.

Industry analysts consider the agreement strategically significant for GE, as it strengthens the company’s foothold in the competitive aerospace sector. Nevertheless, GE faces challenges related to sustaining production efficiency and managing costs amid rising demand from Cathay Pacific and other carriers. Although the market responded positively with a modest uptick in GE’s share price, the company must effectively navigate these operational pressures to fully leverage the expanded order.

Market Context and Broader Implications

While competitors may seek to secure similar contracts with major airlines, no specific counteractions have been reported to date. Broader market factors, including tariff-related costs impacting companies such as Apple, could indirectly affect GE’s performance and the aerospace industry more broadly.

GE Aerospace highlighted its extensive global presence, with a fleet of 49,000 commercial engines currently in operation. The company’s strong liquidity position is further evidenced by recent data showing that a strategy of purchasing the top 500 stocks by daily trading volume and holding them for one day has yielded a 166.71% return since 2022, significantly outperforming the benchmark return of 29.18%. This trend underscores the importance of liquidity concentration in driving short-term stock performance, particularly in volatile market conditions.

As GE continues to meet growing demand and maintain its technological leadership, the expanded order from Cathay Pacific represents a notable milestone in the company’s aerospace ambitions and its ongoing influence on the future of commercial aviation.

Skyportz Unveils Modular Vertipad Prototype to Advance Air Mobility Infrastructure

Blue Angels’ ‘Fat Albert’ Undergoes Overhaul in the U.K.

Airbus Faces Year-End Delivery Challenge Despite Major Vietnamese Order

Poland’s LOT Wet-Leases A320 for Tel Aviv Route

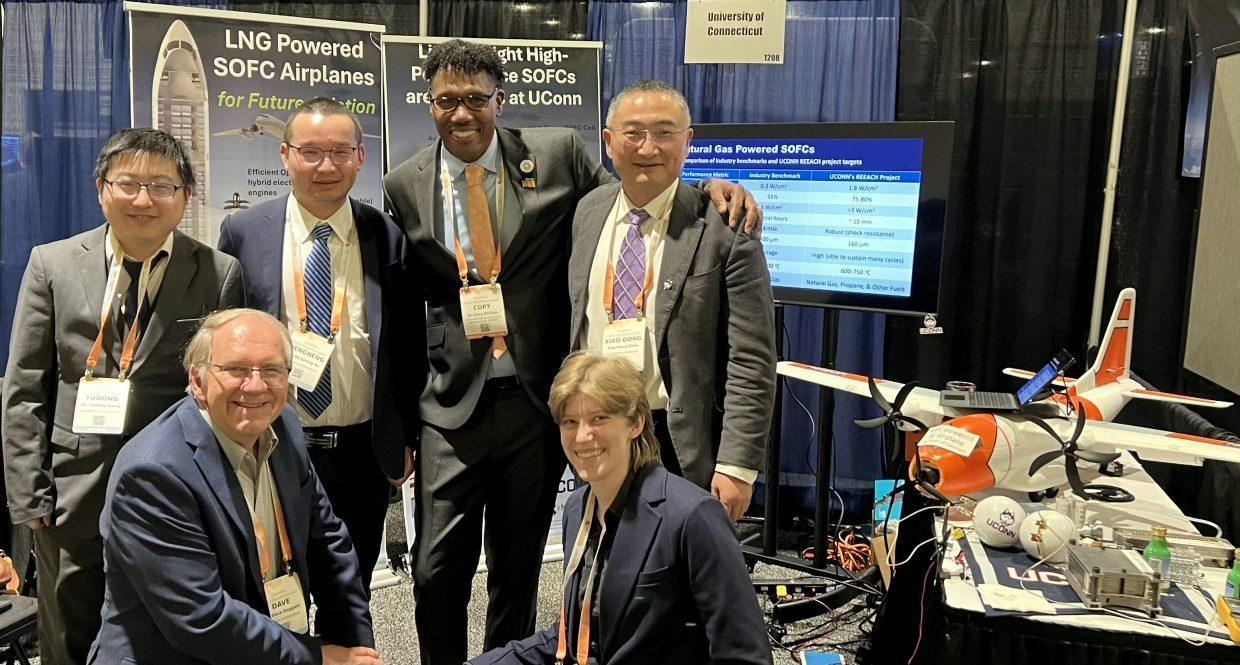

Aviation Advances at the Innovation Center

Boeing to Showcase Middle East Partnerships at Dubai Airshow 2025

AerFin Completes Transition of Two A320 Aircraft

Kenya Bans Import of F27 and F50 Models Over Safety Concerns

SKF Introduces ARCTIC15 Steel for Advanced Aircraft Engines