AeroGenie — Your Intelligent Copilot.

Trending

Categories

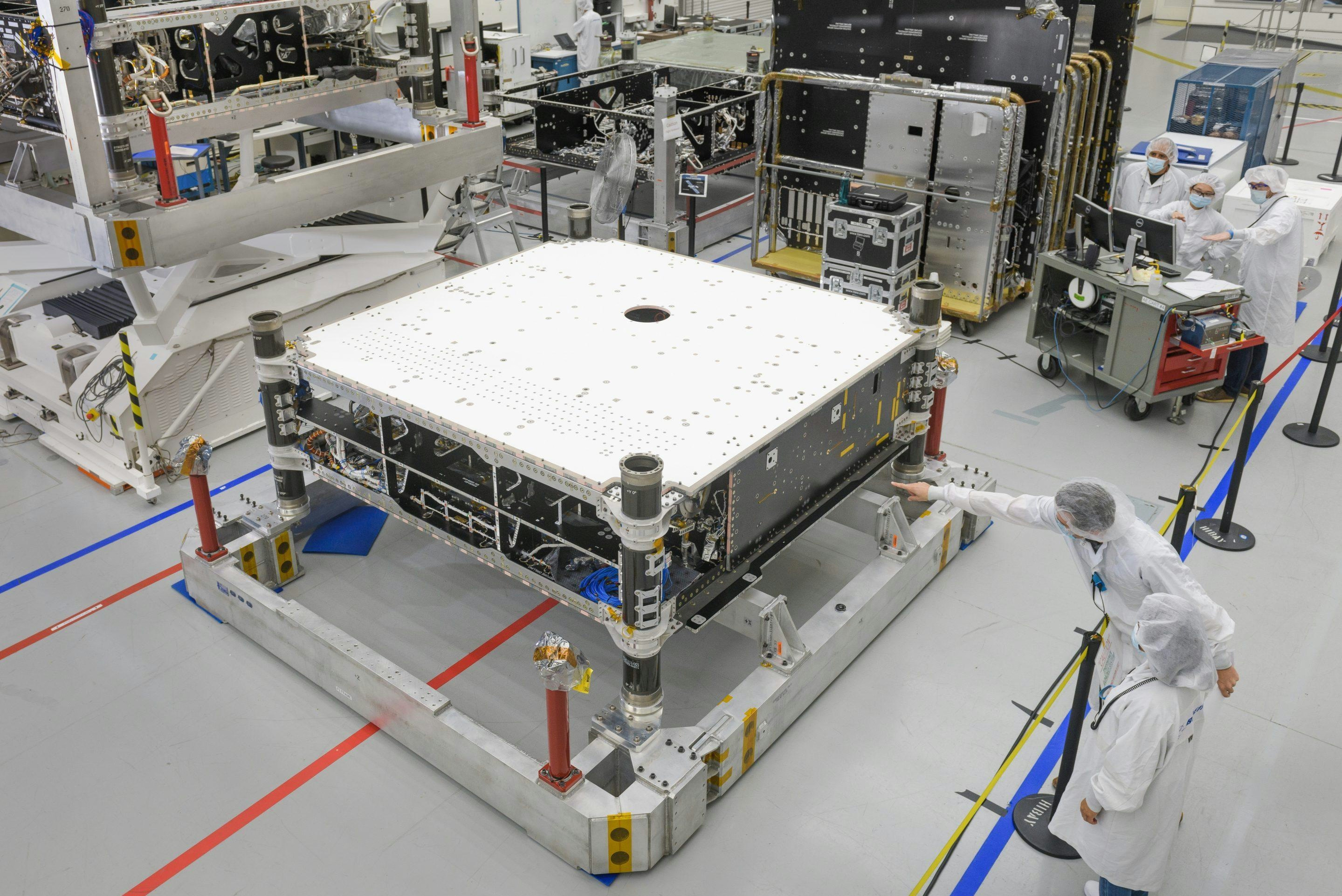

Boeing Expands Global Connectivity with SES Satellite Deliveries

Boeing Expands Global Connectivity with SES Satellite Deliveries

Boeing has recently delivered the ninth and tenth O3b mPOWER satellites to SES, marking a pivotal advancement in global connectivity infrastructure. These satellites incorporate cutting-edge software-defined payload technology, highlighting Boeing’s dedication to pioneering aerospace innovations. The deliveries coincide with a notable 40% increase in Boeing’s share price over the past quarter, driven by favorable market conditions and significant aircraft orders from Qatar Airways and China Airlines.

Strategic Momentum Amid Market Dynamics

Boeing’s recent performance gains are supported by broader upward trends in the S&P 500 and Nasdaq indices. However, the company’s strategic progress in satellite and military technologies, including the Wideband Global SATCOM satellites, has been a critical factor in its robust market showing. Despite these strengths, Boeing faces intensifying competition as it expands its satellite business. The European Commission’s unconditional approval of the SES-Intelsat merger underscores the growing presence of vertically integrated competitors such as Starlink, Viasat, and Inmarsat. This evolving competitive landscape is expected to increase scrutiny on pricing structures and service reliability, as rivals enhance their satellite capabilities to protect market share.

Addressing Technical Challenges and Financial Outlook

The delivery of fixed O3b mPOWER satellites to SES also reflects Boeing’s ongoing efforts to resolve prior technical issues. While these improvements are intended to enhance service quality, some industry analysts question their necessity, particularly given recent solar storm events that have temporarily boosted satellite performance. Financially, Boeing’s share price currently stands at $200.26, slightly below the consensus target of $224.12, indicating room for potential appreciation. Over the past three years, the company has achieved a total shareholder return of 55.55%, inclusive of dividends. Nevertheless, Boeing’s one-year performance lags behind the U.S. Aerospace & Defense industry’s 38.5% return, highlighting persistent challenges amid industry pressures even as the company secures new contracts and stabilizes production of its 737 and 787 aircraft.

Looking forward, Boeing’s advancements in satellite technology and recent contract acquisitions may positively influence future revenue and earnings projections. The company’s emphasis on operational stability and strategic innovation appears to be fostering investor confidence, as reflected in its recent share price gains. However, ongoing risks remain, including heightened competition and the imperative to maintain technological leadership in a rapidly evolving market.

As Boeing continues to expand its role in enhancing global connectivity, its capacity to overcome technical obstacles and respond effectively to competitive pressures will be crucial to sustaining growth and delivering shareholder value.

Marshall Aerospace’s 115-Year Evolution from Cars to C-130s

Advancing Sustainable Aviation Goals for 2050

Sabre Introduces New AI-Driven Platform

Photo of the Day: Special Delivery

GOL CEO Confirms Possible Arrival of A330neo Widebody Aircraft

American Airlines donates APU to AIM Chicago for student training

Steer Appointed Base Maintenance Manager at Caerdav

How Airline Technology Is Changing U.S. Domestic Travel in 2026

New Il-96 Wide-Body Aircraft Built in Russia; Customer Remains Undisclosed

Japan Airlines Launches JAL Innovation Fund II to Support Technology Ventures