AeroGenie — Tu copiloto inteligente.

Tendencias

Categories

Boeing 737 MAX Production Resumes Amid Supply Chain Challenges

Boeing 737 MAX Production Resumes Amid Supply Chain Challenges

Strategic Supply-Chain Realignment Drives Recovery

The Boeing 737 MAX program, once emblematic of crisis within the aerospace sector, is now demonstrating a significant turnaround through strategic supply-chain realignment and enhanced operational discipline. By the second quarter of 2025, Boeing has stabilized production at 38 aircraft per month, with plans to gradually increase output to 42 units by late 2025 and 47 units by the end of the year. This resurgence goes beyond merely restoring pre-2019 production levels; it represents a comprehensive recalibration of Boeing’s supply chain to emphasize resilience, transparency, and closer collaboration with suppliers.

The grounding of the 737 MAX in 2019 revealed Boeing’s vulnerability due to its heavy reliance on single-source suppliers and its limited capacity to manage production interruptions without triggering widespread financial and operational disruptions. In response, Boeing has adopted a multi-faceted strategy aimed at diversifying its supplier base, strengthening partnerships, and integrating real-time data analytics into inventory management systems. A notable development in this strategy is Boeing’s negotiation to acquire Spirit AeroSystems, the primary supplier of the 737 MAX fuselage. This acquisition, alongside renegotiated credit terms and prepayment agreements for work-in-progress, has helped stabilize critical supply nodes.

Smaller suppliers, previously exposed to cash flow shocks during production halts, now benefit from structured financial support mechanisms. Boeing has also introduced “slowdown playbooks” designed to mitigate the bullwhip effect—where sudden production cuts destabilize supplier networks. Inventory management has evolved significantly; production rate increases are now carefully phased to align with demand forecasts, thereby avoiding the overstock issues experienced in 2020. Real-time data sharing with suppliers optimizes inventory levels, reduces idle stock, and improves cash flow efficiency. These changes mark a shift from a cost-driven model to one that prioritizes agility and risk mitigation.

Investor Confidence and Financial Outlook

Investor sentiment toward Boeing has improved markedly in 2025, with the company’s stock (BA) rising by 32.12% year-to-date. This optimism is supported by concrete financial improvements, including a 63% reduction in losses in the second quarter of 2025 compared to the same period in 2024, and a significantly reduced cash burn rate of $200 million per quarter, down from $4.3 billion in 2020. Boeing’s production strategy now balances speed with safety, contributing to a more stable financial outlook.

Analysts forecast a return to profitability in 2026, with adjusted earnings per share (EPS) projected to reach $11.92 by 2029. Boeing’s strategic initiatives, such as partnerships focused on sustainable aviation fuel and expansion into the Asia-Pacific market, further enhance its long-term growth prospects. Nonetheless, challenges persist. Certification delays for the 737 MAX 7 and MAX 10 variants, expected to extend into 2026, may disrupt delivery schedules. Additionally, labor disputes within Boeing’s defense unit pose operational risks. Investors must weigh these uncertainties against Boeing’s disciplined production approach and its substantial cash reserves of $23 billion, which provide a buffer against its $53.3 billion debt.

Implications for Airline Operators

For airline operators, Boeing’s production recovery promises greater predictability in aircraft deliveries. Airlines such as United and Delta, which had previously criticized Boeing’s communication during the 2020 production freeze, now report improved transparency and collaboration. This renewed partnership is expected to facilitate more reliable fleet planning and operational efficiency, marking a new era of cooperation between Boeing and its airline customers.

Capital A Completes Sale of Aviation Business to AirAsia X

Four Gateway Towns to Lake Clark National Park

PRM Assist Secures €500,000 in Funding

Should Travelers Pay More for Human Support When Plans Go Wrong?

InterGlobe Aviation Shares Rise 4.3% Following January Portfolio Rebalancing

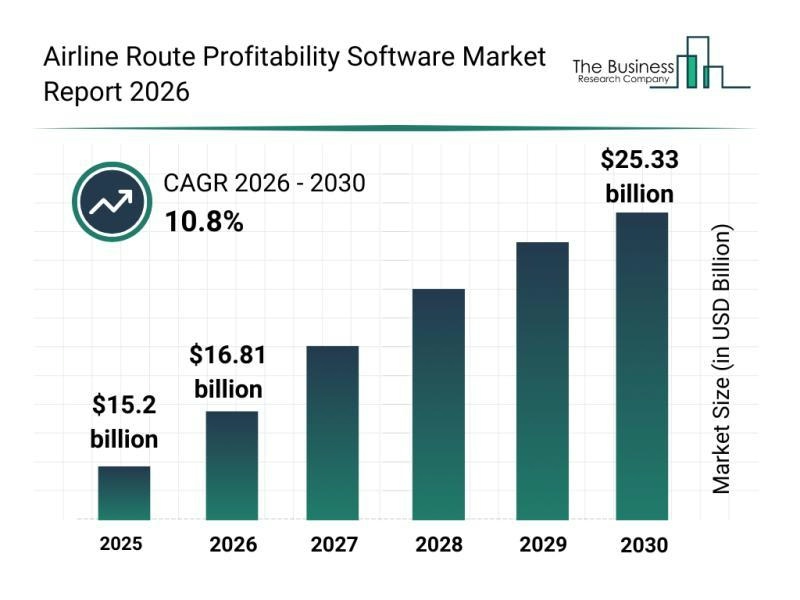

Key Market Segments Shaping Airline Route Profitability Software

Locatory.com Gains Traction Among Aviation MROs and Suppliers

JetBlue Flight Makes Emergency Landing Following Engine Failure

58 Pilots Graduate from Ethiopian University

The Engine Behind Boeing’s Latest Widebody Aircraft