AeroGenie — Il tuo copilota intelligente.

Tendenze

Categories

Forecast for U.S. Commercial Fleet and MRO Growth Through 2026

Forecast for U.S. Commercial Fleet and MRO Growth Through 2026

The Aviation Week Network’s recently published 2026 Commercial Fleet & MRO (Maintenance, Repair, and Overhaul) forecast outlines a promising outlook for the U.S. aviation industry, despite ongoing challenges such as supply chain disruptions and increasing engine maintenance demands. Sustained global demand for air travel is expected to drive accelerated commercial aircraft deliveries, which are projected to peak at over 2,200 units annually by the end of the decade.

Commercial Fleet Expansion and Production Dynamics

Although aircraft deliveries are anticipated to experience a slight decline in the near term, the long-term forecast remains optimistic. Leading manufacturers, including Airbus and Boeing, are expected to increase production as they navigate supply chain constraints and certification hurdles. Currently, the industry holds more than 17,500 firm orders for new aircraft, reflecting steady and robust demand.

A significant factor influencing fleet growth is the replacement of aging aircraft, particularly in North America, where the average fleet age exceeds the global norm. This renewal process is projected to contribute to a 3% compound annual growth rate (CAGR) in the global active in-service fleet over the next decade. However, delays in new aircraft deliveries have compelled airlines to extend the operational lifespan of older planes, thereby intensifying maintenance requirements and placing additional strain on the MRO sector.

Maintenance, Repair, and Overhaul Market Outlook

The forecast anticipates that unconditional demand for MRO services will reach $853 billion over the next ten years, with the overall MRO aftermarket expected to surpass $1.6 trillion, growing at a CAGR of 3.2%. This expansion is driven by heightened needs for unscheduled maintenance, engine overhauls, and the replacement of life-limited parts.

Narrowbody aircraft are projected to dominate the market, accounting for approximately 75% of the more than 21,000 global aircraft deliveries anticipated over the coming decade. Airbus is expected to maintain its lead over Boeing in this segment, with the A320 family surpassing the 737 in-service fleet by roughly 3,000 aircraft by 2035. The extended use of older aircraft, a consequence of production and supply chain challenges, is increasing maintenance costs, particularly in the engine sector. Additionally, the increased utilization and durability challenges associated with newer narrowbody engines are likely to have significant implications for MRO providers.

Industry Challenges and Strategic Responses

The forecast highlights the necessity for increased investment in MRO infrastructure and workforce development to support the expanding fleet. Competition among MRO providers is expected to intensify as airlines seek dependable partners to manage growing maintenance demands. In response, market participants may pursue strategic partnerships, acquisitions, and broadened service offerings to capture greater market share.

Furthermore, evolving regulatory frameworks and rapid technological advancements are anticipated to reshape market dynamics and operational strategies within the MRO sector. Both providers and airlines will need to demonstrate adaptability to navigate these changes effectively.

As the U.S. commercial aviation sector embarks on a decade of growth, the interplay between fleet modernization, rising MRO demand, and competitive industry dynamics will be pivotal in defining its trajectory through 2026 and beyond.

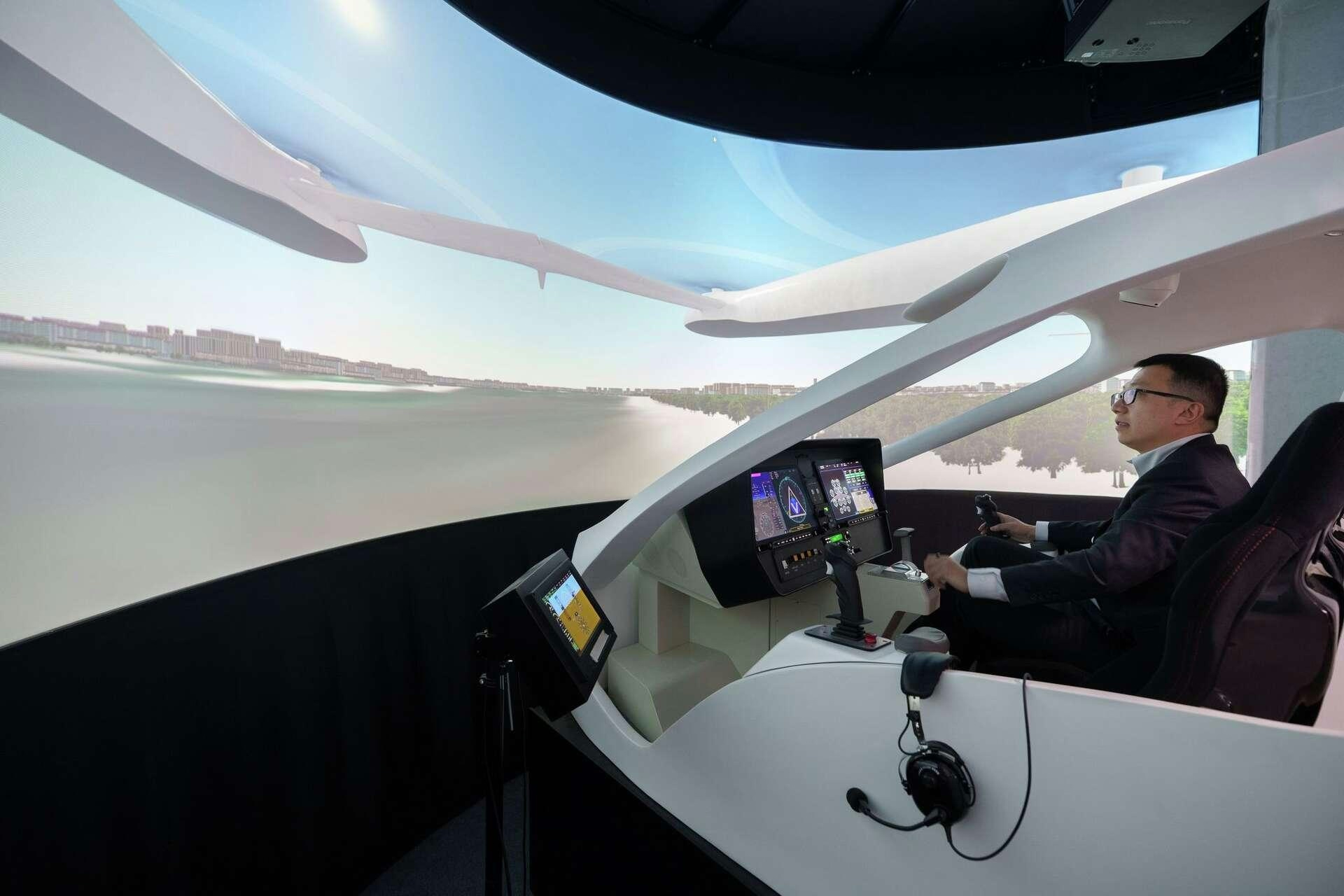

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services

ETF Airways to Receive First ATR Aircraft