AeroGenie — Uw intelligente copiloot.

Trending

Categories

Air India and IndiGo Resume Large Aircraft Orders

Air India and IndiGo Resume Large Aircraft Orders

Renewed Expansion Amidst Intense Competition

India’s two largest airlines, IndiGo and Air India, are accelerating their fleet expansion through significant new aircraft orders, reflecting ambitious growth strategies despite already substantial acquisitions announced earlier in 2023. IndiGo has confirmed plans to exercise an option to purchase 30 additional Airbus A350-900 widebody jets, effectively doubling its existing widebody order. This development coincides with a recently signed Memorandum of Understanding involving Delta Air Lines, Air France-KLM, and Virgin Atlantic. The agreement is designed to integrate IndiGo’s network on a global scale while fostering collaboration in areas such as maintenance, training, and operational systems.

Simultaneously, Air India, now under the ownership of the Tata Group, is advancing its own fleet expansion efforts. According to sources cited by Reuters, the airline is close to finalizing a deal with Boeing for the 777X widebody aircraft and is engaged in ongoing discussions with both Airbus and Boeing to acquire approximately 200 narrowbody jets. This follows Air India’s record-breaking order in 2023, which included 470 aircraft from the two manufacturers, supplemented by an additional 100 Airbus jets added to its backlog last year.

Challenges in Delivery and Market Implications

The surge in aircraft orders highlights both carriers’ determination to capture a larger share of India’s rapidly expanding aviation market. However, they face significant challenges related to delivery schedules. Airbus and Boeing continue to contend with global supply chain disruptions and extensive order backlogs, which threaten to delay the delivery of new aircraft. Airbus, in particular, is prioritizing the sizeable Indian orders but remains constrained by limited assembly line capacity for popular models such as the A320neo and Boeing’s 737 MAX, with availability projected to extend well into the next decade.

These production bottlenecks could hinder the airlines’ efforts to modernize their fleets on schedule, potentially affecting profitability and market share amid intensifying competition. Rival carriers may respond with pricing strategies or operational adjustments to defend their positions, further increasing competitive pressures within the sector.

As Indian airlines aggressively pursue fleet expansion, their ordering strategies are reshaping the domestic aviation landscape and exerting influence on global industry dynamics. The ultimate impact will depend on manufacturers’ ability to fulfill delivery commitments and the airlines’ capacity to navigate evolving market challenges.

SkyWest Expands Maintenance Operations in Salina

Nigeria’s Air Peace Wet-Leases Additional Boeing 737-800

Industry Leaders to Discuss AI’s Impact at SATEC 2026

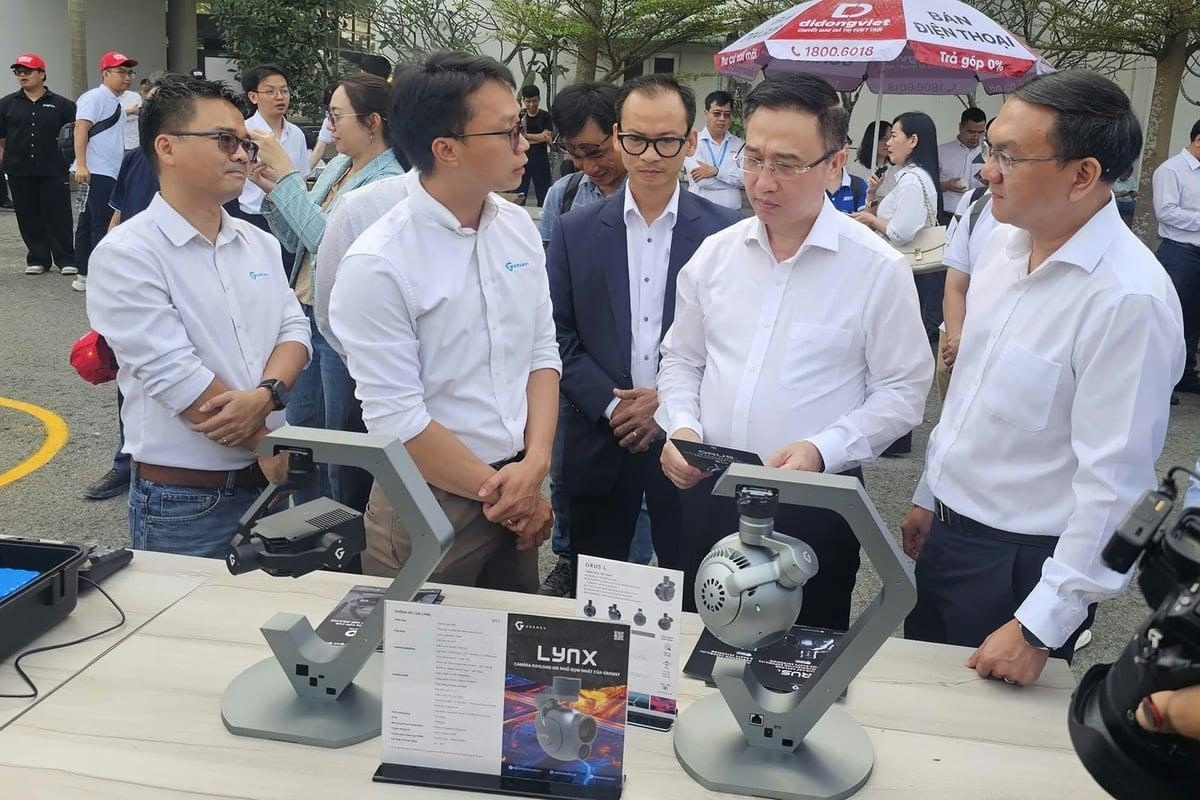

Ho Chi Minh City Launches Drone Delivery Pilot Program

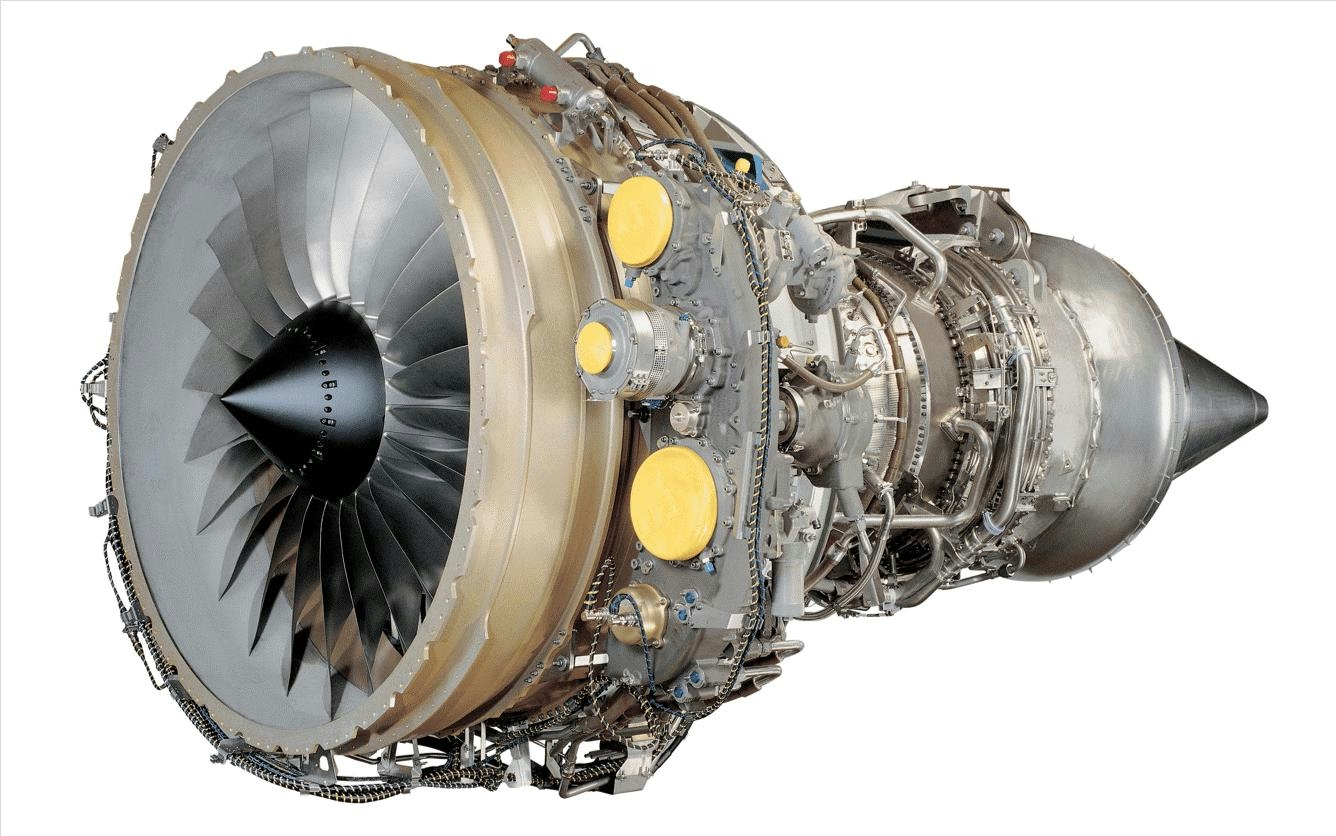

APOC Aviation Acquires CF34-10E Engine for Teardown

Growth in Aerospace Adhesives and Sealants Driven by Innovation and Aviation Expansion

UAE Plans to Launch First Flying Taxi Service

Alex Wilcox, Co-Founder and CEO of JSX, Redefines Regional Air Travel Through Customer-First Innovation

Garuda Indonesia MRO Unit Completes $332 Million Land Injection