AeroGenie — Seu copiloto inteligente.

Tendências

Categories

Joby Aviation’s Acquisition of Uber Elevate and Its Role in Urban Air Mobility

Joby Aviation’s Acquisition of Uber Elevate and Its Role in Urban Air Mobility

Joby Aviation has positioned itself as a frontrunner in the burgeoning urban air mobility (UAM) industry, a status significantly bolstered by its 2020 acquisition of Uber Elevate. This strategic acquisition merged Joby’s cutting-edge electric vertical takeoff and landing (eVTOL) technology with Uber’s extensive experience in on-demand mobility services, accelerating Joby’s trajectory toward launching commercial air taxi operations.

Strategic Integration and Technological Synergy

The acquisition of Uber Elevate represented a pivotal moment for Joby, bringing with it a $125 million investment alongside critical software infrastructure. This included sophisticated market simulation models and multi-modal operations platforms essential for managing complex urban air transport networks. At the heart of this integration lies ElevateOS, a system inspired by Uber’s ride-hailing technology, which now underpins Joby’s FAA-approved, Part 135-certified air taxi services. ElevateOS encompasses rider and pilot applications as well as backend operational software, streamlining the user experience and enabling frequent, on-demand flights.

Key personnel from Uber Elevate, led by Chief Product Officer Eric Allison, have been instrumental in refining Joby’s operational framework. By aligning the convenience of air travel with the familiar model of ridesharing, Joby aims to lower barriers to adoption and leverage Uber’s global network and customer insights. This approach is designed to facilitate rapid scaling once regulatory approvals are secured.

Regulatory Landscape and Competitive Environment

Despite these technological and operational advances, Joby faces considerable regulatory challenges. As of 2025, the company has completed 43% of the Federal Aviation Administration’s (FAA) Stage 4 certification requirements and 62% of its internal development milestones. Type Inspection Authorization (TIA) flight testing is anticipated within the next year. Joby is also actively collaborating with the NAA Network—a consortium including the FAA, the UK Civil Aviation Authority, and other regulators—to harmonize international standards by 2027, a move intended to streamline global deployment.

Market reactions to Joby’s progress have been varied. While some investors express optimism about the transformative potential of urban air mobility, others remain cautious due to ongoing technological, safety, and regulatory uncertainties. The competitive landscape is intensifying, with rivals such as Archer Aviation and Lilium making significant strides in the eVTOL sector, heightening the race to commercialize air taxi services.

Production Growth and Innovation Initiatives

Joby is rapidly expanding its manufacturing capabilities to meet anticipated demand. Its 435,500-square-foot facility in Marina, California, currently produces 24 eVTOL aircraft annually. Meanwhile, a new plant in Dayton, Ohio, backed by a $500 million investment from Toyota, aims to scale production to 500 units per year by 2027. Toyota’s involvement extends beyond financial support, contributing lean manufacturing expertise that has enhanced Joby’s production efficiency and quality control.

Recent technological milestones, including the completion of a nine-hour flight with an uncrewed, hydrogen-powered aircraft, highlight Joby’s commitment to innovation and scalability. Nonetheless, the company must continue to address challenges related to public acceptance and regulatory complexity to fully realize its vision for urban air mobility.

Financial Position and Global Expansion

Joby’s strong financial footing distinguishes it from competitors such as Volocopter and EHang, which have encountered liquidity difficulties. With $1.5 billion in cash reserves—including $933 million reported in the fourth quarter of 2024—Joby is well-positioned to sustain its research, development, and certification efforts. Additional support comes from state and federal grants, including $19.8 million awarded by California’s GO-Biz program.

Geographically, Joby is capitalizing on its first-mover advantage. In Dubai, the company holds exclusive six-year operating rights and is constructing its inaugural vertiport at Dubai International Airport, targeting a 2026 launch. This international foothold underscores Joby’s ambition to lead the global urban air mobility market.

As Joby Aviation continues to integrate Uber Elevate’s assets and expertise, it remains at the forefront of the UAM sector. However, the company must navigate a complex environment of regulatory approvals, public acceptance, and intensifying competition to achieve commercial viability.

Comparing the Fuselage Lengths of the Airbus A350-1000 and Boeing 787-10

Thailand Establishes U-Tapao Aircraft MRO Center Contract for January 2026

United Airlines Announces Routes for New Premium Boeing 787s

Boeing Introduces Remote Co-Pilot Technology

The Airbus A350-1000’s Fuel Efficiency Advantage Explained

McNally Capital Expands Aviation Operations to Support Global Tourism

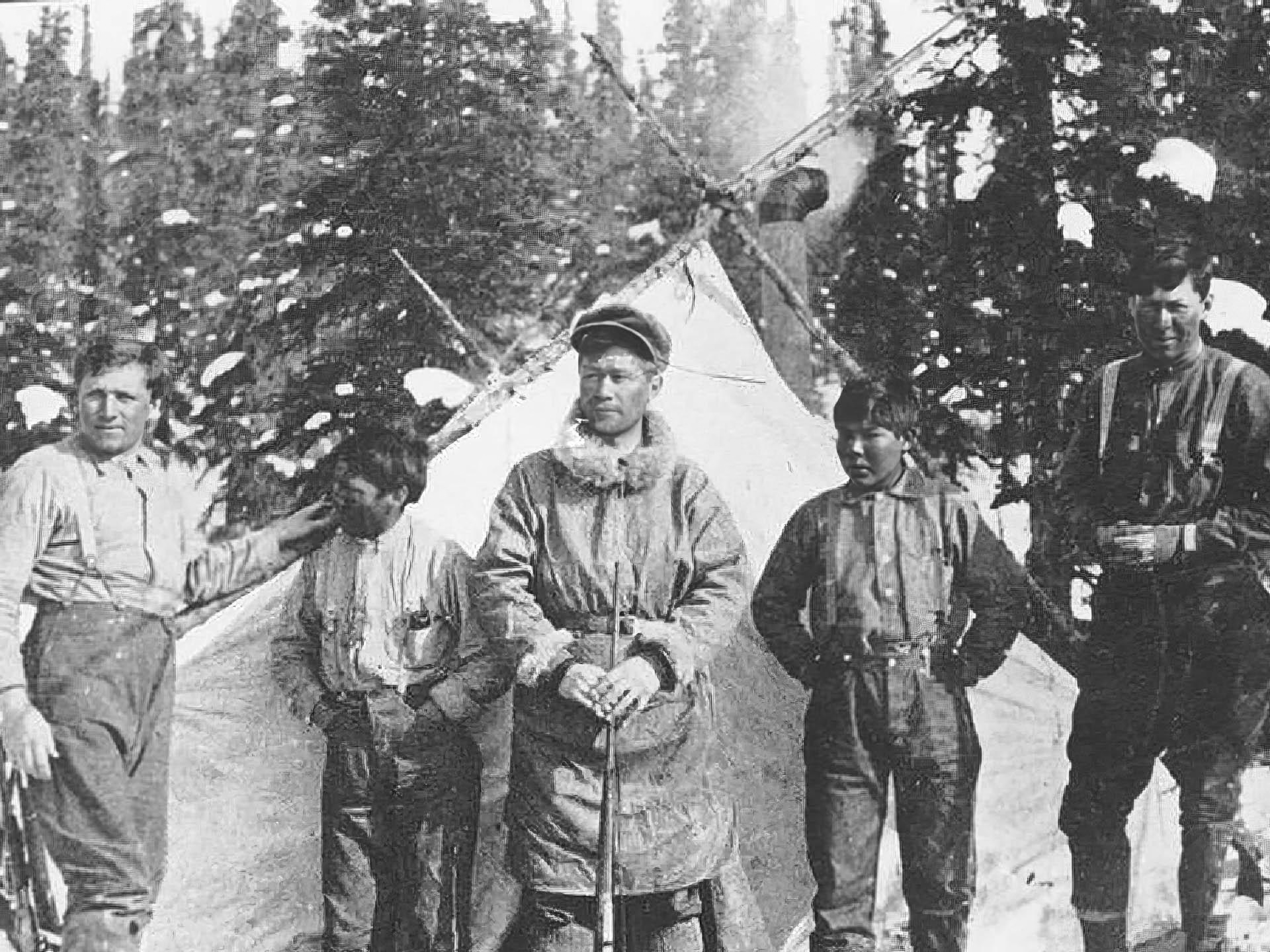

Two Young Climbers Begin Winter Ascent of McKinley

Elroy Air’s Autonomous Chaparral Delivers Lunch on A-to-B Flight

Texarkana College Holds First Graduation for Aviation Maintenance Technician Program