E-mail mais inteligente, negócios mais rápidos. Marque, analise e responda automaticamente a RFQs, cotações, pedidos e muito mais — instantaneamente.

Tendências

Tokyo Narita International Airport Plans 'Airport City' Development

Tokyo Narita International Airport Unveils Ambitious 'Airport City' Development Plans

Japanese authorities have announced a comprehensive plan to develop a transformative "airport city" at Tokyo Narita International Airport, aiming to enhance the airport’s global competitiveness and stimulate the regional economy. Spearheaded by the NRT Area Design Center—established in April through a collaboration between Chiba Prefecture officials and Narita International Airport Corporation—the initiative unites a diverse coalition of stakeholders, including central and local governments, private enterprises, academic institutions, and community organizations.

Structure and Phases of the Airport City

The proposed airport city will be structured into five interconnected zones, each serving distinct functions. The Airport Zone will focus on advanced industries, logistics, aircraft maintenance, research, and business hubs. The Urban Zone is intended to foster tourism and retail development, while the Riverside and Seaside Zones will emphasize natural, cultural, and tourism activities. Lastly, the Natural-Life Zone will prioritize eco-friendly living and high-tech agriculture.

The project is approaching its execution phase, slated for 2025 to 2030, aligning with significant airport expansion efforts. Construction of a third runway, known as Runway C, is already underway, alongside the extension of Runway B. These infrastructure enhancements are expected to increase Narita’s annual flight slots from 300,000 to 500,000. During this initial phase, land acquisition for industrial and urban zones will begin, accompanied by the development of new road infrastructure. The subsequent phase, spanning 2030 to 2040, will focus on launching new cargo facilities, opening various zones and buildings, and realizing measurable economic benefits.

Challenges and Competitive Landscape

Despite its ambitious scope, the development faces several challenges. Securing complex regulatory approvals and addressing environmental concerns will be critical hurdles. Additionally, the project must navigate potential opposition from local communities affected by the expansion. The initiative also enters a competitive regional environment, where neighboring airports are expected to respond with their own expansions or enhanced services to protect market share.

These local challenges coincide with broader scrutiny in the global aviation sector. Industry-wide issues, such as safety concerns highlighted by recent incidents at Newark Airport in 2025, underscore the necessity for stringent operational and regulatory oversight. As Narita advances its airport city vision, balancing growth ambitions with safety, sustainability, and community engagement will be essential.

If successfully implemented, the airport city could establish Tokyo Narita as a premier international hub, driving economic growth while setting new benchmarks for integrated airport development.

GE Aerospace and China Airlines Forge Strategic Partnership in Asia-Pacific Aviation

Spain, Belgium, and Hungary Advance Sustainable Aviation with Wizz Air’s SAF Trials

Akasa Air Signs Three-Year Maintenance Agreement with GMR Aero Technic for Boeing 737 MAX Fleet

Foam Floods Spirit Airlines Hangar, Coating Jets at Detroit Airport

SMBC Aviation Capital and AJet Sign Lease for Five Airbus Aircraft

Air India Tells DGCA Rs 1 Crore Ex-Gratia Is Not Final Compensation for AI 171 Crash

AviaAM Leasing Nears Completion of Boeing 777 Passenger-to-Freighter Conversion

Inside Bombardier's Secret New Innovation Center: How It Will Revolutionize Private Aviation Design

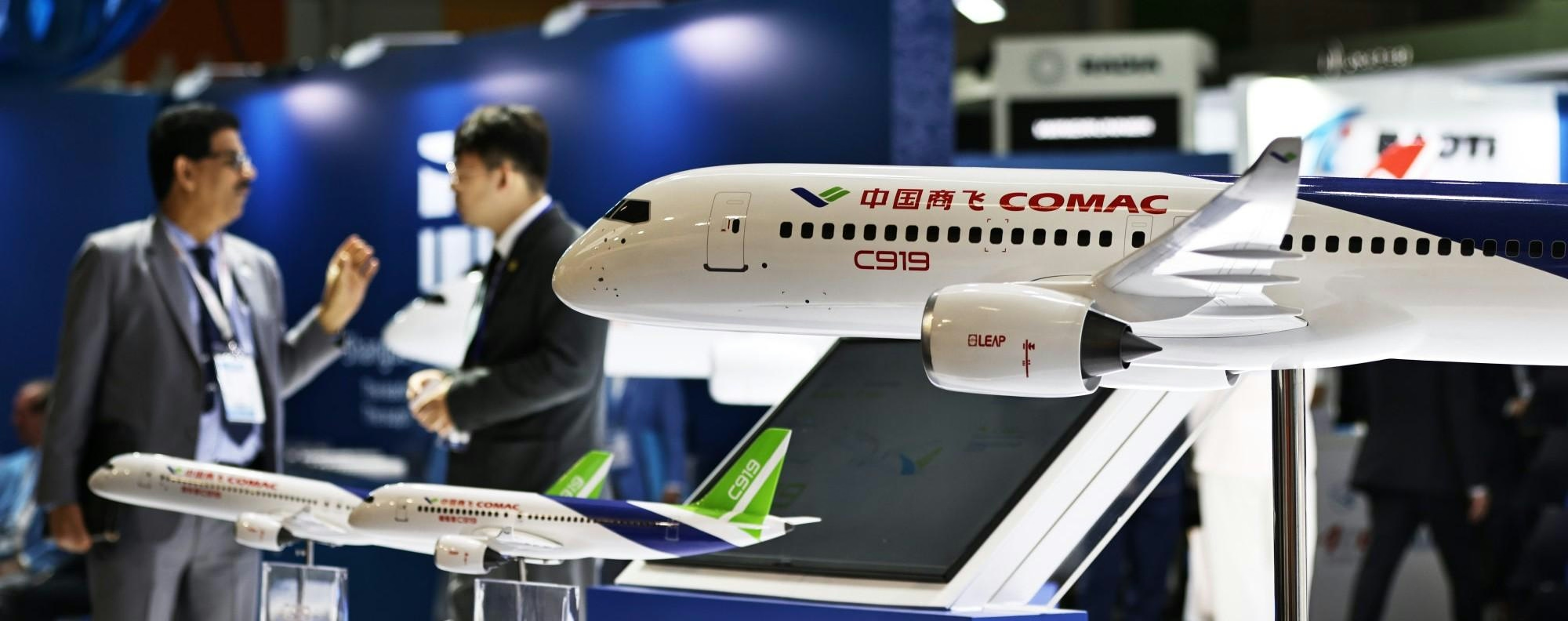

China’s C919 May Benefit from Renewed U.S. Jet Engine Exports, Analysts Say