AeroGenie — Tu copiloto inteligente.

Tendencias

Categories

Yak-40 Testbed Completes First Flight with UZGA VK-800 Engine

Yak-40 Testbed Completes First Flight with UZGA VK-800 Engine

Milestone Flight in Novosibirsk

The Siberian aerospace research institute SibNIA has successfully completed the maiden test flight of a Yakovlev Yak-40 aircraft powered by the new UZGA VK-800 engine. Conducted in Novosibirsk, this flight represents a crucial step in the VK-800 engine’s certification process. The engine is intended for use in the UZGA LMS-901 utility aircraft and is also being considered for other future platforms, including the twin-engined LMS-192 Osvey and the UTS-800 trainer.

During the flight, which lasted just over 15 minutes, the Yak-40 reached altitudes of up to 700 meters (2,300 feet) and speeds near 180 knots. According to UZGA, the VK-800 operated smoothly throughout all phases of the flight, including taxiing, takeoff, cruising, and landing, with all systems performing as expected. The engine’s design incorporates a single-stage compressor and a two-stage turbine, reflecting its modern engineering tailored for regional aviation needs.

Challenges Ahead and Industry Context

Despite the successful initial flight, the VK-800 program faces several challenges as it advances toward full certification and integration. Industry analysts have pointed to supply chain complexities that could delay production and deployment. Furthermore, integration issues similar to those experienced by other manufacturers, such as Airbus, may emerge as the engine is adapted to various airframes.

Market reception to the VK-800 has been mixed. Some traditional aviation stakeholders remain cautious about the engine’s unconventional design and its potential for widespread adoption. At the same time, competitors are accelerating development of alternative propulsion technologies. Major players like Pratt & Whitney and Collins Aerospace are progressing with hybrid-electric engine demonstrators, including the PW1100G, while companies such as Skyfly are advancing electric vertical takeoff and landing (eVTOL) technologies.

As UZGA continues its testing program and moves closer to certification, the VK-800’s performance in upcoming flights and its ability to navigate integration and supply chain challenges will be closely monitored by industry experts and prospective customers alike. The engine’s success or failure may have significant implications not only for the LMS-901 and related aircraft but also for the future trajectory of regional aviation propulsion systems.

The Mechanics and Importance of Single-Engine Autorotations

Nexus Airlines Adds Refurbished Dash 8-400 to Fleet

European Supply Chain Supports Do228 NXT Production

Ambassador Victor Smith Strengthens Ties with Robinson Helicopter Company

HAVELSAN Earns Dual Certification for Turkish-Built 737NG Flight Training Device

Awery Selected as Software Provider for Group Concorde’s Global GSSA Operations

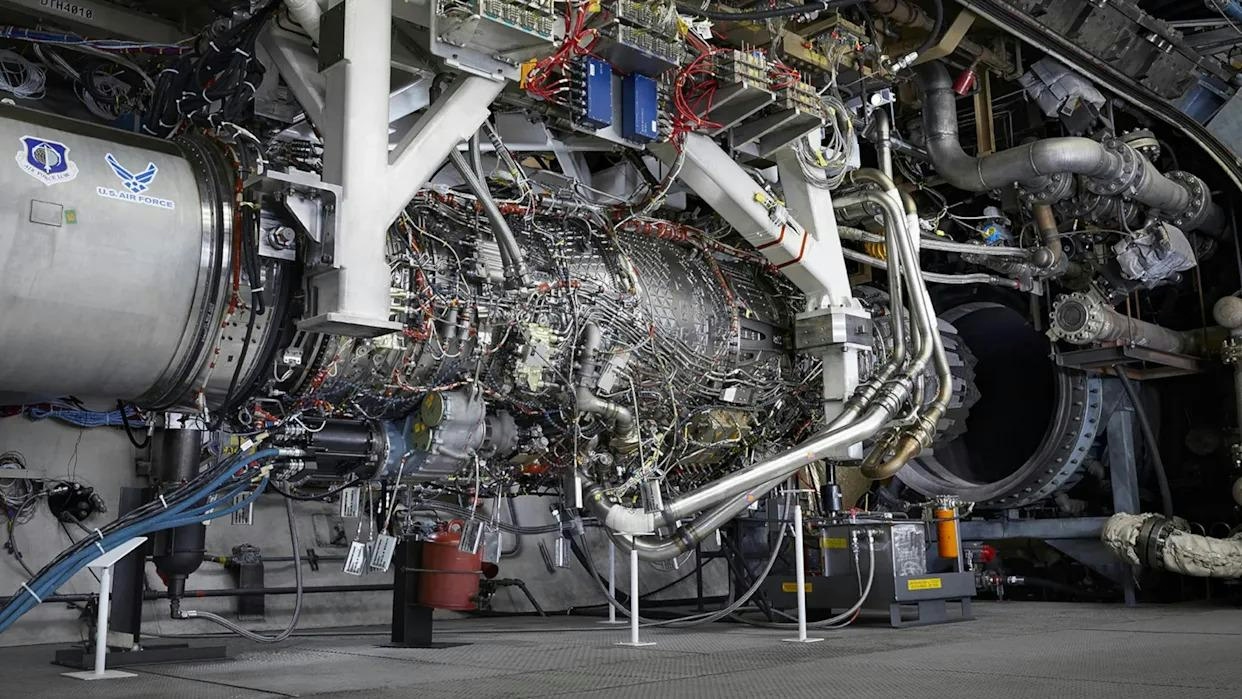

New Video of Pratt & Whitney XA-103 Engine Hints at Boeing F-47

China Plans to Order Up to 120 Airbus Jets

US Concerns Over China’s Expanding Widebody Aircraft Fleet

Interview with Brian Cobb, Chief Innovation Officer at CVG Airport