AeroGenie — Votre copilote intelligent.

Tendances

Categories

Werner Aero Sells A319 Aircraft to Regourd Aviation

Werner Aero Sells A319 Aircraft to Regourd Aviation Amid Market Shifts

Werner Aero, LLC has finalized the sale of an Airbus A319 aircraft, bearing manufacturer serial number 2716, to Regourd Aviation. This transaction represents a key milestone in Werner Aero’s strategic approach to aircraft asset management, which encompasses acquisition, strategic deployment, and long-term value optimization. The deal underscores the company’s commitment to maintaining a dynamic and responsive asset lifecycle management framework.

Strategic Partnership and Fleet Expansion

Tony Kondo, Chief Executive Officer and President of Werner Aero, highlighted that the sale exemplifies the company’s dedication to fostering enduring industry partnerships and delivering customized solutions tailored to client needs. He remarked, “Working with Regourd Aviation on the A319 sale reinforces our role as a trusted partner capable of supporting a wide range of operational and investment objectives across the sector.”

Regourd Aviation confirmed that the newly acquired A319 will play a pivotal role in expanding its long-range executive fleet. Alain Regourd, Chief Executive Officer of Regourd Aviation and Amelia, welcomed the collaboration, emphasizing the aircraft’s significance in advancing the group’s strategic development plans. The acquisition aligns closely with Regourd Aviation’s focus on specialized A319 platforms designed for executive and long-range missions.

Industry Context and Market Dynamics

The sale occurs amid ongoing challenges within the aviation sector, where Werner Aero, like many industry players, contends with supply chain disruptions and volatile fuel prices that continue to impact operational efficiency. Recent analyses from the Aviation Week Network have underscored these pressures, while market observers remain attentive to the financial stability of asset management firms, particularly in economically uncertain regions such as Latin America and the Caribbean.

In response to such market conditions, competitors may adjust their fleet strategies to capitalize on opportunities created by transactions like this one. For instance, LAM Mozambique has recently undertaken fleet revitalization efforts, while other industry participants are increasingly exploring advanced air mobility solutions to mitigate potential revenue impacts stemming from traditional aircraft sales.

Despite these challenges, Werner Aero continues to broaden its portfolio of aircraft and parts, serving a diverse clientele that includes airlines, maintenance and repair organizations, and leasing companies worldwide. The company remains focused on sourcing, managing, and placing assets that address the evolving operational, commercial, and technical requirements of its customers, demonstrating adaptability amid shifting market conditions.

SCAT and Boeing Begin Construction of Central Asia’s Largest Aircraft Maintenance Hub in Shymkent

Ranking the Most Influential Passenger Airplanes of All Time

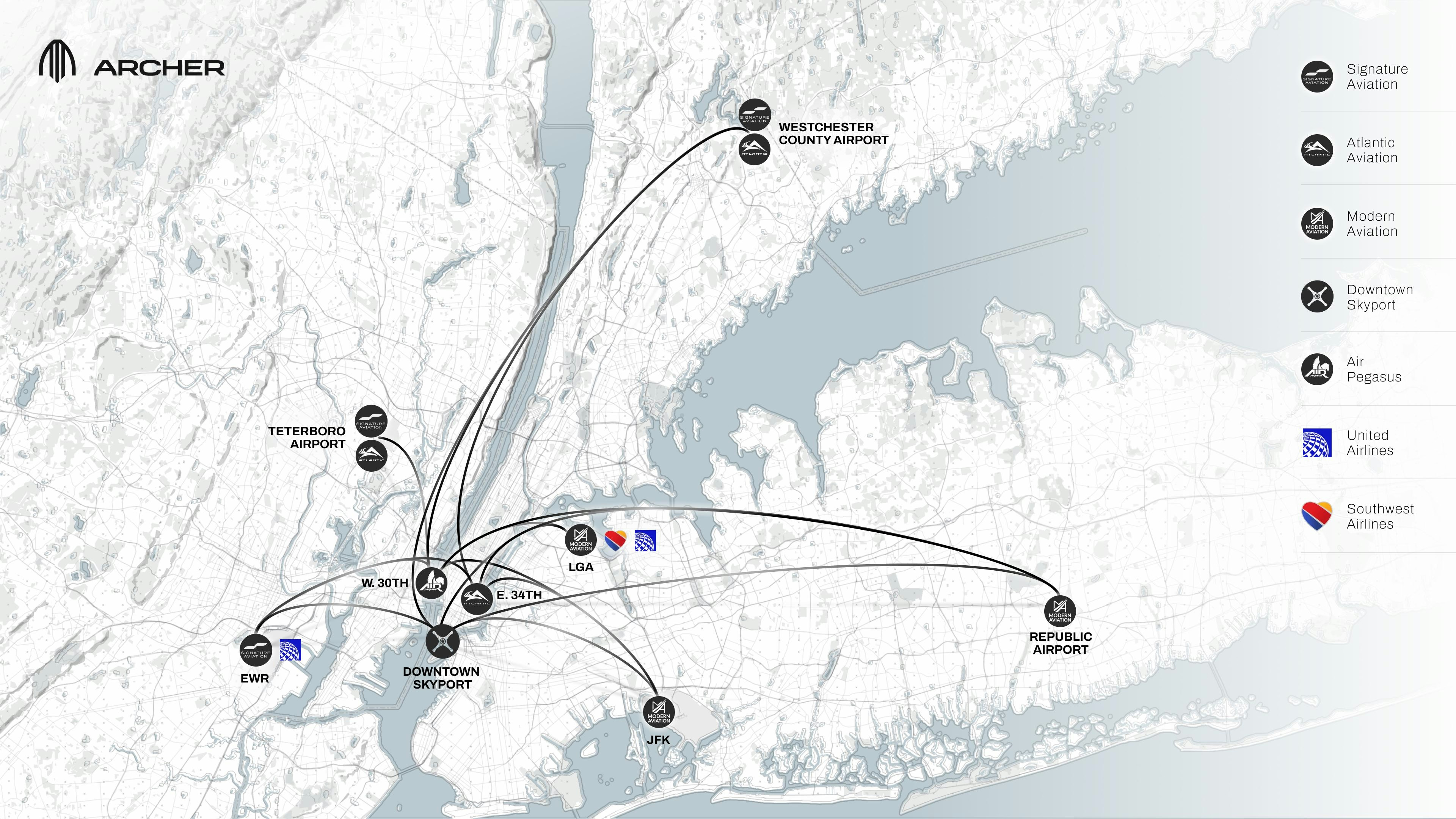

Tri-State Region Prepares for Arrival of Air Taxis

Delta (DAL) Expands Fleet with New Airbus A321neo Order

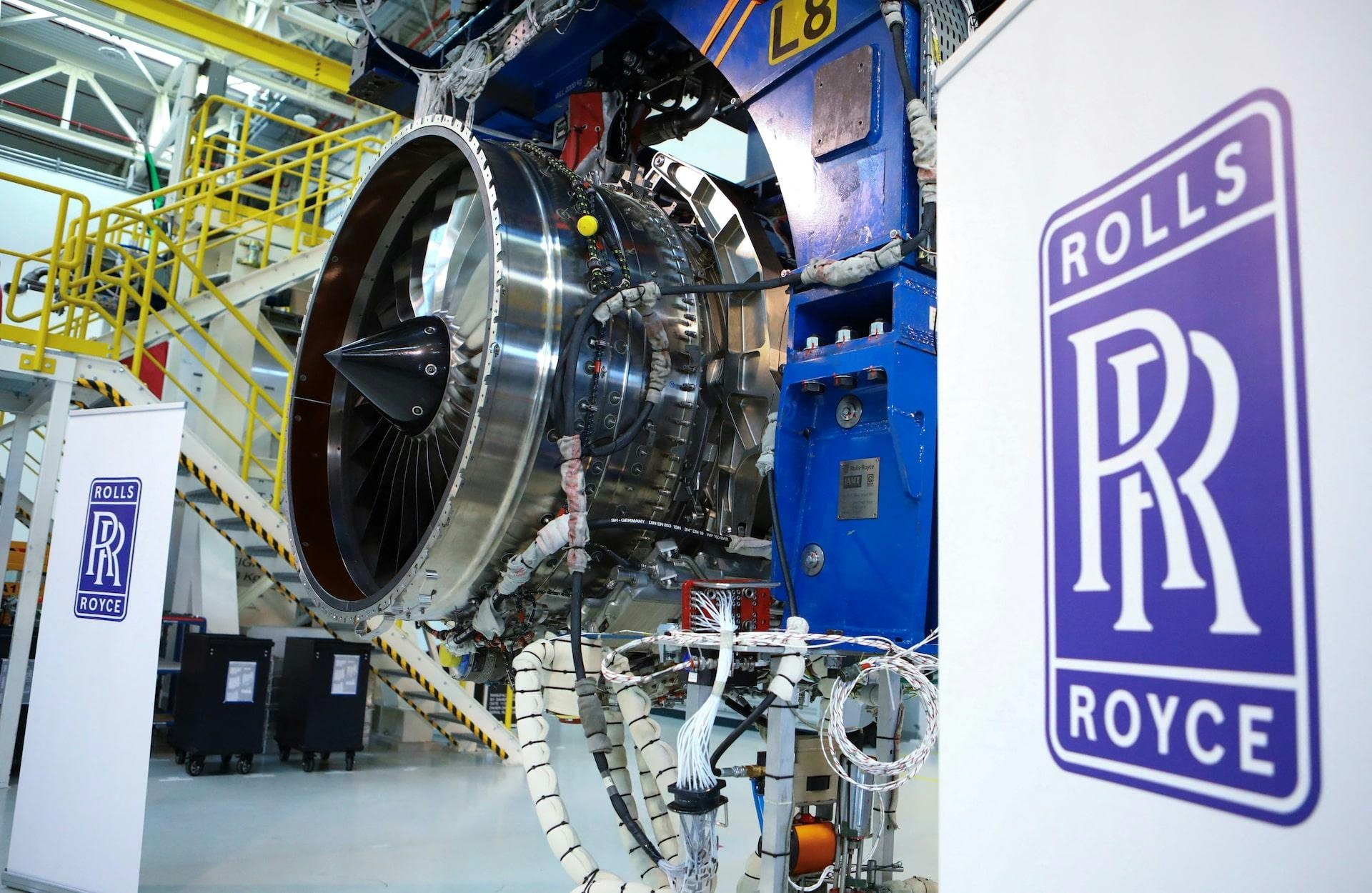

Rolls-Royce Plans Return to Narrowbody Aircraft Engines

FTAI Aviation Details Engine Leasing Strategy and Associated Risks

Castlelake Makes First Aircraft ABS Repayment Since Pandemic

Delta orders 34 more Airbus A321neo jets in fleet renewal push

Top Widebody Premium Seats Available for Booking

An-2 Successor Flies for First Time with Russian Engine