AeroGenie — Seu Copiloto Inteligente.

Tendências

Categories

Air France-KLM to Acquire Majority Stake in SAS

Air France-KLM to Acquire Majority Stake in SAS

Air France-KLM has announced its intention to increase its stake in Scandinavian airline SAS from 19.9% to 60.5%, thereby acquiring a majority shareholding. The transaction involves purchasing shares from Castlelake and Lind Invest, which would result in SAS becoming a subsidiary of the Air France-KLM Group. The Danish State will maintain a 26.4% ownership in SAS and continue to hold representation on the airline’s Board of Directors.

Strategic Integration and Operational Synergies

This acquisition follows the commercial cooperation initiated in the summer of 2024, during which SAS joined the SkyTeam alliance and expanded codeshare and interline agreements with Air France and KLM. The move aims to deepen integration between SAS and Air France-KLM beyond commercial collaboration, extending into operational areas and loyalty programmes. Upon completion, Air France-KLM is expected to assume the majority of board seats at SAS.

The final investment value will be determined at closing, based on SAS’s latest financial metrics such as EBITDA and net debt, aligning with Air France-KLM’s medium-term financial strategy. The group anticipates finalizing the acquisition in the second half of 2026, subject to regulatory approvals and the fulfillment of all conditions precedent.

Challenges and Market Implications

While the acquisition is positioned as a strategic effort to strengthen Air France-KLM’s presence in the Nordic region, it faces potential regulatory scrutiny due to concerns over increased market concentration and competition in Scandinavia. Additionally, there may be resistance from SAS employees regarding the integration process, underscoring the importance of effective management to realize synergies without disrupting operations.

Market reactions are expected to be mixed. Investors may view the acquisition positively, seeing it as a move to bolster Air France-KLM’s position in Northern Europe and potentially enhance share value. Conversely, competitors might respond by forming new alliances or intensifying their market presence to counterbalance Air France-KLM’s expanded reach.

Leadership Perspective and Future Outlook

Air France-KLM’s decision is supported by SAS’s improved financial and operational performance, the success of recent partnership initiatives, and confidence in the airline’s long-term growth prospects. Benjamin Smith, CEO of Air France-KLM, expressed optimism about the acquisition, highlighting SAS’s successful restructuring and the potential benefits of deeper integration. He emphasized that the operation would enhance connectivity for customers and Scandinavians alike, while recognizing the dedication of SAS teams in restoring the airline’s position.

If completed, this acquisition would represent a significant consolidation within the European aviation sector, enabling Air France-KLM to leverage synergies and expand its influence in the Nordic market while navigating the associated regulatory and operational complexities.

Capital A Completes Sale of Aviation Business to AirAsia X

Four Gateway Towns to Lake Clark National Park

PRM Assist Secures €500,000 in Funding

Should Travelers Pay More for Human Support When Plans Go Wrong?

InterGlobe Aviation Shares Rise 4.3% Following January Portfolio Rebalancing

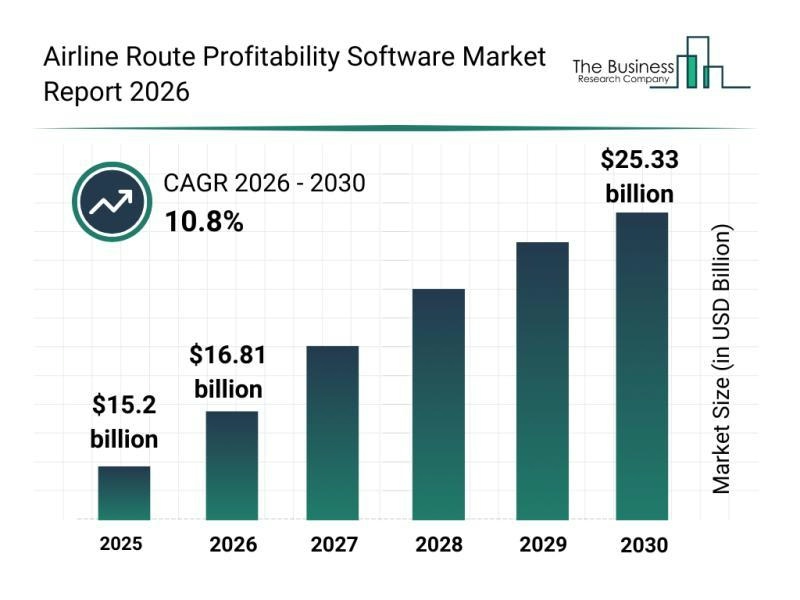

Key Market Segments Shaping Airline Route Profitability Software

Locatory.com Gains Traction Among Aviation MROs and Suppliers

JetBlue Flight Makes Emergency Landing Following Engine Failure

58 Pilots Graduate from Ethiopian University

The Engine Behind Boeing’s Latest Widebody Aircraft