AeroGenie — Seu copiloto inteligente.

Tendências

Categories

Aircraft Lessors Sue Flair Airlines Over 2023 Plane Seizures

Aircraft Lessors Initiate $30.9-Million Lawsuit Against Flair Airlines Over 2023 Aircraft Repossessions

In a significant escalation of a legal dispute that has captured industry attention, four Irish aircraft leasing companies have filed a $30.9-million counterclaim against Canadian carrier Flair Airlines. The lawsuit arises from the repossession of four Boeing 737 aircraft in March 2023, a move that Flair previously challenged as unlawful and “draconian.”

Background of the Dispute

The lessors—Columbia Lights Aviation, Corvus Lights Aviation, Mam Aircraft Leasing, and Airborne Capital—lodged their counterclaim in Ontario Superior Court as part of their defence against an earlier $50-million lawsuit initiated by Flair Airlines. Flair’s original suit accused the lessors of breaching contract terms by seizing the planes. In response, the lessors contend that Flair repeatedly failed to meet its financial obligations under the lease agreements, with outstanding payments reaching as high as $3.5 million at the time of repossession.

According to the lessors’ statement of defence, Flair ignored multiple default notices and missed monthly payments between September 2022 and March 2023, with arrears fluctuating between $1.8 million and $3.5 million. The lessors assert that they incurred substantial costs related to repossessing, repairing, and subsequently re-leasing or selling the aircraft. They are seeking damages to cover lost rental income, maintenance, marketing expenses, and taxes.

Details of the Repossession and Legal Arguments

The repossession occurred on March 11, 2023, when agents representing the leasing companies took control of the aircraft at airports in Toronto, Waterloo, and Edmonton. At the time, Flair’s then-CEO Stephen Jones acknowledged delays in lease payments following a challenging winter period but estimated the amount owed to be closer to $1 million.

The lessors reject Flair’s allegations that they induced the airline to breach its contracts or conspired to transfer the aircraft to other operators at inflated rates. They maintain that the lease agreements explicitly granted them the right to repossess the planes in the event of default.

Industry Implications and Legal Context

This high-profile case underscores the growing complexities and risks inherent in aircraft leasing arrangements. It has prompted increased scrutiny within the aviation sector, with competitors and market participants reevaluating their approaches to mitigate financial exposure related to aircraft repossessions.

Recent judicial decisions, including rulings favoring insurers compensating for seized aircraft, are reshaping the legal and commercial landscape. These developments are influencing negotiations between lessors and airlines and highlight the evolving nature of aircraft leasing, where legal outcomes carry significant consequences for all parties involved.

Flair Airlines has not yet responded to requests for comment. Further updates will be provided as the case advances.

ANA Introduces The Room FX Business Class on Boeing 787 Dreamliners

New Three-Cylinder Engine Features Rotating Block and Stationary Head

Credit Card Rewards Compete with Airline and Hotel Loyalty Programs

ExecuJet MRO Installs Starlink on Falcon 8X

New Airlines Confront Supply Chain and Staffing Challenges

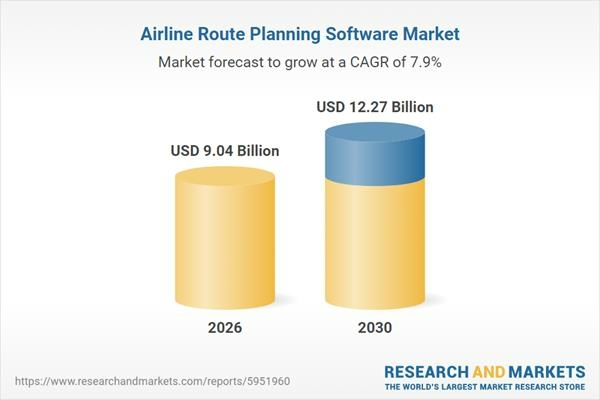

Global Airline Route Planning Software Market Forecasts Through 2035

Archer Aviation Shares Rise Premarket Following Nvidia IGX Thor AI Partnership

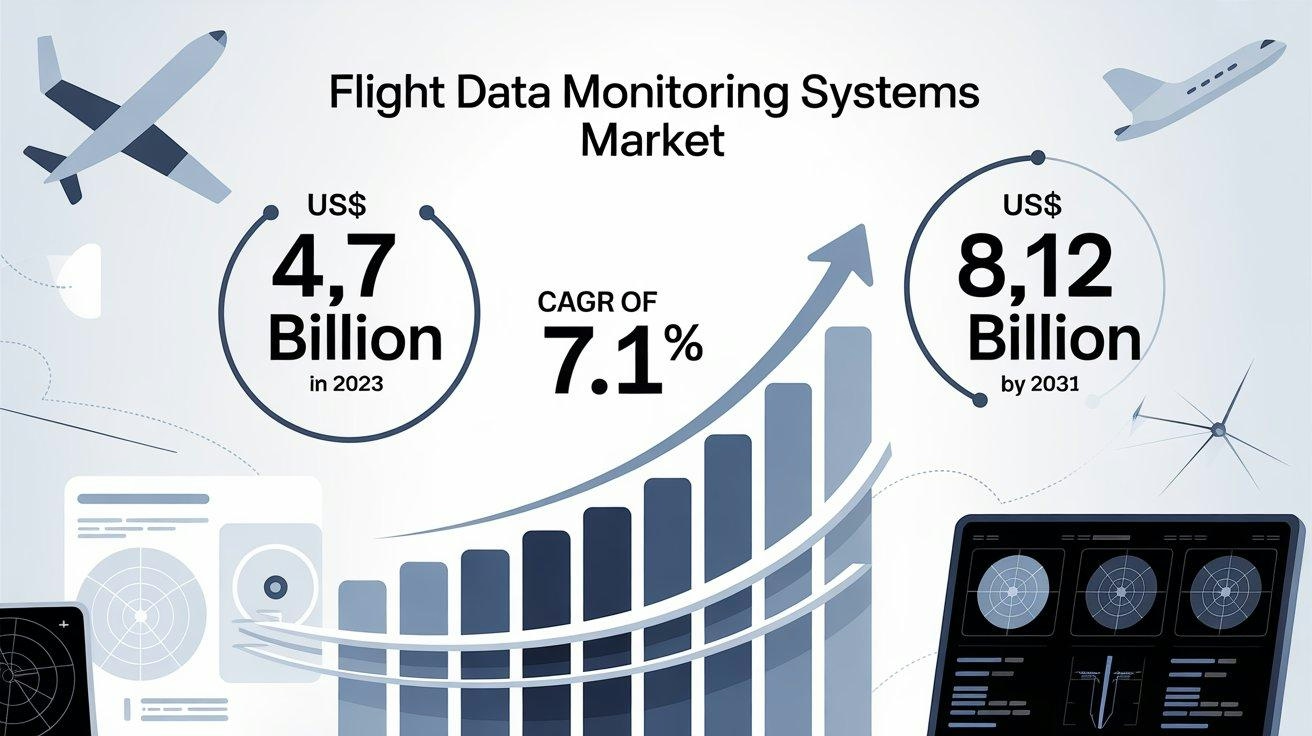

Flight Data Monitoring Systems Market Poised for Robust Growth Amid Rising Focus on Aviation Safety and Digital Transformation

Aircraft Avionics MRO Market Forecast and Analysis, 2024–2035