AeroGenie — Seu Copiloto Inteligente.

Tendências

Categories

Roadmap for Advanced Air Mobility Type Certification: Flying Towards a Collaborative Future

Roadmap for Advanced Air Mobility Type Certification: Flying Towards a Collaborative Future

Global Progress in Advanced Air Mobility

The global landscape of Advanced Air Mobility (AAM) is undergoing rapid transformation, marked by significant developments across various regions. In Dubai, the completion of the International Vertiport infrastructure, coupled with the implementation of AAM regulations, positions the city to soon launch commercial electric air taxi services. This milestone reflects Dubai’s commitment to integrating innovative urban air transport solutions into its broader mobility framework.

Southeast Asia is also emerging as a key player in the AAM sector. In October 2025, EHang Holdings Limited, a prominent Chinese AAM technology firm, announced the initiation of its AAM Sandbox Initiative in Thailand. This project, conducted in partnership with the Civil Aviation Authority of Thailand and local stakeholders, seeks to expedite the commercial deployment of AAM aircraft through a pioneering regulatory trial model. Early trials indicate that Thailand may soon witness operational AAM aircraft, signaling a significant step forward for the region.

Closer to home, Airservices Australia’s 2025-26 Corporate Plan identifies uncrewed aircraft and air mobility operators as critical participants in the nation’s increasingly complex airspace. The plan underscores the necessity of collaboration to ensure the safe, efficient, and sustainable management of airspace as traditional and emerging aircraft types begin to coexist. It also highlights the growing emphasis on decarbonisation, anticipating that AAM will contribute to long-term growth by delivering productivity improvements and environmental benefits, particularly in the context of escalating road congestion.

Harmonising Certification for a New Era of Air Mobility

As Brisbane prepares to host the 2032 Olympic and Paralympic Games, the recent announcement by the National Aviation Authorities Network—comprising aviation regulators from Australia, Canada, New Zealand, the United Kingdom, and the United States—of its Roadmap for Advanced Air Mobility Aircraft Type Certification represents a pivotal development. This Roadmap aims to harmonise and streamline the certification process for emerging AAM aircraft, including flying taxis, across member countries. By establishing unified airworthiness standards, the initiative seeks to reduce regulatory barriers and accelerate the commercial introduction of AAM technologies in these markets.

Despite its promise, the Roadmap faces considerable challenges. Achieving streamlined certification across multiple jurisdictions demands extensive international cooperation and alignment of regulatory frameworks, a complex and ongoing process. Furthermore, the commercial rollout of AAM services has progressed more slowly than initially anticipated, highlighting the need for sustained collaboration and flexibility among industry stakeholders.

Market responses to the Roadmap have been immediate and notable. The defence sector has expressed heightened interest, recognising the potential of AAM technologies for military applications. Meanwhile, industry competitors are leveraging the harmonised standards to expedite their own certification and market entry efforts. A significant milestone in this context is Pivotal’s recent attainment of AS9100D certification for quality management, which sets a new benchmark for scaled production and may encourage other manufacturers to elevate their standards.

With aircraft movements in Australia projected to increase substantially in the coming years, the Roadmap is a critical step toward realising the vision of flying taxis, particularly in the lead-up to the 2032 Games. Wisk Aero, supported by Boeing and Kitty Hawk Corporation, has already announced plans to launch flying taxi services in Australia in time for the event, underscoring the growing momentum within the sector.

As the global AAM ecosystem continues to mature, the collaborative framework established by the Roadmap will be essential in addressing regulatory, operational, and market challenges, thereby paving the way for a new era of urban air mobility.

ATR Signs Maintenance Agreement with India's Fly91

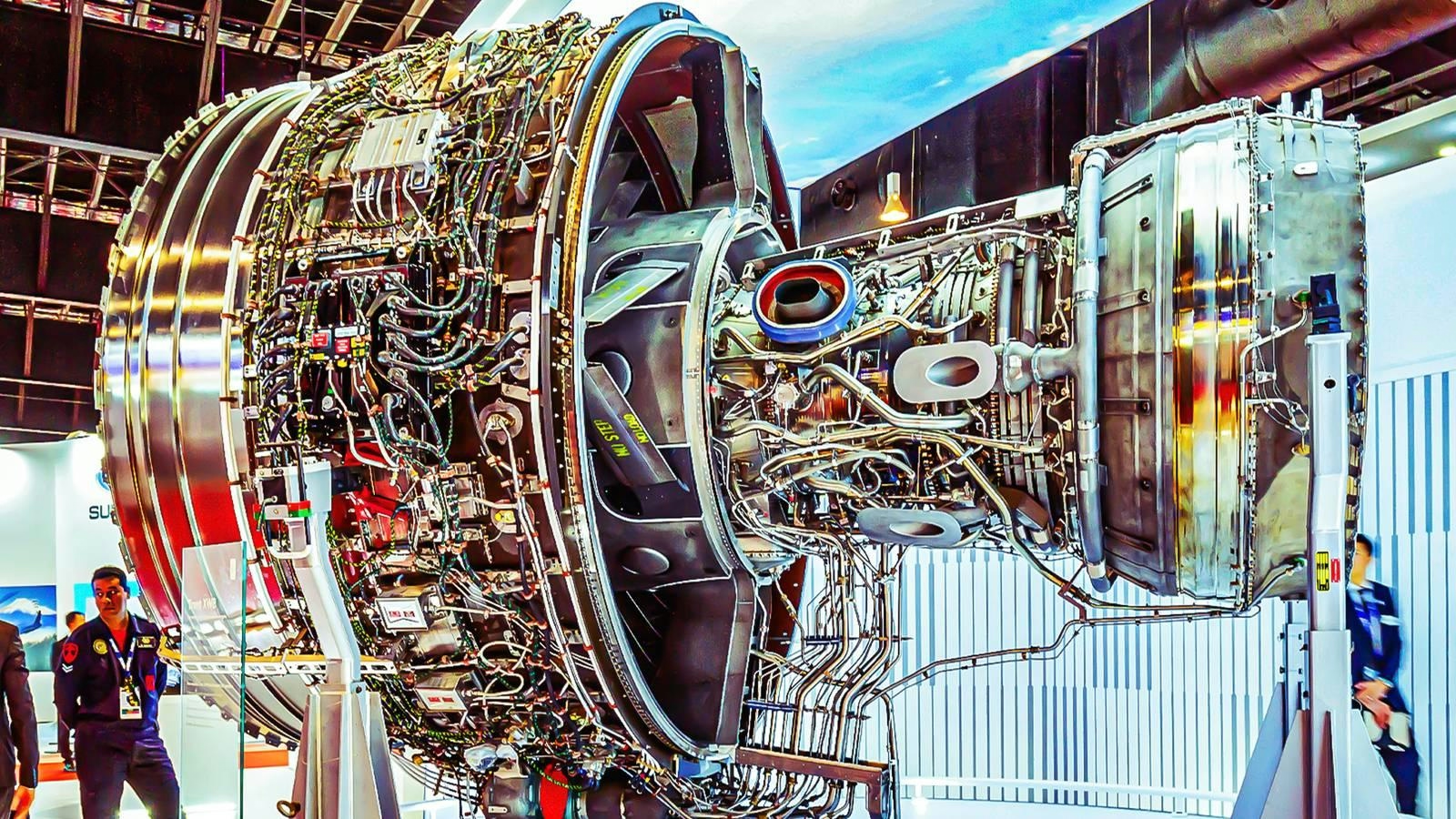

What Is Rolls-Royce's Most Popular Engine?

Global Aerospace’s Annual Jetstream Report Examines Aviation’s Future in Safety, Training, AI, and Geopolitics

Which Airline Will Operate the Largest Boeing 747 Fleet in 2026?

Breeze Airways to Add Learjet 45s for Crew and Parts Transport

Airbus Focuses on Production Stability Amid Delivery Challenges

Nigeria Seeks International Partners for Aircraft Financing

Airports Use AI to Manage Increasing Global Passenger Traffic

IATA Warns of Supply Chain and Decarbonization Challenges Amid Record Passenger Demand in 2025

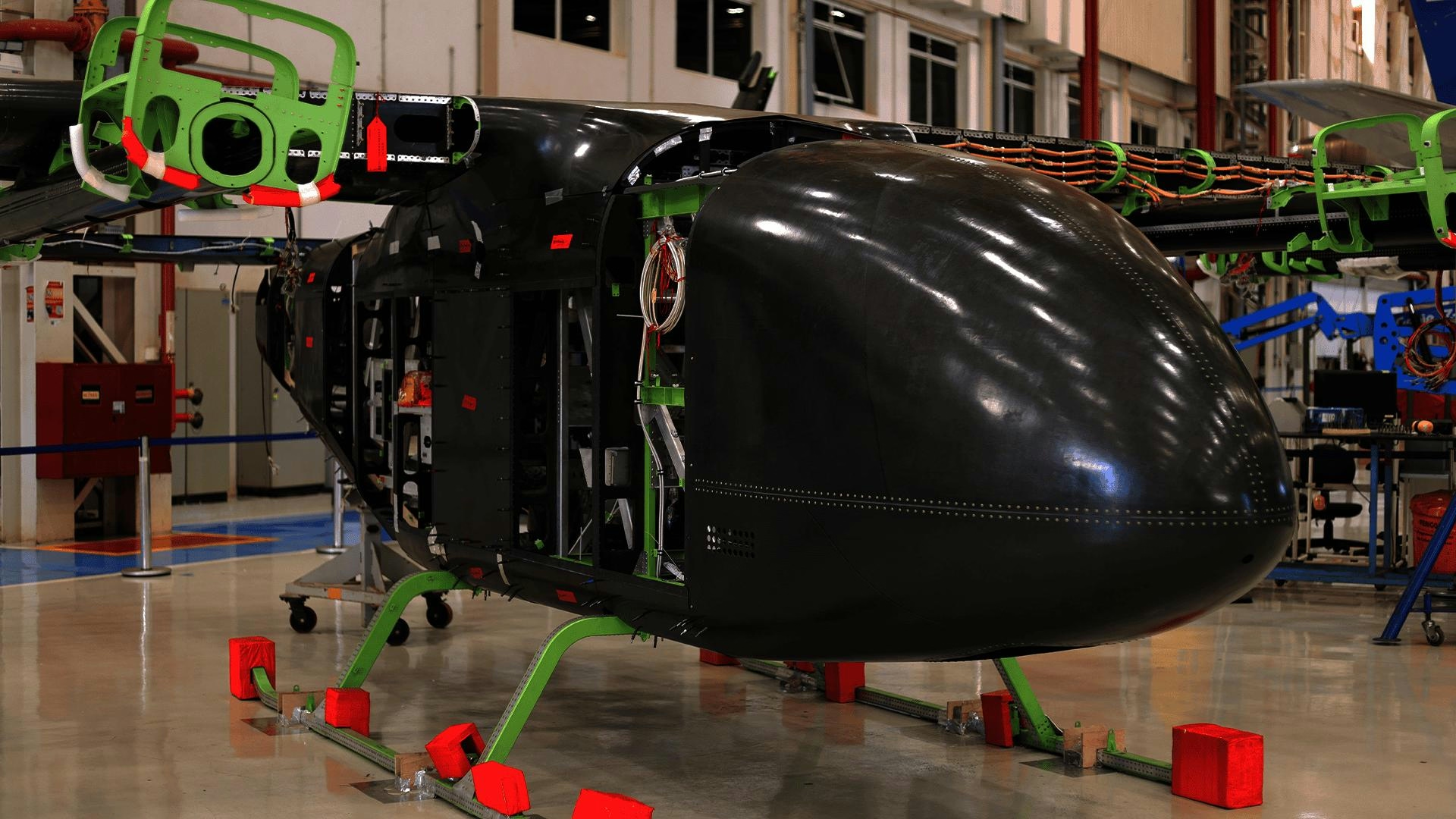

Pentagon Contracts and Emerging Markets Could Support eVTOL Stock Growth