AeroGenie — 您的智能副驾驶。

热门趋势

Categories

The Economics of Dismantling a Six-Year-Old Aircraft

The Economics of Dismantling a Six-Year-Old Aircraft

Shifting Strategies in Aircraft Asset Management

The aviation industry is experiencing an unexpected development: the dismantling of aircraft as young as six years old. At the recent MRO Europe conference in London, Scott Symington, Chief Commercial Officer at aviation services provider AJW, explained the economic factors driving this emerging trend. Increasingly, lessors are choosing to part out newer aircraft rather than maintain them in service or attempt to remarket them. This shift is largely influenced by the strong demand and limited supply of engines and spare parts, which has altered the financial calculus for fleet management worldwide.

Symington highlighted that parting out aircraft offers lessors a higher immediate return compared to leasing the entire plane. He provided a concrete example involving geared turbofan (GTF) engines: leasing two such engines can generate approximately $500,000 per month—$250,000 per engine—whereas leasing the complete aircraft, including both airframe and engines, yields only $450,000 to $460,000 monthly before accounting for transition and remarketing expenses. At the six-year mark, lessors recognize that dismantling the aircraft to lease engines separately and selling the airframe can be more profitable. This realization has led to the parting out of relatively young models such as the A320neo.

Industry Challenges and Financial Pressures

This trend emerges amid ongoing supply chain disruptions that continue to delay aircraft production and maintenance schedules. The International Air Transport Association (IATA) projects that these disruptions will cost the global airline industry over $11 billion in 2025. Consequently, airlines are compelled to extend the operational life of older aircraft beyond initial plans, resulting in increased fuel consumption and escalating maintenance expenses.

The prolonged use of aging fleets has driven up spending on maintenance, repair, and overhaul (MRO) services. In response, airlines and lessors are increasingly pursuing joint ventures and collaborative strategies in aircraft leasing and maintenance to mitigate the financial burdens associated with operating older aircraft. These cooperative approaches aim to optimize resource allocation and manage costs more effectively in a challenging market environment.

Rethinking Asset Management Amid Market Realities

The decision to dismantle relatively new aircraft reflects more than a pursuit of immediate profit; it is a strategic response to broader industry dynamics. Supply chain constraints, rising operational costs, and a lucrative market for spare parts are compelling lessors to reconsider traditional asset management models. Under different market conditions, many of these aircraft might have remained in service for many additional years. However, the current economic landscape is reshaping how aviation assets are valued and utilized, with significant implications for the future of fleet management.

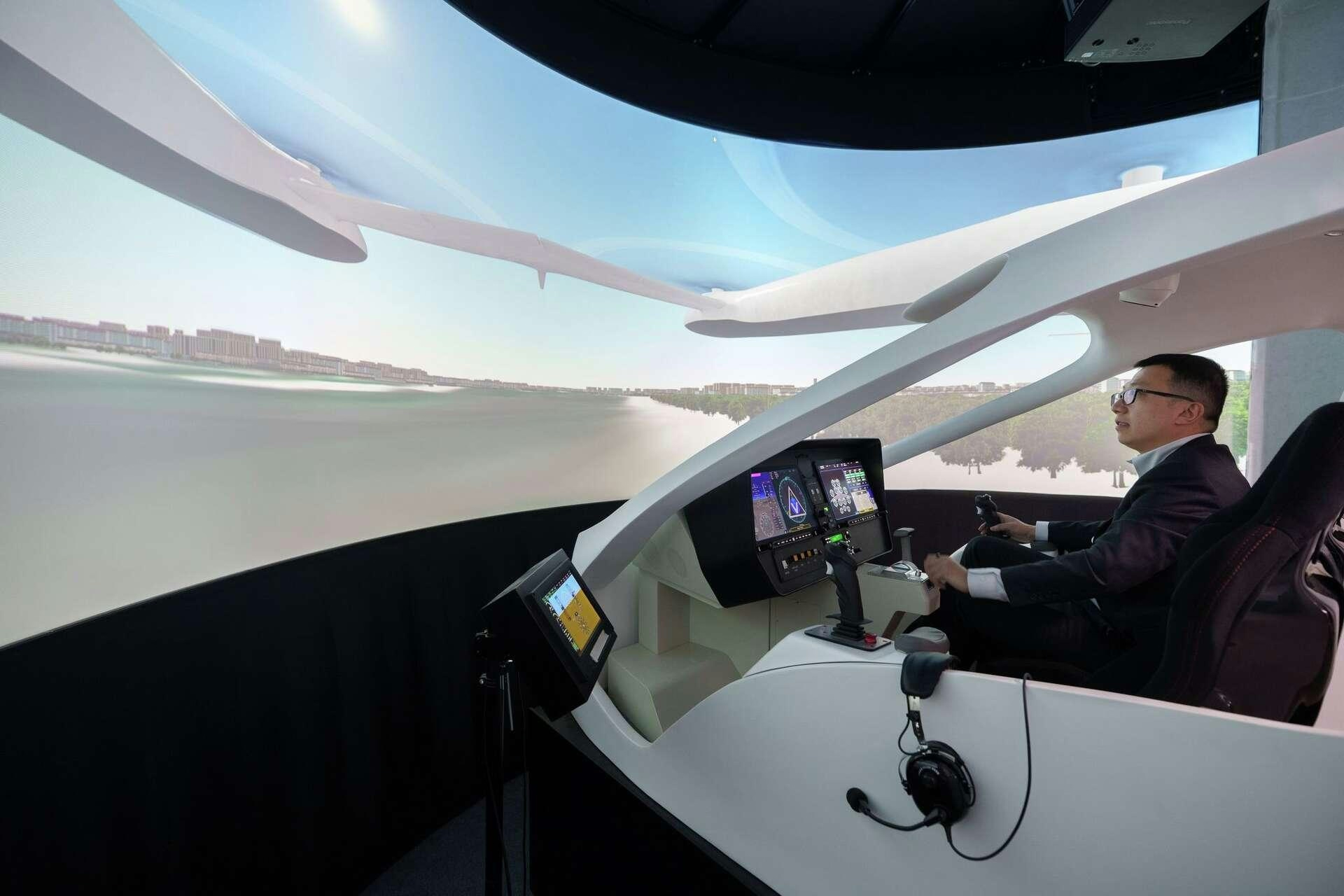

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

SkyDrive’s Tokyo Launch and the Future of Flying Cars

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services