AeroGenie — Ihr intelligenter Copilot.

Trends

Categories

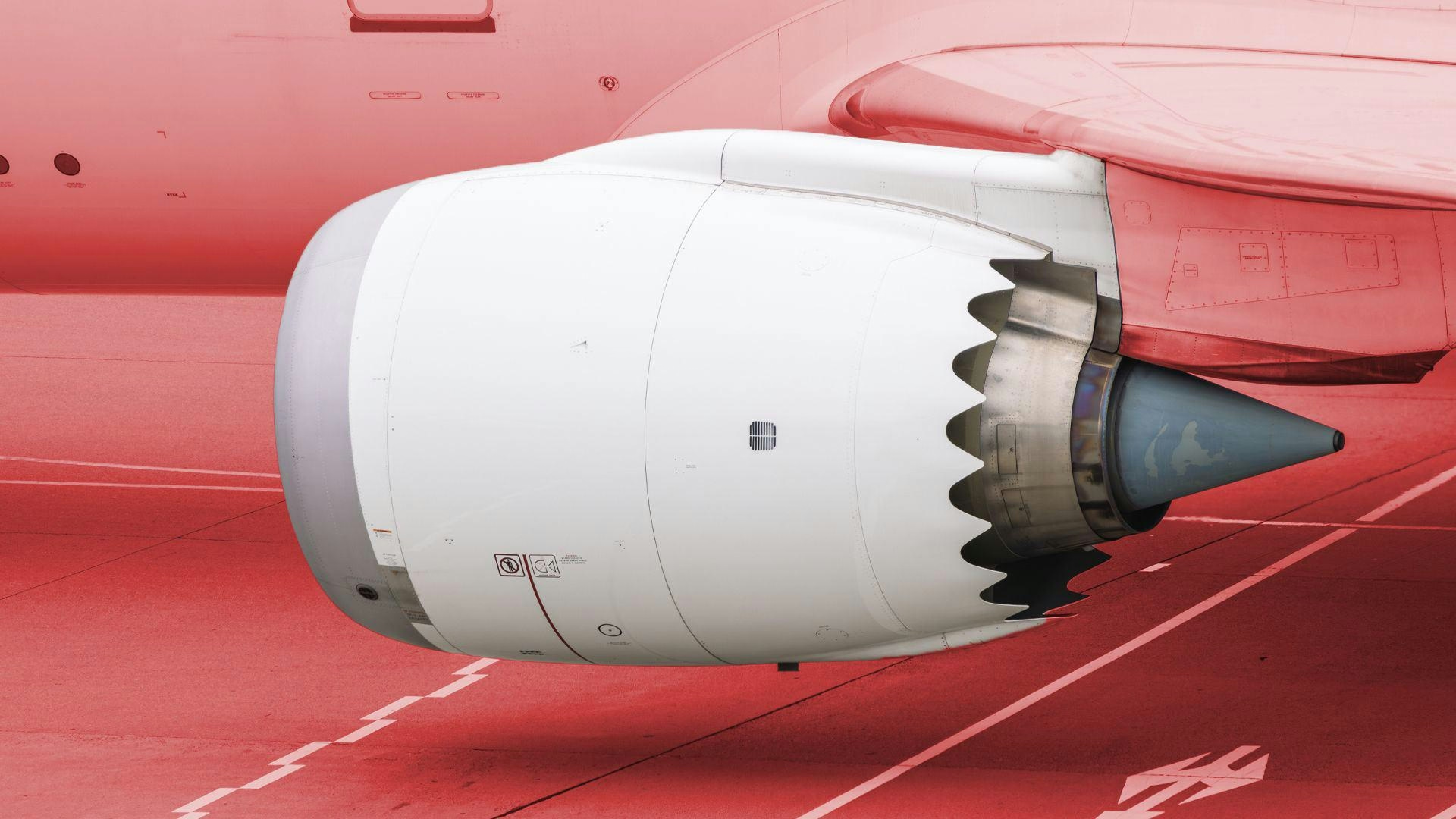

Nearly New Airbus Planes Scrapped to Salvage Valuable Jet Engines

Nearly New Airbus Planes Scrapped to Salvage Valuable Jet Engines

The global aviation sector is confronting an unprecedented challenge as nearly new Airbus A321neo aircraft are being dismantled to recover their engines amid a severe worldwide shortage. At Castellon Airport in Spain, several A321neos, some as young as six years, are being stripped of their prized geared turbofan (GTF) engines. These engines are subsequently leased to airlines struggling to maintain operational fleets in the face of limited engine availability.

Supply Chain Disruptions and Market Shifts

This unusual practice stems from a combination of supply chain disruptions and production delays, particularly at Pratt & Whitney, a leading engine manufacturer unable to meet soaring demand. Traditionally, airlines would retain older aircraft in service until replacements arrived. However, with hundreds of planes grounded due to maintenance backlogs and a scarcity of engines, the market dynamics have shifted dramatically. Firms such as eCube and Tarmac Aerosave have found it more profitable to salvage engines from relatively new aircraft rather than leasing entire planes. Currently, the monthly lease rate for a GTF engine is approximately $200,000—less than half the cost of leasing a full A321neo—making engine leasing an attractive option amid the acute shortage.

Broader Industry Implications and Geopolitical Factors

The engine shortage is reverberating throughout the global aviation market, exacerbated by geopolitical tensions and trade disputes. US-China trade frictions have delayed deliveries of China’s C919 jet, hindering its competitiveness against Boeing’s 737 and Airbus’s A320 families. This has intensified demand for single-aisle jets, prompting Airbus to increase production of its A320 series in China to expand its market share. Meanwhile, competitors are forging new partnerships; notably, India’s Hindustan Aeronautics Ltd has collaborated with Russia to produce SJ-100 jets, introducing additional competition for both Boeing and Airbus.

The practice of dismantling nearly new aircraft for their engines is also reshaping airline and lessor strategies regarding aircraft storage and asset management. With the soaring value of spare engines, decisions about when and how to retire or store aircraft are evolving. For some operators, including Delta, salvaging engines from newer jets provides an innovative solution to navigate international tariffs and supply constraints.

As the aviation industry grapples with these challenges, the dismantling of modern jets for parts highlights the volatility and complexity of today’s aircraft market. Persistent engine shortages combined with geopolitical disruptions to global supply chains are compelling airlines and manufacturers to adopt new strategies that may redefine the industry’s future landscape.

Rolls-Royce Pushes Trent 1000 XE to Win Back 787 Customers

The Reason Behind Boeing’s Use of Engine Chevrons on the 737 MAX

Osaka Introduces Electric Air Taxis to Reduce Travel Times

Oman Air Plans to Add Six Widebody Aircraft by 2028 to Expand Global Network

UK Civil Aviation Authority Issues Notice to Air India Over Fuel Switch on Flight AI-132

ATP Flight School to Receive Over 30 Aircraft in 2026

Global AI Partners with European Airline to Automate Revenue and Financial Reconciliation

Rolls-Royce Signs Service Agreement with Taiwan's Flag Carrier

MRO Middle East: Joramco celebrates first EASA Type Rating graduates

IFS and Albatechnics Partner to Enhance Digital MRO Services in the Middle East