AeroGenie — Ваш интеллектуальный второй пилот.

В тренде

Categories

ACIA Aero Expands Credit Facility for Regional Aircraft Leasing

ACIA Aero Expands Credit Facility to Boost Regional Aircraft Leasing

ACIA Aero Leasing has announced the successful extension and expansion of its syndicated credit facility, led by Investec Bank. The enhanced facility now includes term loan and revolving credit tranches, alongside a newly introduced subordinated term loan tranche. This revised financial structure is designed to provide greater flexibility and increased funding capacity, supporting ACIA’s growing aircraft portfolio and its global leasing operations.

Strengthening Banking Relationships and Lender Confidence

The lending syndicate has expanded with the addition of Absa Corporate and Investment Banking, joining existing institutional investors Ninety One and Sanlam Alternative Investments. ACIA described this development as a significant broadening of its banking relationships and lender base, highlighting strong confidence in the company’s business model and growth strategy. The company emphasized that the expanded facility offers a tailored, scalable financing solution aligned with its dynamic operational needs.

Bradley Gordon, senior vice president of banking and capital markets at ACIA Aero Leasing, expressed satisfaction with the broadened lender base and extended credit facility. He noted that the inclusion of Absa, Ninety One, and Sanlam Alternative Investments, alongside Investec Bank’s continued leadership, reflects the deep trust placed in ACIA by its financing partners. John Shaw, aviation finance consultant at Investec Bank, reaffirmed the bank’s commitment to ACIA, praising the syndicate’s confidence in the company’s business strength. Kobus Swart, structured asset finance director at Absa Corporate and Investment Banking, also highlighted the resilience, agility, and long-term growth potential demonstrated by ACIA in the global aviation sector.

Navigating Market Challenges and Competitive Dynamics

The expanded credit facility is expected to underpin ACIA’s ongoing growth and its capacity to deliver innovative and flexible leasing solutions to regional airlines worldwide. This development occurs amid a challenging market environment, where the regional aircraft leasing sector—particularly the new-generation engine leasing market—faces high liquidity demands and is dominated by a limited number of players. Market reactions to ACIA’s expansion are likely to be mixed; some investors view the move as a strategic effort to capitalize on rising demand for regional aircraft, while others express concerns about the increased financial risk associated with a larger credit facility.

Competitors may respond by either seeking to match ACIA’s expanded credit capacity to preserve market share or by differentiating their offerings through technological innovation and enhanced services. Despite these challenges, ACIA’s leadership remains confident that the expanded credit facility will enable the company to meet evolving market demands and sustain its growth trajectory within the competitive regional aircraft leasing sector.

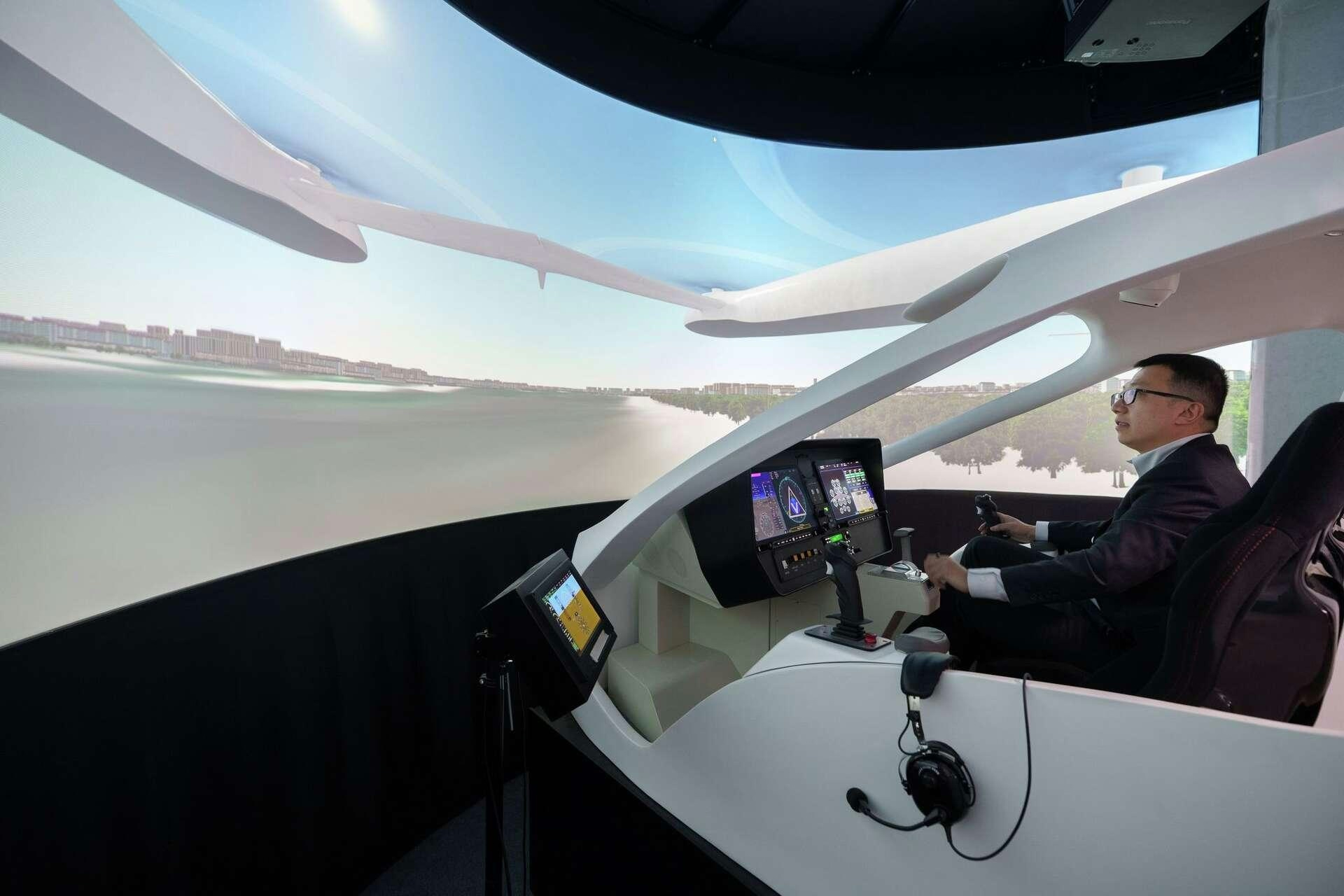

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

SkyDrive’s Tokyo Launch and the Future of Flying Cars

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services