AeroGenie — Ваш интеллектуальный второй пилот.

В тренде

Categories

Boeing Surpasses Airbus in Orders for the First Time in a Decade

Boeing Surpasses Airbus in Orders for the First Time in a Decade

Boeing has overtaken Airbus in net aircraft orders for the first time since 2018, signaling a notable recovery for the American aerospace manufacturer after several difficult years. In 2025, Boeing secured 1,173 new orders, surpassing Airbus’s total of 1,000. This shift reflects a growing preference among airlines worldwide for American-made jets, a trend that some analysts suggest is influenced by efforts to maintain favorable relations with the U.S. government.

Recovery Amid Regulatory Easing and Market Dynamics

Boeing’s resurgence follows a turbulent period marked by intense scrutiny after two fatal crashes and a near-catastrophic incident involving its flagship 737 Max model since 2018. The easing of restrictions by U.S. regulators has been interpreted as a renewed vote of confidence in Boeing’s safety measures, encouraging airlines to increase their orders. The Financial Times has reported that some carriers may also be motivated by strategic considerations to strengthen ties with Washington.

Despite Boeing’s lead in new orders, Airbus retained its advantage in aircraft deliveries last year. Airbus delivered 793 aircraft, exceeding its revised annual target, while Boeing delivered 600, the highest number for the company in seven years. This delivery gap is partly attributable to Airbus’s larger backlog, which has constrained its ability to fulfill new orders as swiftly as Boeing.

Production and Industry Outlook

Boeing’s recovery is largely credited to its enhanced capacity to deliver new single-aisle jets, particularly the 737 Max, at a faster pace than Airbus. The company is also preparing to increase production of both the 737 Max and the 787 Dreamliner to meet growing demand.

The broader aviation sector is experiencing robust growth, with airlines such as Delta Air Lines projecting a 20% increase in profits this year, driven primarily by high-end customers. As carriers continue to modernize their fleets and expand capacity, both Boeing and Airbus stand to benefit from the sustained expansion in global air travel.

Comparing the Engine Sizes of the Airbus A380 and A320

Applying AI in Aerospace Software Development Under DO-178C Standards

SCAT and Boeing Begin Construction of Central Asia’s Largest Aircraft Maintenance Hub in Shymkent

Ranking the Most Influential Passenger Airplanes of All Time

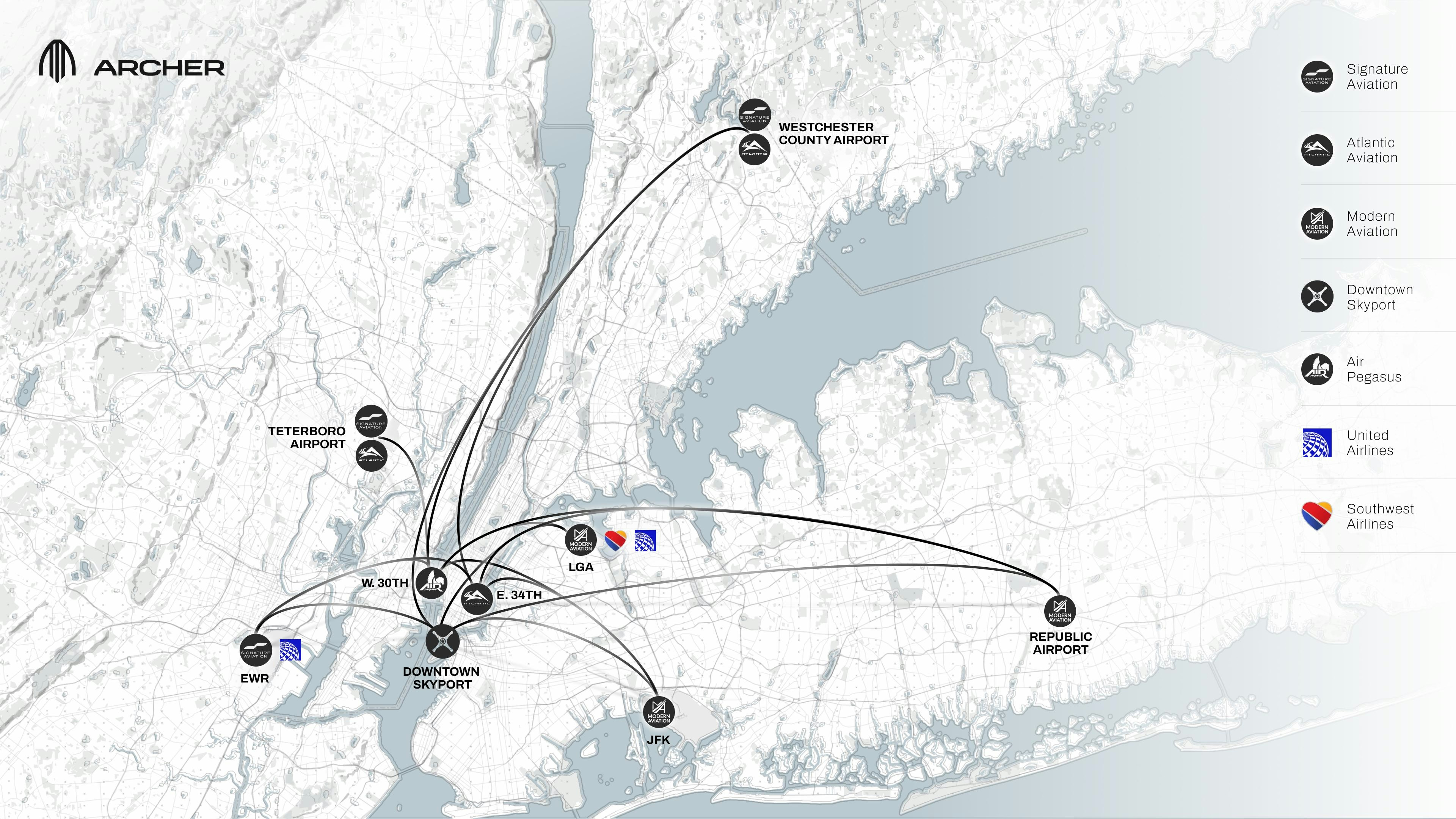

Tri-State Region Prepares for Arrival of Air Taxis

Delta (DAL) Expands Fleet with New Airbus A321neo Order

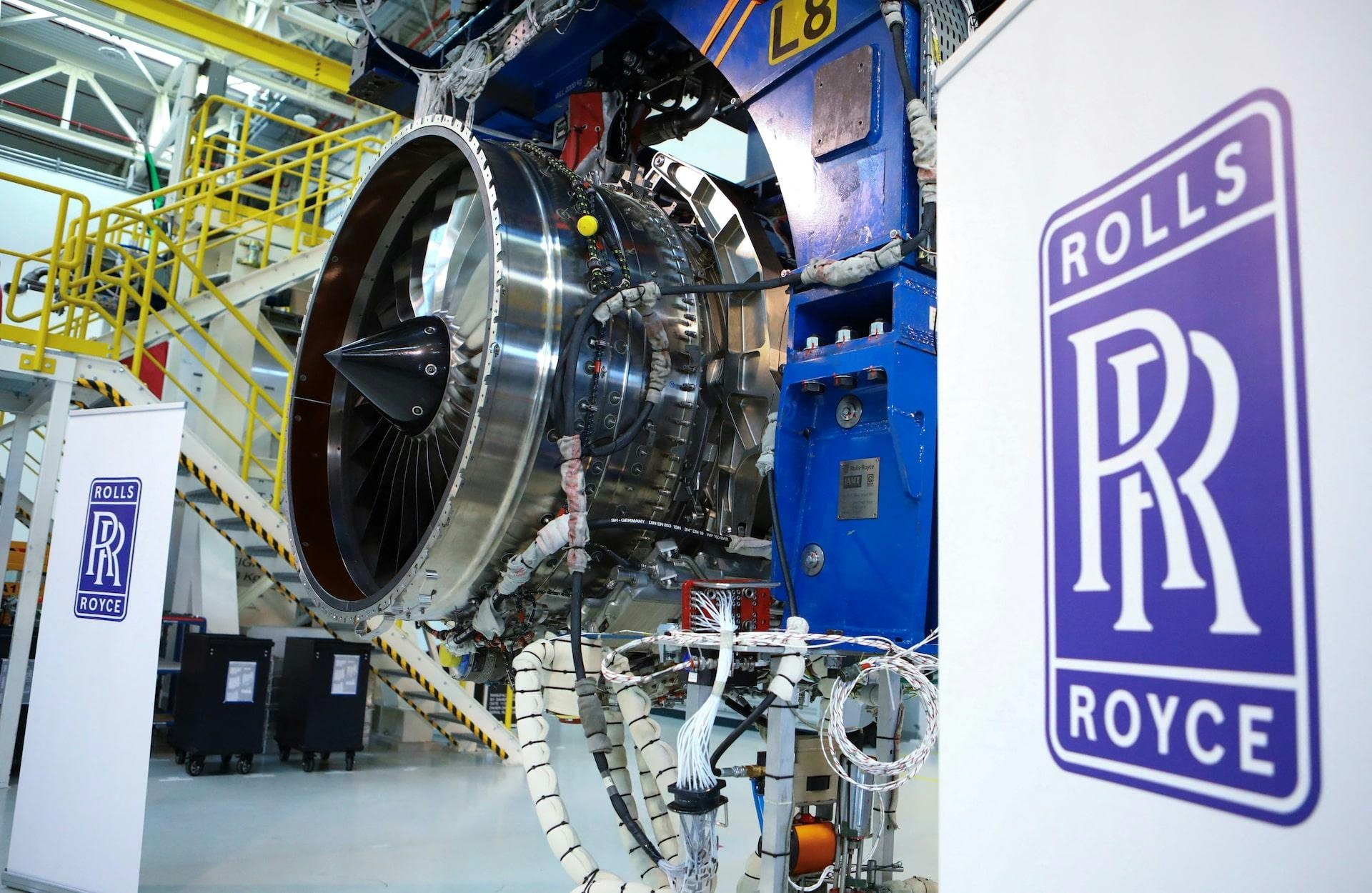

Rolls-Royce Plans Return to Narrowbody Aircraft Engines

FTAI Aviation Details Engine Leasing Strategy and Associated Risks

Castlelake Makes First Aircraft ABS Repayment Since Pandemic

Delta orders 34 more Airbus A321neo jets in fleet renewal push