エアロジニー — あなたのインテリジェントな副操縦士。

現在のトレンド

Categories

How StandardAero's (SARO) New MRO Deals Could Shape Its Role in Global Aviation

How StandardAero’s New MRO Deals Could Shape Its Role in Global Aviation

StandardAero has recently secured new and extended maintenance, repair, and overhaul (MRO) agreements with Mauritania Airlines and Oman’s SalamAir, reinforcing its status as a leading provider of services for CFM International engines. These contracts, effective through October 2025, focus on the CFM LEAP and CFM56 engine families and highlight StandardAero’s dedication to advancing technician training and innovating component repair. Such commitments are increasingly vital as airlines modernize their fleets and demand more sophisticated MRO capabilities.

Expanding Partnerships Amidst a Growing Market

These expanded agreements arrive at a critical juncture for the global aviation aftermarket. Airlines worldwide are intensifying efforts to optimize operations and extend the service life of their aircraft, driving heightened demand for specialized MRO services. By broadening its customer base and increasing workshop utilization, StandardAero strengthens its competitive position in a sector marked by rapid technological advancements and evolving fleet requirements.

Nevertheless, scaling service growth to align with broader industry ambitions presents notable challenges. For instance, ATR’s strategy to expand its presence in the U.S.—where only 49 of its roughly 1,200 aircraft currently operate—underscores the necessity for a robust MRO infrastructure. This expansion is poised to support an anticipated increase of 12 million annual regional air passengers on routes under 400 nautical miles. To capitalize on such growth, StandardAero must ensure its service network can adapt and expand in tandem with the evolving regional aviation market.

Navigating Competitive and Market Pressures

Competitive pressures within the MRO sector are intensifying. Pratt & Whitney, a key rival, is addressing material supply chain constraints through vertical integration and the implementation of advanced, data-driven materials forecasting. This strategy may establish new benchmarks for supply chain management, compelling StandardAero to enhance its own logistics and procurement processes to maintain reliability and cost efficiency.

Looking ahead, Europe’s commercial fleet is projected to expand by 40% by 2035, fueling a $350 billion MRO market. This anticipated growth presents both significant opportunities and increased competition for StandardAero as it aims to capture a larger share of global MRO demand. The company’s ongoing investments in workforce development and repair technology position it favorably, yet its success will depend on its ability to respond effectively to shifting market dynamics and evolving customer expectations.

Investment Outlook and Strategic Considerations

From an investment perspective, StandardAero’s recent contract momentum may provide reassurance to shareholders seeking evidence of sustainable earnings growth. While these new deals support the company’s growth outlook, they are unlikely to materially alter its near-term risk profile, as forecasts had already accounted for a steady pipeline of contracts and robust demand in commercial aerospace. However, the company’s premium valuation and elevated price-to-earnings ratio remain potential risks, particularly if future contract acquisitions slow or profit margins face downward pressure.

Ultimately, StandardAero’s capacity to manage supply chain complexities, scale its service offerings, and respond to global fleet expansion will be decisive in shaping its long-term role within the aviation MRO landscape. As the industry continues to evolve, the company’s strategic partnerships and operational agility will be critical factors influencing its future trajectory.

Capital A Completes Sale of Aviation Business to AirAsia X

Four Gateway Towns to Lake Clark National Park

PRM Assist Secures €500,000 in Funding

Should Travelers Pay More for Human Support When Plans Go Wrong?

InterGlobe Aviation Shares Rise 4.3% Following January Portfolio Rebalancing

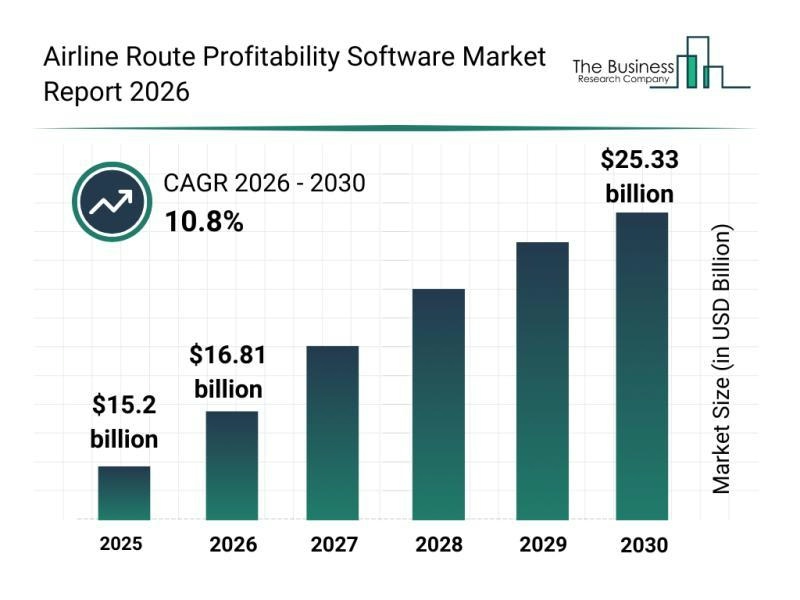

Key Market Segments Shaping Airline Route Profitability Software

Locatory.com Gains Traction Among Aviation MROs and Suppliers

JetBlue Flight Makes Emergency Landing Following Engine Failure

58 Pilots Graduate from Ethiopian University

The Engine Behind Boeing’s Latest Widebody Aircraft