أيروجيني — مساعدك الذكي للطيران.

الرائج الآن

Categories

The Middle East's Potential Role in Launching Joby Aviation's Flying Taxis

The Middle East's Emerging Role in Launching Joby Aviation's Flying Taxis

When envisioning the debut of flying taxis, global investors often focus on metropolitan hubs such as Los Angeles or Tokyo. However, Joby Aviation, a pioneer in electric vertical takeoff and landing (eVTOL) technology, is positioning the Middle East—particularly Dubai and Saudi Arabia—as a potential epicenter for the commercial rollout of air taxi services. This strategic focus could see the region surpassing the United States in bringing eVTOL operations to market.

Dubai’s Ambitious Urban Air Mobility Initiatives

The United Arab Emirates is aggressively advancing its position at the forefront of next-generation transportation. Dubai, in particular, has made substantial investments in urban air mobility infrastructure, signaling its commitment to becoming a global leader in this emerging sector. Joby Aviation has conducted 21 piloted full-transition flights in Dubai, successfully demonstrating the aircraft’s capabilities in desert conditions with temperatures reaching 110°F (45°C). These tests have been crucial in validating the aircraft’s performance, battery reliability, and thermal management systems under extreme environmental stress, marking significant progress toward commercial viability.

Dubai’s Roads and Transport Authority has announced plans to launch an air taxi service by 2026, with infrastructure development already underway. Skyports Infrastructure is constructing a network of vertiports, including key hubs at Dubai International Airport and the city’s downtown area. Joby’s collaboration with Skyports, alongside plans to initiate services by 2027 in Ras Al Khaimah, further cements its presence in the UAE. Supported by government initiatives and integrated with Uber’s app platform, these developments position Joby to potentially offer the world’s first live, paying eVTOL service within the next few years.

Saudi Arabia’s Accelerated Air Mobility Strategy

Saudi Arabia is advancing rapidly in its pursuit of urban air mobility. In 2025, Joby Aviation entered into a partnership with Abdul Latif Jameel, one of the kingdom’s largest conglomerates, to explore a deal for up to 200 eVTOL aircraft valued at approximately $1 billion. This initiative aligns closely with Saudi Arabia’s Vision 2030, which seeks to diversify the economy through innovation, sustainable technologies, and tourism development. The country’s new urban projects are being designed with air mobility infrastructure in mind, incorporating vertiports and electric transport corridors from the outset.

Saudi Arabia’s centralized governance and readiness to fund pilot programs could facilitate swift regulatory approvals for air taxi routes, potentially outpacing the more protracted timelines seen in Western markets. This environment offers Joby a unique opportunity to influence the design and implementation of a new transportation ecosystem from its inception.

Prospects and Challenges in the Middle East Market

The Middle East presents an attractive environment for Joby’s initial commercial deployment, characterized by compact yet congested urban centers, robust government support, and a strong appetite for futuristic infrastructure investments. Market sentiment has been favorable, with significant capital inflows and strategic partnerships bolstering confidence in the region’s potential.

Nonetheless, challenges persist. Regulatory complexities, the pace of infrastructure rollout, and competition from established aviation players could affect Joby’s trajectory. Rival eVTOL companies, including Archer Aviation, are also targeting the UAE for their commercial launches, indicating that competition in the region will intensify as the market evolves.

Navigating the Path to Commercialization

For investors and industry observers monitoring Joby Aviation’s commercialization journey, the Middle East’s combination of ambition, investment capacity, and regulatory flexibility makes it a critical region to watch. Should Joby succeed in launching passenger flights in Dubai or Saudi Arabia ahead of the United States, it could establish a global benchmark for urban air mobility and significantly influence the future landscape of transportation.

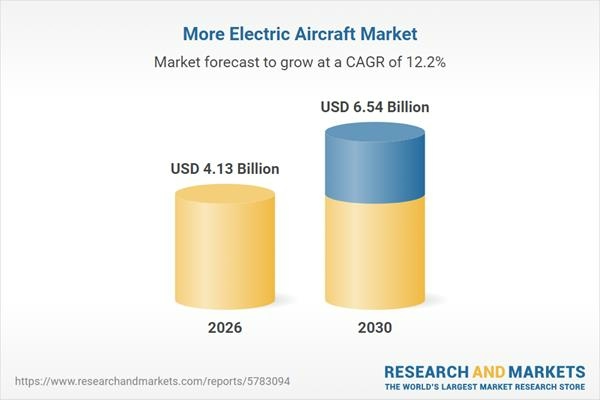

Electric Aircraft Market Outlook Through 2035

Capital A Completes Sale of Aviation Business to AirAsia X

Four Gateway Towns to Lake Clark National Park

PRM Assist Secures €500,000 in Funding

Should Travelers Pay More for Human Support When Plans Go Wrong?

InterGlobe Aviation Shares Rise 4.3% Following January Portfolio Rebalancing

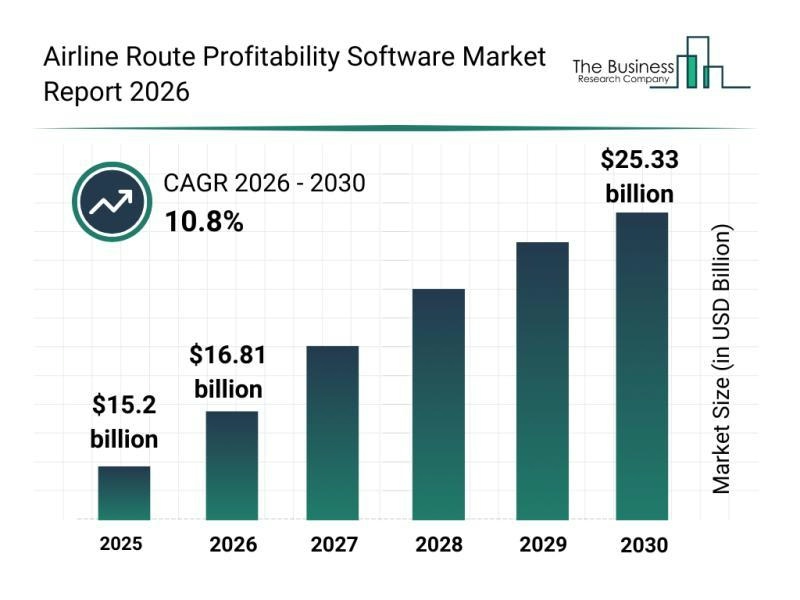

Key Market Segments Shaping Airline Route Profitability Software

Locatory.com Gains Traction Among Aviation MROs and Suppliers

JetBlue Flight Makes Emergency Landing Following Engine Failure

58 Pilots Graduate from Ethiopian University