AeroGenie — Your Intelligent Copilot.

Trending

Categories

Aircraft Spares, Rotables, and Logistics Market: Steady Growth Amid Rising Global Aviation Needs

Aircraft Spares, Rotables, and Logistics Market: Steady Growth Amid Rising Global Aviation Needs

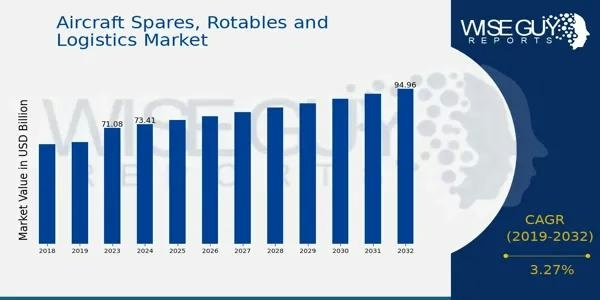

The global market for aircraft spares, rotables, and logistics is witnessing steady expansion, driven by a resurgence in aviation activity, aging aircraft fleets, and an intensified focus on operational efficiency and safety. Valued at $71.08 billion in 2023, the market is projected to increase to $73.41 billion in 2024 and is expected to reach $95.0 billion by 2032. This growth corresponds to a compound annual growth rate (CAGR) of 3.27% from 2025 to 2032, reflecting sustained demand across the sector.

Market Drivers and Emerging Trends

The expansion of both commercial and defense aviation fleets in developed and emerging economies is a key factor propelling market growth. Airlines and military operators are investing in advanced aircraft, which in turn elevates the demand for high-quality spares and rotables—components such as landing gears, avionics, and engines that are designed for repair and reuse. Rotables are particularly valued for their cost-effectiveness and essential role in maintenance cycles.

Increasing air passenger traffic, both domestically and internationally, places pressure on operators to maximize aircraft availability and reduce downtime. This dynamic has intensified the need for reliable logistics services and just-in-time inventory systems, ensuring the rapid delivery and turnaround of critical parts. Additionally, aging aircraft fleets contribute significantly to market demand, as older planes require more frequent maintenance and part replacements. Regulatory mandates from authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) further reinforce the necessity for timely part replacement and upkeep, making compliance both an operational and legal imperative.

Digitalization and Automation Transforming the Sector

The integration of digital technologies is reshaping the aircraft spares and logistics landscape. Predictive maintenance, powered by artificial intelligence (AI) and the Internet of Things (IoT), enables operators to proactively identify component wear, thereby reducing emergency replacements and minimizing aircraft downtime. Maintenance, Repair, and Overhaul (MRO) providers, along with logistics companies, are increasingly adopting innovations such as digital twins, blockchain technology, and real-time inventory management systems to enhance supply chain transparency and traceability.

Cloud-based fleet maintenance software and digital tracking tools have become standard industry practices, facilitating accurate forecasting, optimized inventory management, and accelerated service cycles. These technological advancements are critical for operators seeking to reduce turnaround times and improve overall aircraft readiness.

Market Challenges and Global Dynamics

Despite robust growth prospects, the market faces several challenges. The high cost of aircraft components and rotables can impose financial strain on smaller operators and MRO facilities. Furthermore, global tariffs present a significant risk by potentially disrupting supply chains and increasing operational costs. In response, companies are reevaluating their vendor networks, diversifying sourcing strategies, and relocating maintenance operations to countries less affected by tariffs to mitigate these challenges.

The broader aviation Maintenance, Repair, and Overhaul (MRO) market mirrors these trends, with an estimated value of $90 billion in 2024 and projections reaching $155 billion by 2034. The aviation safety compliance segment is also expanding, valued at $8 billion in 2024 and expected to grow to $13 billion by 2034, underscoring the sector’s ongoing commitment to safety and regulatory adherence.

Outlook

As global aviation activity continues to increase and fleets undergo modernization, demand for aircraft spares, rotables, and efficient logistics solutions is expected to remain strong. The continued adoption of digital technologies, adherence to regulatory requirements, and strategic supply chain management will be pivotal in shaping the market’s trajectory in the coming years.

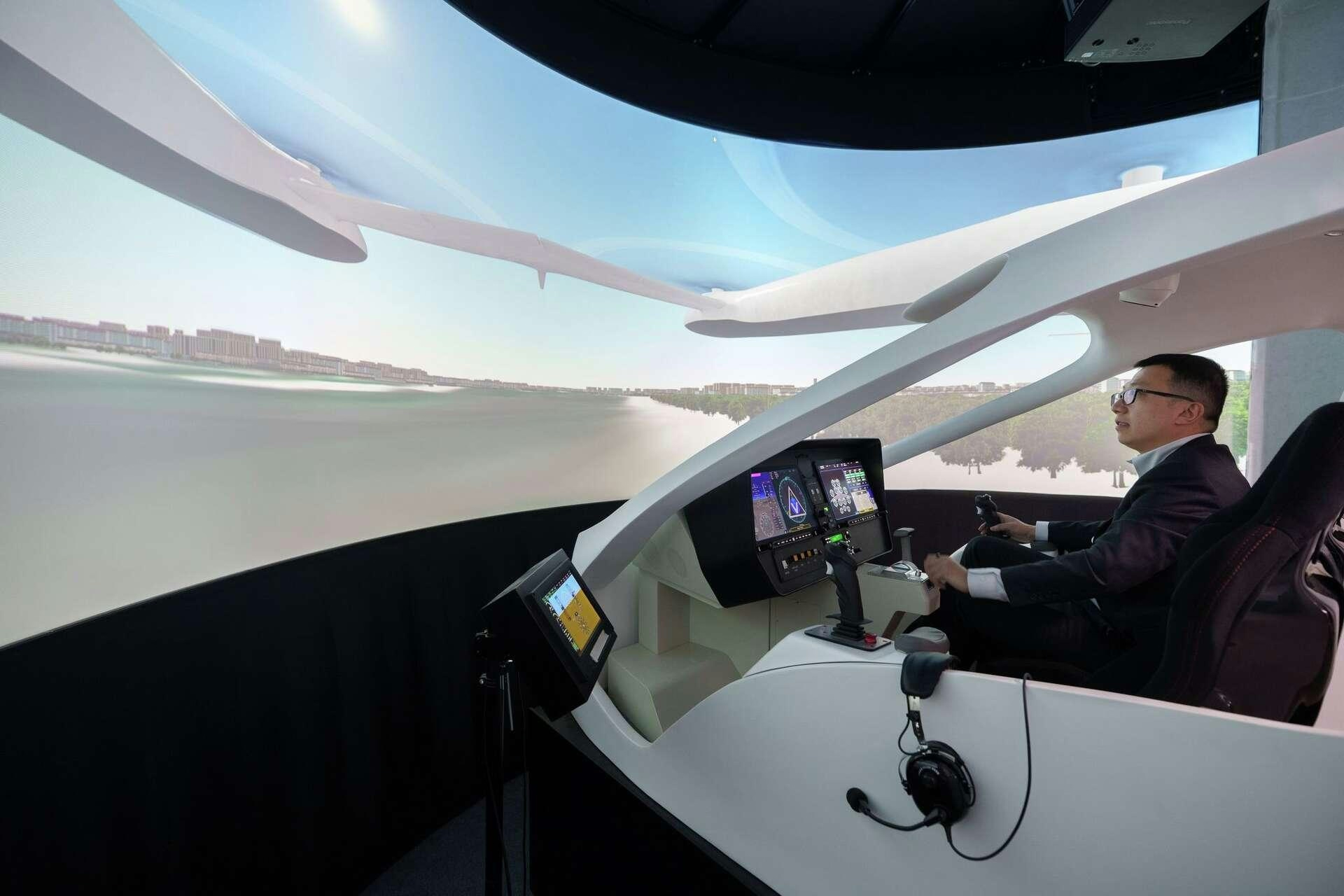

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

SkyDrive’s Tokyo Launch and the Future of Flying Cars

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services