AeroGenie — Your Intelligent Copilot.

Trending

Categories

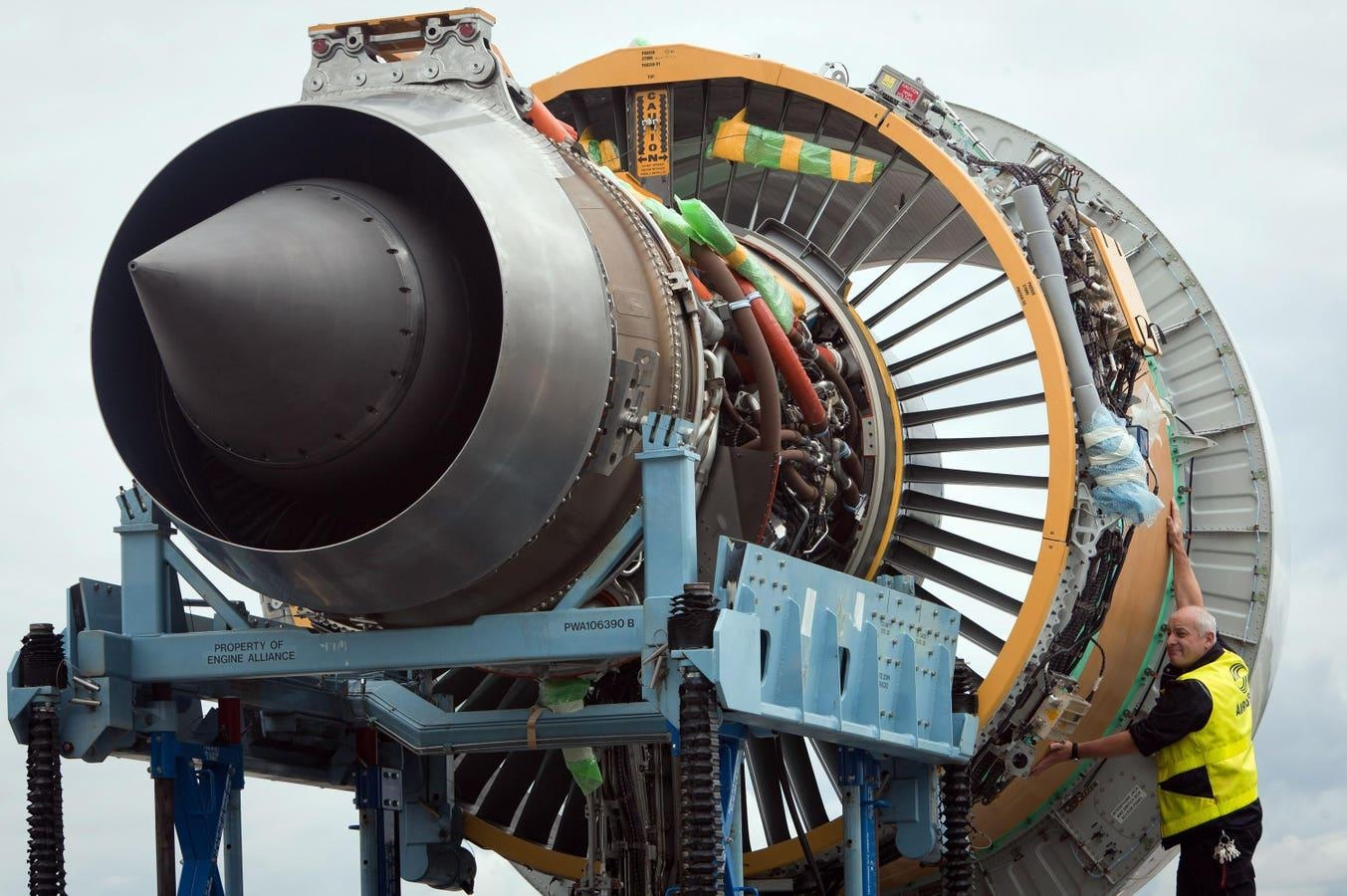

Alliance Aviation Sells Engines to Reduce Debt

Alliance Aviation Sells Engines to Reduce Debt Amid Market Pressures

Alliance Aviation Services has announced the sale of twelve General Electric CF34-10 aircraft engines to Beautech Power Systems for AU$62.3 million, marking a significant step in the company’s efforts to strengthen its financial position. This transaction forms part of a broader strategy aimed at reducing debt and streamlining operations amid a challenging market environment.

Details of the Transaction and Market Response

The engines involved in the sale were removed from airframes previously sold to Eirtrade and are scheduled for delivery to Knock, Ireland. Ten of the engines will be delivered within the current fiscal year, with the remaining two expected in early 2026. Alliance Aviation has confirmed that this sale will not affect its profit guidance but will substantially reduce inventory value and net debt. Following the announcement, the company’s shares rose by 9%, reflecting investor confidence in Alliance’s financial management and operational discipline.

Market Context and Industry Challenges

The sale occurs against a backdrop of significant strain in the midlife aircraft engine market. High demand, persistent supply chain disruptions, and intensified competition have driven up prices and complicated the sourcing and sale of engines. Alliance’s ability to secure a substantial deal under these conditions underscores both the competitive pressures within the sector and the company’s strategic agility. Rival firms in the aviation engine market may respond by offering more competitive pricing or enhanced services to bolster their market positions.

Beyond the aviation industry, broader market dynamics also influence engine demand. For instance, in the Indian agriculture engines market, the high upfront costs of mechanized equipment are shaping demand patterns, which in turn can affect global engine markets. These external factors add complexity to Alliance’s strategic decision-making process.

Implications for Investors and Industry Trends

For investors, Alliance’s engine sale signals a proactive approach to maintaining financial health. By reducing debt and managing inventory without revising profit forecasts, the company is positioning itself to navigate uncertain market conditions effectively. The positive share price reaction highlights market approval of this strategy.

More broadly, Alliance’s transaction exemplifies a growing trend among companies to optimize operations and concentrate on core assets to preserve financial stability. As global markets continue to face challenges, strategic asset sales such as this may become increasingly prevalent as businesses seek resilience and robust balance sheets without compromising profitability.

Emirates Unveils Cabin Design for New Boeing 777X

Eighteen Years On, the Airbus A380 Remains Central to a $34 Billion Airline

How a boom in luxury airline seats is slowing down jet deliveries

Navitaire Outage Attributed to Planned Maintenance

DigiYatra Debuts Outside Aviation at India AI Impact Summit

Vietnam Orders Strengthen Boeing’s Commercial Outlook

Airbus Signals Uncertainty Over Future A400M Orders

JobsOhio Awards $2 Million Grant to Hartzell Propeller for Innovation Center

Collins Aerospace Tests Sidekick Autonomy Software on YFQ-42A for U.S. Air Force CCA Program

How the Airbus A350-1000 Compares to the Boeing 777