AeroGenie — Your Intelligent Copilot.

Trending

Categories

Delays at Airbus and Boeing Raise Concerns Over Air Cargo Capacity

Delays at Airbus and Boeing Raise Concerns Over Air Cargo Capacity

Major air cargo operators are increasingly warning of an impending capacity shortage as aging fleets and delivery delays from Boeing and Airbus threaten to constrain the global supply of large freighter aircraft. Michael Steen, CEO of US-based Atlas Air, highlighted that the imbalance between supply and demand for wide-body freighters is expected to worsen in the coming years.

Factors Driving the Capacity Shortfall

Steen attributes the growing shortfall to several converging factors: a wave of aircraft retirements, limited new capacity entering the market, and ongoing supply chain challenges affecting aircraft manufacturers. Of the approximately 630 large wide-body freighters currently in service worldwide, up to 150 have reached or exceeded the typical retirement age of 25 years. This aging fleet presents a significant challenge to maintaining adequate air cargo capacity.

Aircraft remain vital to global trade, transporting roughly one-third of goods by value—an estimated $8.3 trillion annually, according to the International Air Transport Association. The surge in e-commerce and increased shipments from Asia to Western markets have further intensified demand for air cargo services in recent years.

Production Delays and Market Implications

Despite rising demand, deliveries of new wide-body freighters remain constrained. Both Boeing and Airbus continue to grapple with material shortages and labor constraints that have delayed production schedules. Frank Bauer, chief operating officer at Lufthansa Cargo, described these delivery delays as a “key constraint” for the sector.

Boeing currently faces a backlog of 63 wide-body 777 freighter orders, according to aviation advisory firm IBA. The manufacturer is producing four 777 and 777-9 aircraft per month, but the first deliveries of its next-generation 777-8F cargo aircraft, which began production in July, have been postponed from 2027 to 2028. Airbus has similarly delayed the introduction of its A350 freighter from 2026 to the second half of 2027 due to persistent supply chain issues.

These delays are influencing market dynamics. Boeing’s share price has risen sharply, buoyed by the prospect of a significant 500-aircraft deal with China that could reverse a seven-year slump in deliveries to the country. Meanwhile, Airbus, despite its own supply chain challenges, has maintained more predictable delivery schedules. In July 2025, Airbus delivered eight wide-body aircraft compared to Boeing’s ten and is expected to surpass Boeing in narrow-body deliveries. These shifts may reshape the competitive landscape and further impact air cargo capacity.

Industry Response and Future Outlook

Airlines are now urgently seeking to secure freight capacity amid these constraints. Loay Mashabi, CEO of Saudia Cargo, warned of a challenging period ahead, stating, “There will be a few years of challenge... it will hit us severely before we know it.” Some operators are attempting to extend the service life of aircraft beyond 30 years, but Mashabi cautioned that rising maintenance and fuel costs are making this approach increasingly prohibitive.

Analysts suggest that tightening global air cargo capacity could enhance operators’ pricing power and drive up freight rates. However, ongoing geopolitical uncertainties—including Houthi attacks on Red Sea shipping lanes and unpredictable US trade policies—continue to cloud demand forecasts.

Boeing declined to comment on these developments, while Airbus did not respond to requests for comment.

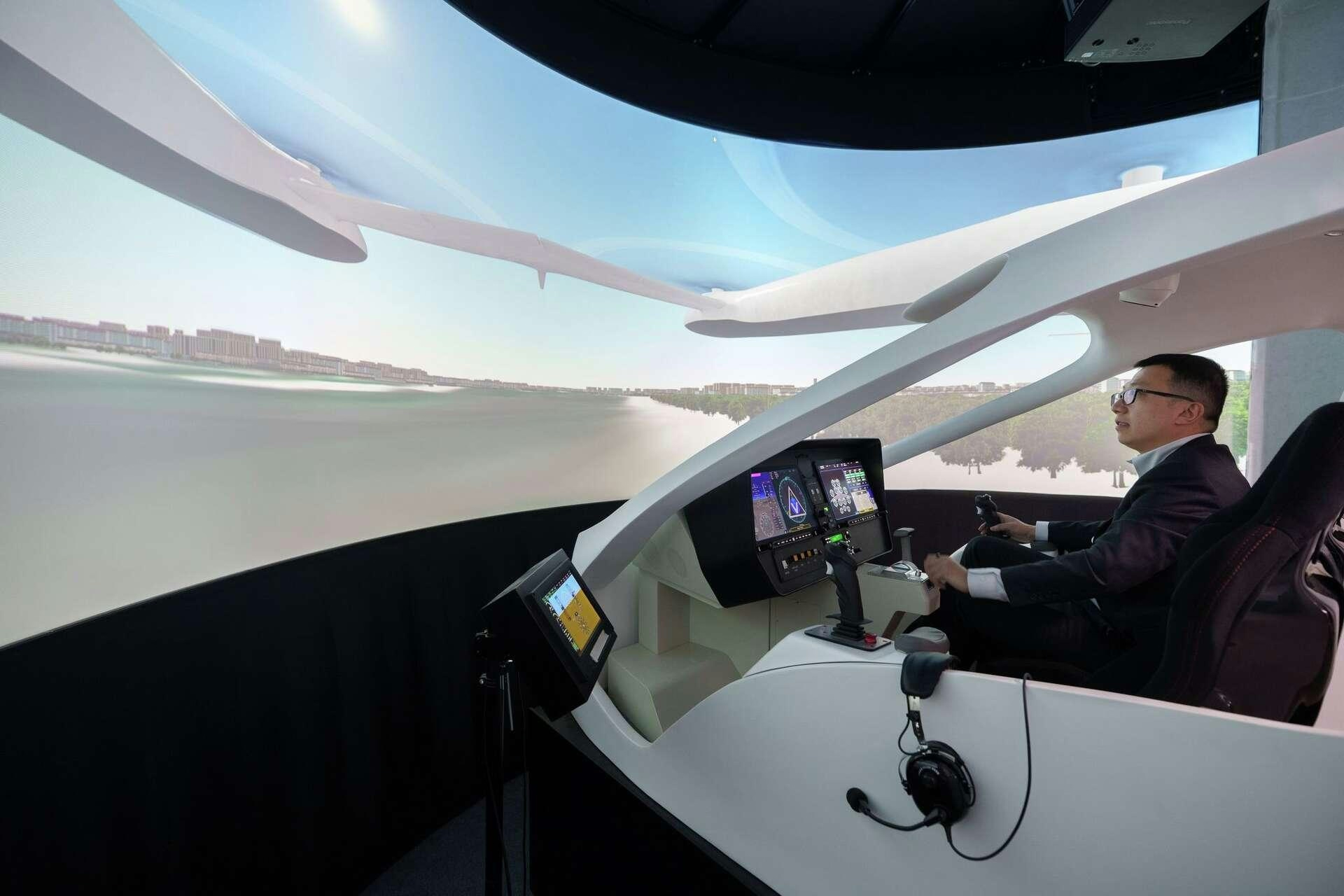

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services

ETF Airways to Receive First ATR Aircraft