AeroGenie — Your Intelligent Copilot.

Trending

Categories

Garuda Indonesia Requests $500 Million from Sovereign Wealth Fund

Garuda Indonesia Seeks $500 Million Injection from Sovereign Wealth Fund

Garuda Indonesia Group, which includes the national airline Garuda Indonesia and its low-cost subsidiary Citilink, is seeking approximately $500 million in funding from Indonesia’s sovereign wealth fund, Danantara (Daya Anagata Nusantara). This financial support aims to address ongoing operational challenges and facilitate the carriers’ recovery amid persistent financial difficulties, according to Bloomberg reports.

Background and Strategic Context

Earlier this year, the Indonesian government undertook a significant restructuring by transferring its 64.5% ownership stake in Garuda Indonesia to an operational entity controlled by Danantara. Since May, discussions have been underway regarding the proposed capital injection, with the Minister of State-Owned Enterprises, Erick Thohir, granting approval for the investment late last month. This move is part of President Prabowo Subianto’s broader economic reform agenda, which emphasizes revitalizing the national airline as a key element of Indonesia’s strategic economic development.

Funding Structure and Operational Challenges

The funding deal is expected to be finalized by June or July, with the capital disbursed in two tranches. A substantial portion of the funds will be directed to Citilink to support the reactivation of grounded aircraft, a critical step in restoring operational capacity. Currently, a significant number of aircraft remain out of service, limiting the airlines’ ability to generate revenue and improve financial performance.

According to ch-aviation Commercial Aviation News, Citilink has 29 of its 59 aircraft grounded, while Garuda Indonesia has 23 of its 79 aircraft out of service. These operational constraints have contributed to ongoing financial losses and diminishing cash reserves for both carriers. The capital injection from Danantara is therefore considered essential to stabilizing operations and enabling a return to profitability.

Leadership and Future Outlook

Wamildan Tsani Panjaitan, appointed by President Subianto to lead the turnaround effort, has emphasized the urgency of returning grounded aircraft to service. Speaking at the company’s annual general meeting on May 28, Wamildan expressed optimism about the airlines’ prospects, stating, “We are optimistic that we can maximise efforts to improve performance and can help align Garuda's role as the nation's flag carrier.” The forthcoming investment is expected to play a pivotal role in supporting these efforts and reinforcing Garuda Indonesia’s position within the national and regional aviation markets.

The capital injection from Danantara marks a critical milestone in Indonesia’s efforts to revive its flag carrier and strengthen the broader aviation sector, aligning with the government’s strategic economic objectives.

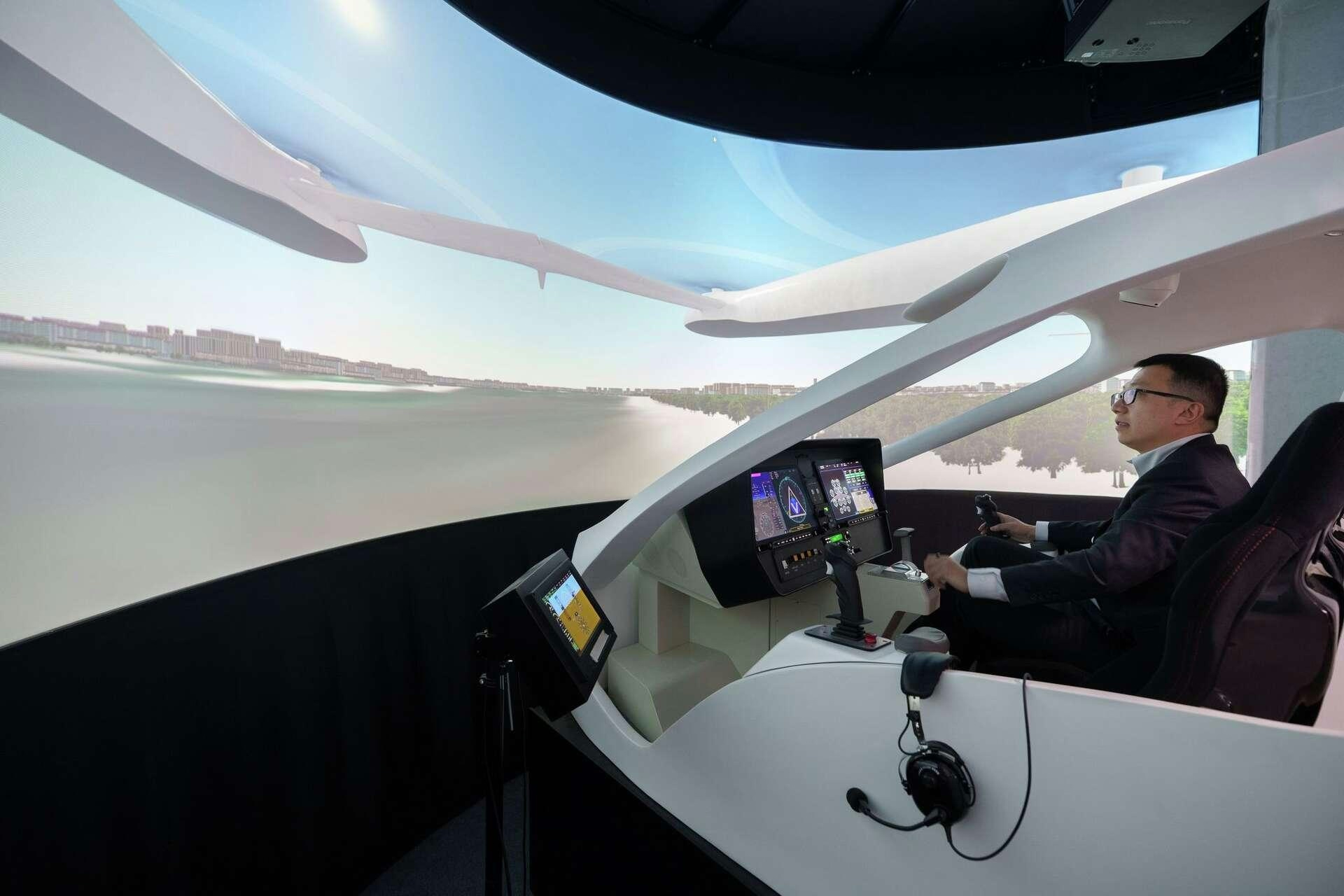

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

SkyDrive’s Tokyo Launch and the Future of Flying Cars

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services