AeroGenie — Your Intelligent Copilot.

Trending

Categories

GE Aerospace Raises Earnings Outlook Amid Strategic Advances

GE Aerospace Raises Earnings Outlook Amid Strategic Advances

GE Aerospace has delivered a remarkable performance in the second quarter of 2025, surpassing Wall Street expectations and revising its earnings outlook upward. The company’s latest financial results and strategic initiatives underscore its growing influence in the aerospace sector, which continues to serve as a key indicator of global economic health.

Strong Financial Performance Driven by Volume and Margins

In the recent quarter, GE Aerospace reported adjusted earnings per share (EPS) of $1.66, representing a 38% increase compared to the same period last year and exceeding analyst forecasts by 15%. This robust growth was supported by a combination of increased volume, stable margins, and strong cash flow generation. Commercial services revenue surged by 29% year-over-year, while engine deliveries rose 45%, reflecting sustained demand from both commercial airlines and defense customers. Total revenue climbed 23% to $10.2 billion, with operating margins maintained at 23% despite ongoing inflationary pressures.

Free cash flow nearly doubled to $2.1 billion, elevating the company’s free cash flow conversion ratio to 21%, a figure that outpaces competitors such as Rolls-Royce and Safran. This strong cash generation capacity is critical for funding innovation, share repurchases, and debt reduction, highlighting GE Aerospace’s operational efficiency and financial discipline.

Strategic Initiatives and Industry Positioning

GE Aerospace’s revised guidance through 2028 signals confidence in its long-term growth trajectory, with projections of $8.40 in adjusted EPS and $11.5 billion in operating profit. Central to this outlook are the company’s investments in next-generation technologies, including the GE9X engine for Boeing’s 777X and the CFM RISE (Revolutionary Innovation for Sustainable Engine) program, which aims to improve fuel efficiency by 20%. These initiatives position GE Aerospace as a potential disruptor within the industry, driving innovation and sustainability.

The company’s strategic momentum is further reinforced by significant contract wins. A $5 billion agreement with the U.S. Air Force for F110 engines and a record $14.2 billion in second-quarter orders—including a major widebody deal with Qatar Airways—demonstrate GE Aerospace’s ability to secure high-margin, long-term contracts. These deals also diversify its customer base, mitigating risks associated with the cyclical nature of commercial aviation.

Capital Allocation and Market Reaction

GE Aerospace has also emphasized shareholder returns, announcing plans to increase capital distributions by 20% through 2026. This includes a proposed $19 billion share buyback program, pending board approval, alongside a dividend increase. This approach contrasts with the more cautious capital strategies adopted by some peers amid ongoing macroeconomic uncertainties.

The market has responded favorably to GE Aerospace’s earnings beat and upgraded profit forecast, with the company’s stock price rising significantly. Analysts estimate that the revised guidance for 2025 to 2028 implies a present value of $135 to $145 per share, representing a 20 to 30 percent premium over the current trading price of $108, even under neutral economic assumptions.

Challenges and Industry Dynamics

Despite its strong performance, GE Aerospace continues to face challenges, including persistent supply chain disruptions and rising raw material costs. Production delays at Boeing and Airbus have increased demand for GE’s aftermarket services, but also highlight vulnerabilities within the broader aerospace supply chain. Competitors are responding by expanding their aftermarket offerings and seeking to address supply chain risks.

Regulatory scrutiny in defense contracting and ongoing supply chain bottlenecks remain potential headwinds. Nevertheless, GE Aerospace’s operational resilience and strategic advances position it well to maintain its competitive edge in a rapidly evolving industry landscape.

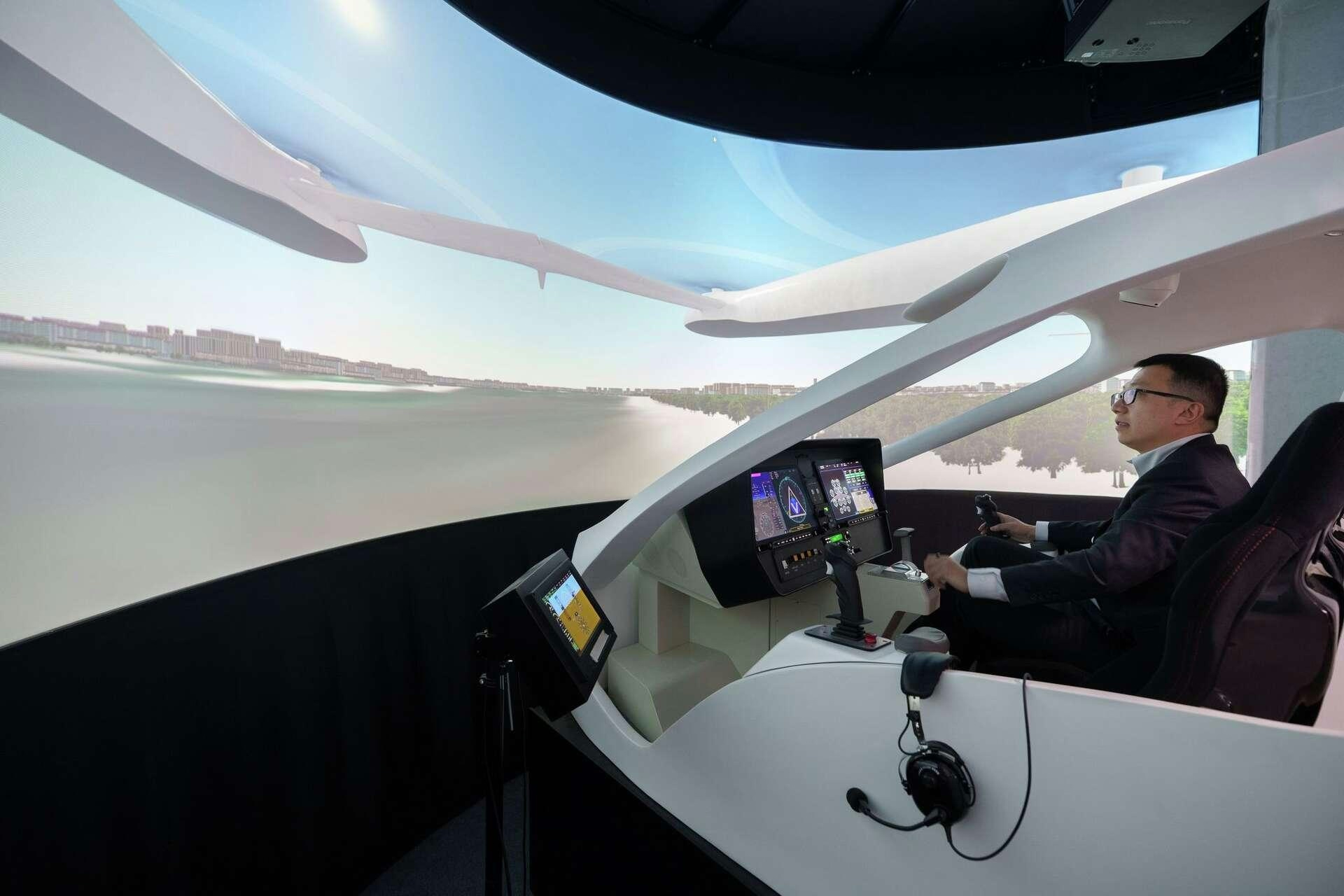

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services

ETF Airways to Receive First ATR Aircraft