AeroGenie — Your Intelligent Copilot.

Trending

Categories

Leasing Industry Poised for Major Change Following $7.4 Billion Deal

Leasing Industry Poised for Major Change Following $7.4 Billion Deal

Landmark Acquisition Reshapes Aircraft Leasing Landscape

Air Lease Corporation (ALC), a leading aircraft leasing company founded by Steven Udvar-Hazy, is set to be acquired by a consortium led by its rival, SMBC Aviation Capital, in a $7.4 billion cash transaction. The investor group also includes Sumitomo Corporation—one of SMBC’s Japanese owners—and private equity firms Apollo and Brookfield Credit. The deal, which has received approval from ALC’s board, offers shareholders $65 per share, valuing the company at $7.4 billion. When accounting for assumed or refinanced debt, the total enterprise value of the transaction rises to $28.2 billion.

The acquisition is expected to close in the first half of 2026, after which ALC will be rebranded as Sumisho Air Lease and operate as a separate entity. SMBC will take ownership of ALC’s substantial orderbook, which at the end of the second quarter comprised firm orders for 241 aircraft. This includes 36 Airbus A220s, 130 A320/A321neos, one A330neo, 64 Boeing 737 Max jets, and 10 Boeing 787-9/10s, with deliveries scheduled through 2031. This expanded orderbook will significantly diversify SMBC’s existing portfolio, which currently consists of 159 A320neo-family aircraft and 89 Boeing 737 Max jets.

Strategic Implications and Industry Impact

SMBC will also serve as the servicer for the majority of Sumisho Air Lease’s 495 in-service aircraft, over a quarter of which are widebody models. Presently, SMBC manages a fleet of 741 owned or managed aircraft, predominantly single-aisle planes, alongside a smaller number of widebody aircraft including 21 Airbus A350s and 27 Boeing 787s.

Peter Barrett, chief executive of SMBC, described the transaction as “transformational” for both the company and the broader leasing sector. He highlighted that the deal positions SMBC to “take a strategic lead in reshaping our sector” amid rapid industry evolution, where diverse capital sources are increasingly necessary to meet the demands of airline and investor clients.

The acquisition occurs during a period marked by intensified competition and shifting dynamics within the aircraft leasing industry. Market rivalry, regulatory changes, and evolving customer preferences are prompting companies to reassess pricing strategies and operational models to maintain competitiveness. Industry analysts suggest that this deal may catalyse further consolidation, with competitors potentially pursuing mergers, acquisitions, or strategic partnerships to bolster market share and expand service offerings.

To facilitate the transaction, SMBC, Citi, and Goldman Sachs Bank USA have arranged $12.1 billion in committed financing. The deal remains subject to customary closing conditions, including approval by ALC shareholders and regulatory review by competition authorities. As the aircraft leasing industry continues to adapt to emerging challenges and opportunities, this landmark acquisition is poised to have significant and far-reaching effects on the global market.

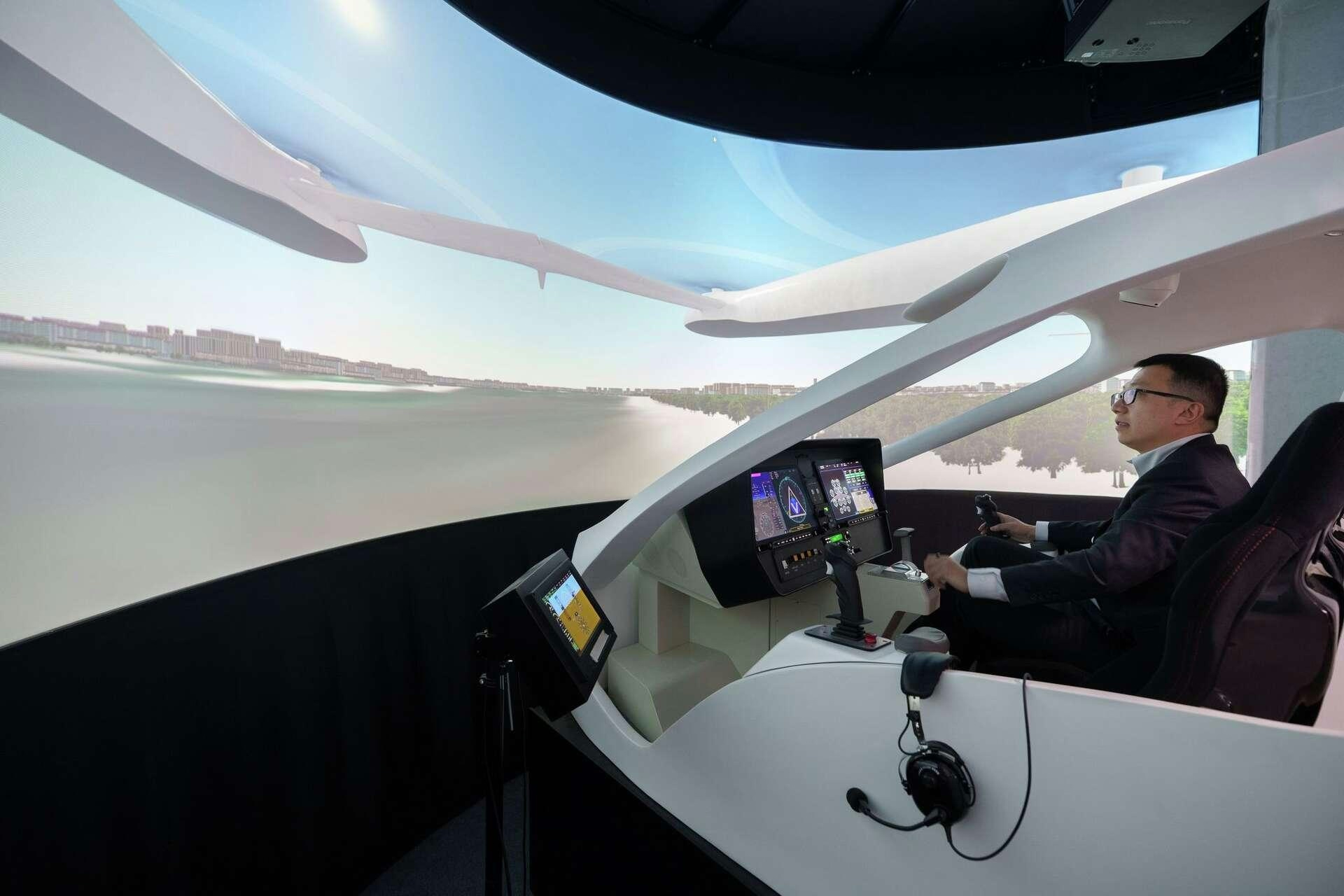

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services

ETF Airways to Receive First ATR Aircraft