AeroGenie — 您的智能副驾驶。

热门趋势

Categories

Brazilian, Chinese, and UK Airlines Target Nigerian Domestic Market for Expansion

Brazilian, Chinese, and UK Airlines Target Nigerian Domestic Market for Expansion

Nigeria’s Ambition as Africa’s Aviation Hub

Nigeria is rapidly positioning itself as a central aviation hub in Africa, drawing significant interest from major international airlines and investors from Brazil, China, and the United Kingdom. This development was highlighted by Nigeria’s Minister of Aviation, Festus Keyamo, during a global press conference held in Abuja to mark the launch of Africa’s first aeronautics university. Keyamo detailed the country’s strategic approach to opening its skies to global players through targeted partnerships and substantial infrastructure development.

Central to this strategy is the concessioning of airports and the attraction of maintenance, repair, and overhaul (MRO) investors, often in collaboration with local partners. A notable example is the recent inauguration of a major MRO facility in Lagos, established in partnership with Brazilian manufacturers, which underscores the growing direct foreign investment in Nigeria’s aviation sector.

Policy Reforms and International Partnerships

Minister Keyamo also announced new initiatives aimed at easing leasing restrictions to attract global aircraft leasing firms. For the first time in nearly two decades, Nigeria is set to receive a dry-leased aircraft, a significant milestone for domestic carriers that signals increasing investor confidence in the country’s aviation market.

International aviation companies are responding to these opportunities. Dublin-based leasing firm Aircap and China’s COMAC are actively exploring partnerships with Nigerian operators. COMAC, in particular, intends to deploy its C919 aircraft on domestic routes, with ambitions for broader expansion across the African continent.

Challenges and Competitive Dynamics

Despite the promising outlook, the entry of Brazilian, Chinese, and UK airlines into Nigeria’s domestic market faces several challenges. Industry analysts have identified regulatory hurdles, competition from well-established Nigerian carriers, and logistical constraints related to infrastructure as potential obstacles. The arrival of new players is expected to intensify competition, which may lead to price wars and enhanced service offerings for passengers. In response, local airlines are likely to pursue strategic alliances and increase marketing efforts to protect their market share.

The launch of the new aeronautics university, coupled with ongoing policy reforms, is anticipated to have a transformative impact on the sector. By training pilots and aviation professionals domestically, Nigeria and other African nations stand to save millions of dollars annually and reduce dependence on foreign training programs, thereby bolstering regional aviation independence.

As Nigeria continues to implement these reforms and attract international investment, it is poised to become a pivotal player in Africa’s rapidly expanding aviation market, notwithstanding the competitive and regulatory challenges that lie ahead.

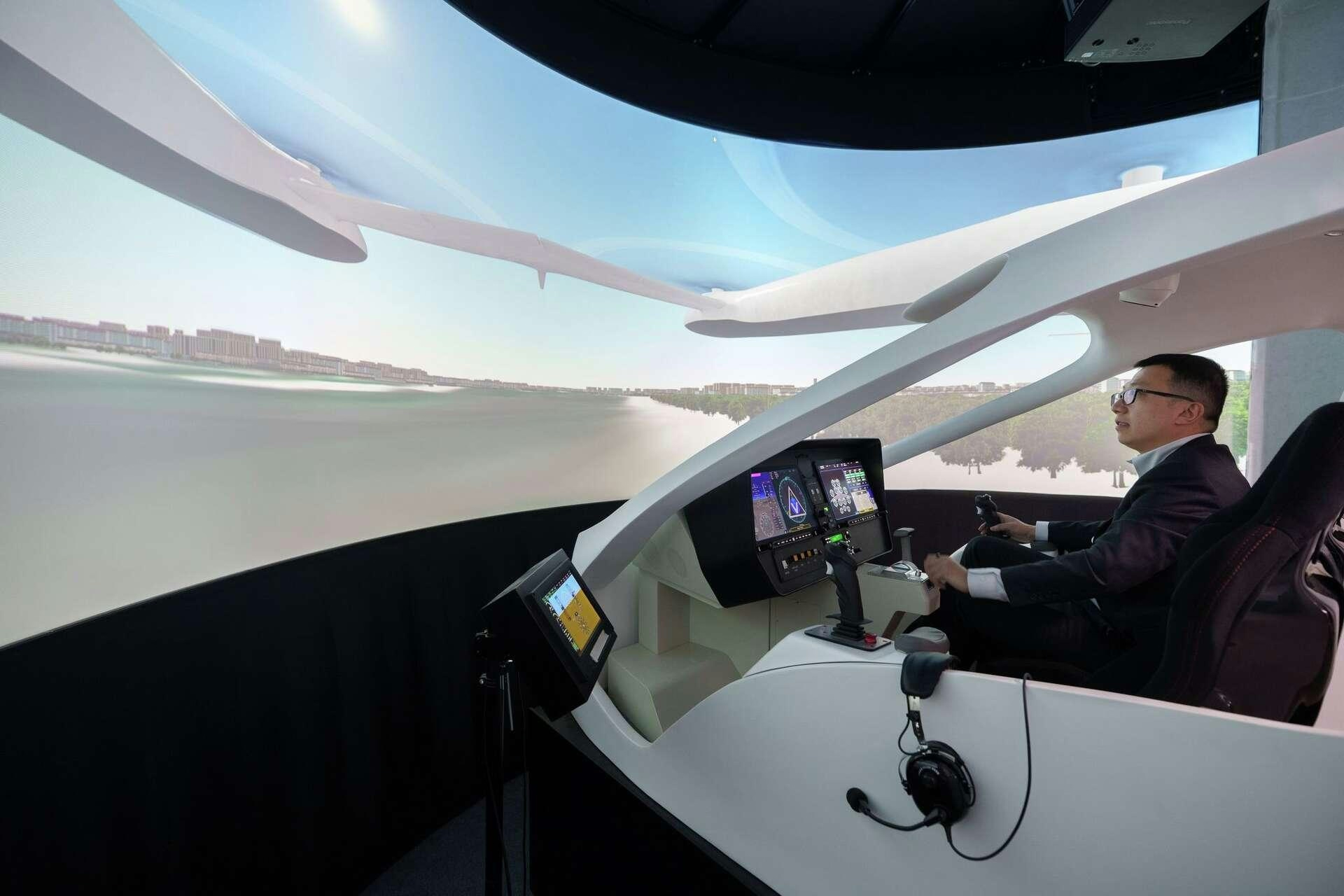

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

SkyDrive’s Tokyo Launch and the Future of Flying Cars

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services