أيروجيني — مساعدك الذكي للطيران.

الرائج الآن

Categories

Why Low-Cost Airlines Rarely Use Widebody Aircraft

Why Low-Cost Airlines Rarely Use Widebody Aircraft

Low-cost carriers (LCCs) have become a defining force in contemporary air travel, emerging prominently after the wave of global deregulation in the late twentieth century. Airlines such as Ryanair, Southwest, and easyJet, once considered niche players, now dominate short-haul markets worldwide. Their success is deeply rooted in a distinctive operating model that prioritizes cost minimization and operational efficiency, a philosophy that profoundly influences their fleet composition and overall business strategy.

The Low-Cost Carrier Model

The essence of a low-cost airline extends beyond merely offering inexpensive tickets. It is characterized by a fundamentally lower cost structure that supports sustainable low fares. Central to this model is fleet simplicity, with most LCCs operating a single aircraft family—typically narrowbody jets like the Boeing 737 or Airbus A320. This standardization simplifies pilot and crew training, maintenance, and scheduling, enabling rapid aircraft turnarounds and maximizing utilization rates.

In addition to fleet uniformity, LCCs employ an unbundled service approach, where the base fare covers only the seat, and ancillary services such as baggage, seat selection, and onboard refreshments are offered as optional extras. This strategy generates significant additional revenue streams. Their networks are predominantly point-to-point, often connecting secondary airports to avoid the congestion and higher fees associated with major hubs, thereby reducing costs and facilitating quicker ground operations. Furthermore, LCCs rely heavily on direct sales through their own websites and mobile applications, minimizing distribution expenses and commissions to third parties. Lean staffing models, emphasizing cross-utilization and streamlined procedures, further enhance productivity.

Ultra-low-cost carriers push these principles even further by negotiating bulk discounts with manufacturers and maximizing seat density, reinforcing their competitive edge.

Why Widebody Aircraft Are Rarely Used

Despite their expanding global presence, LCCs almost exclusively operate narrowbody aircraft. Widebody jets, such as the Boeing 787 or Airbus A350, are engineered for long-haul flights and entail significantly higher acquisition and operating costs. For most low-cost carriers, these elevated expenses conflict with the low-fare business model. Widebodies demand more complex maintenance regimes, specialized crew training, and present challenges in maintaining consistent load factors, particularly on routes with variable demand.

Moreover, the operational intricacies of long-haul flights—including stringent regulatory requirements, catering logistics, and crew scheduling—introduce additional layers of cost and risk. The hallmark of LCC networks—high-frequency, short-haul, point-to-point routes—are optimally served by the agility and efficiency of narrowbody aircraft, which support quick turnarounds and lower operational complexity.

Market Dynamics and Fleet Expansion

The competitive landscape is gradually shifting. The rise of ultra-low-cost carriers has intensified rivalry with legacy airlines, prompting some LCCs to contemplate fleet diversification and network expansion. For instance, Vietnam Airlines is evaluating the incorporation of widebody aircraft such as the Airbus A350 or Boeing 787 to bolster its international growth ambitions. Similarly, Vietjet has recently taken delivery of its first Boeing 737 Max 8, aiming to extend its international reach.

Simultaneously, supply chain disruptions are delaying new aircraft deliveries, compelling airlines to prolong the operational lifespan of older fleets. The ultralight aircraft market is also projected to expand, driven by increasing disposable incomes and technological progress, potentially offering new opportunities for cost-effective operations.

While the foundational low-cost model remains anchored in narrowbody aircraft serving short-haul routes, evolving market pressures and emerging opportunities are encouraging some carriers to reassess their fleet strategies. Nonetheless, the economic advantages and operational simplicity of narrowbodies continue to make them the cornerstone of most low-cost airlines.

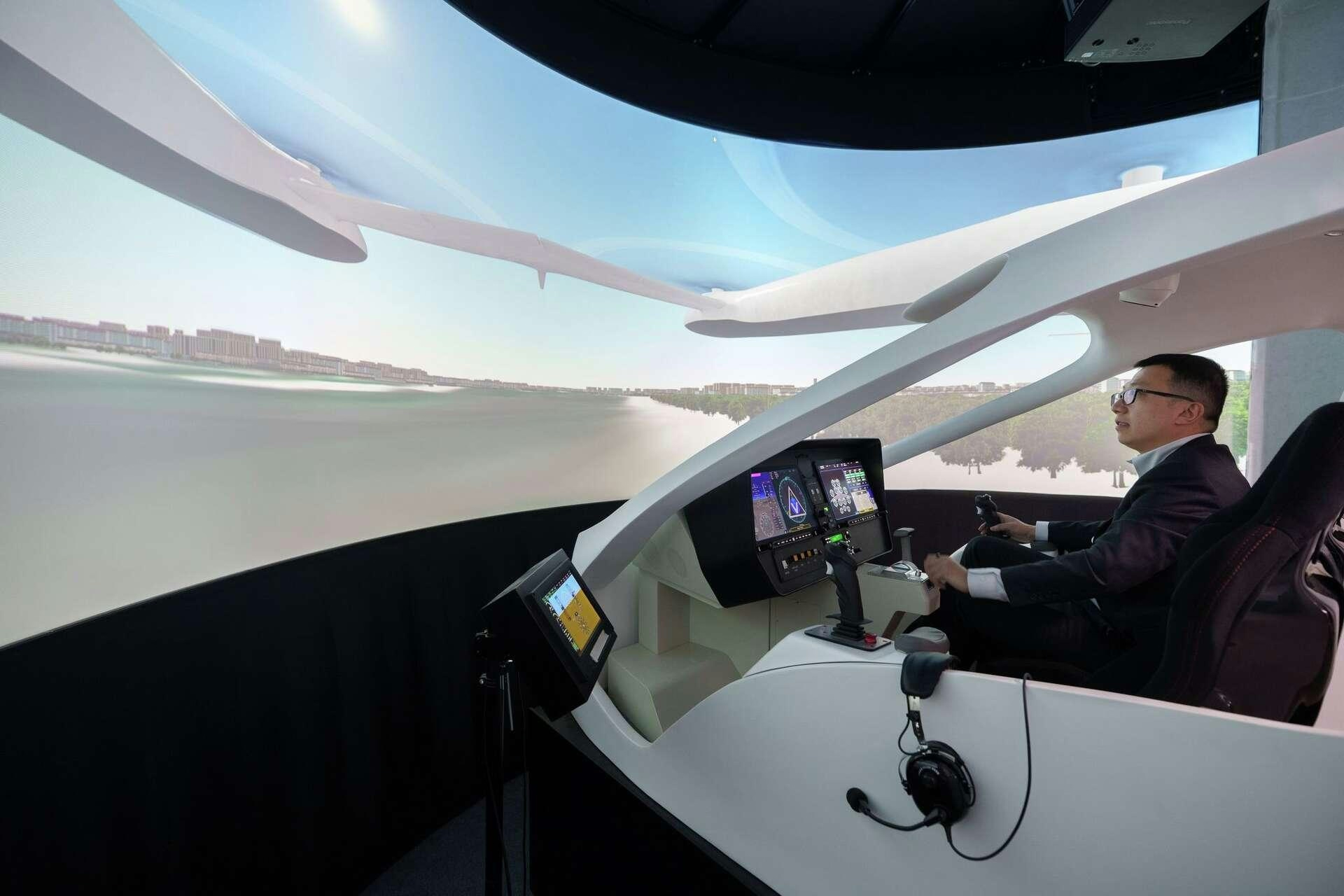

China's 10-passenger electric aircraft, the Matrix, hints at how big flying taxis can be

SkyDrive’s Tokyo Launch and the Future of Flying Cars

American Airlines Expands Premium Offerings on Widebody Fleet

GE Aerospace Stock Approaches 52-Week High

Human Factors: When Effort Falls Short

Cathie Wood Increases Investment in Air-Taxi Stocks

Airlines Face Fundamental Technology Challenges, Not Just AI Issues

Crankshaft Fatigue Causes Emergency Landing

Embraer Integrates AI-Based Counter-Drone System into A-29 Super Tucano

Standardaero and Avilease Sign Agreement for LEAP and CFM56-7B MRO Services